UPS Misses Earnings Due To Foreign Exchange Headwinds

United Parcel Service, Inc. (NYSE: UPS) released first quarter earnings on April 28. The shipping company’s report beat the earnings per share estimate but came up short on revenue. Scott Schneeberger of Oppenheimer weighed in on the company on May 4, reiterating an Outperform rating with a $108 price target.

UPS posted diluted earnings per share of $1.12, which was above both Schneeberger’s estimate of $1.04 and the average consensus of $1.09. This marks a 14% year-over-year increase for UPS’s earnings per share. Analysts had estimated that UPS would post quarterly revenue of $14.27 billion while Schneeberger’s revenue estimate was slightly smaller at $14.2 billion. However, UPS missed both revenue estimates and posted quarterly revenue of $13.977 billion, marking a 1.4% year-over-year increase. UPS noted that revenue would have increased 3.6% barring currency changes. Operating profit increased 11% to $1.7 billion, which Schneeberger attributed to “Solid export volume growth, pricing initiatives, and productivity improvements.”

CEO David Abney commented, “The first quarter results were favorably impacted by our continued investments and revenue management initiatives. These actions delivered high value to our customers and shareowners. We are on track to achieve the company’s long-term financial targets.”

UPS maintained their guidance, estimating diluted earnings per share between $5.05 and $5.30 for full-year 2015, which will be between a 6% and 12% year-over-year increase.

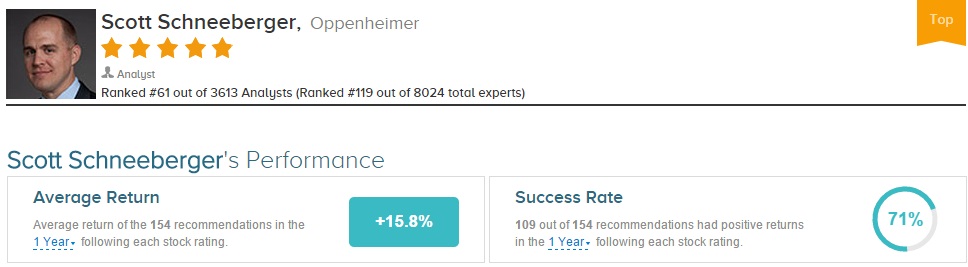

Scott Schneeberger has rated UPS 5 times since October 2013, earning a 75% success rate recommending the stock with a +2.3% average return per rating. Overall, Schneeberger has a 71% success rate recommending stocks with a +15.8% average return per rating.

Schneeberger has rated several other stocks in the industrial sector, such as United Rentals (NYSE: URI) and FedEx (NYSE: FDX). Schneeberger has rated United Rentals 23 times since November 2009, earning a 61% success rate recommending the stock with a +11.3% average return per URI rating. Separately, the analyst has rated FedEx 15 times since January 2014, earning a 73% success rate recommending the stock with a +12.4% average return per FDX rating.

Disclosure: To see more recommendations by Scott Schneeberger, visit TipRanks ...

more