Upbeat Australia Employment Report To Generate AUD/USD Rebound

(Click on image to enlarge)

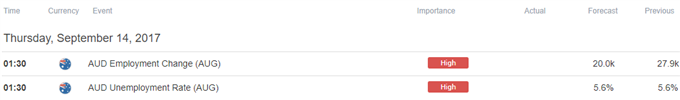

A 20.0K rise in Australia Employment may spark a bullish reaction in AUD/USD as it puts pressure on the Reserve Bank of Australia (RBA) to lift the cash rate off of the record-low.

The RBA may gradually alter the outlook for monetary policy as ‘various forward-looking indicators point to solid growth in employment over the period ahead,’ and Governor Philip Lower and Co. may show a greater willingness to implement higher borrowing-costs over the coming months as ‘stronger conditions in the labour market should see some lift in wages growth over time.’ As a result, AUD/USD may continue to gain ground throughout the remainder of the year especially as the pair breaks out of the 2016 range.

However, the RBA may continue to toughen the verbal intervention on the local currency as ‘an appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast,’ and the central bank may merely buy more time at the next meeting on October 3 as ‘growth in housing debt has been outpacing the slow growth in household incomes.’

Impact that Australia Employment report has had on AUD/USD during the previous print

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

JUL 2017 |

08/17/2017 01:30:00 GMT |

20.0K |

27.9K |

-18 |

-61 |

July 2017 Australia Employment Change

AUD/USD 5-Minute Chart

(Click on image to enlarge)

The Australian economy added another 27.9K jobs in July, with the Unemployment Rate unexpectedly narrowing to an annualized 5.6% from a revised 5.7% the month prior even as the Participation Rate climbed to 65.1% from 65.0% during the same period. A deeper look at the report showed the gains were led by a 48.2K expansion in part-time positions, while full-time employment narrowed 20.3K in July. Despite the uptick in the headline print, the Australian dollar struggled to hold its ground, with AUD/USD slipping below the 0.7900 handle to end the day at 0.7884.

Bullish AUD Trade: Employment Climbs 20.0K Jobs or Greater

- Need a green, five-minute candle following the release to favor a long AUD/USD position.

- If the market reaction favors a bullish aussie trade, buy AUD/USD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish AUD Trade: Australia Labor Market Report Disappoints

- Need a red, five-minute candle to favor a short aussie position.

- Implement the same setup as the bullish AUD trade, just in the opposite direction.

Potential Price Targets For The Release

AUD/USD Daily Chart

(Click on image to enlarge)

Chart - Created Using Trading View

- AUD/USD stands at risk for a larger pullback after failing to test the 0.8150 (100% expansion) hurdle, with the first region of interest coming in around 0.7930 (50% retracement) to 0.7940 (61.8% retracement), which sits just below the 20-Day SMA (0.7961); next downside hurdle comes in around 0.7850 (38.2% retracement) to 0.7860 (61.8% expansion).

- Even though the Relative Strength Index (RSI) preserves the bullish formation carried over from May, the momentum indicator appears to be deviating with price as the oscillator struggles to push back into overbought territory.

- Interim Resistance: 0.8270 (38.2% retracement) to 0.8295 (2015-high)

- Interim Support: 0.7720 (23.6% retracement) to 0.7740 (78.6% expansion)

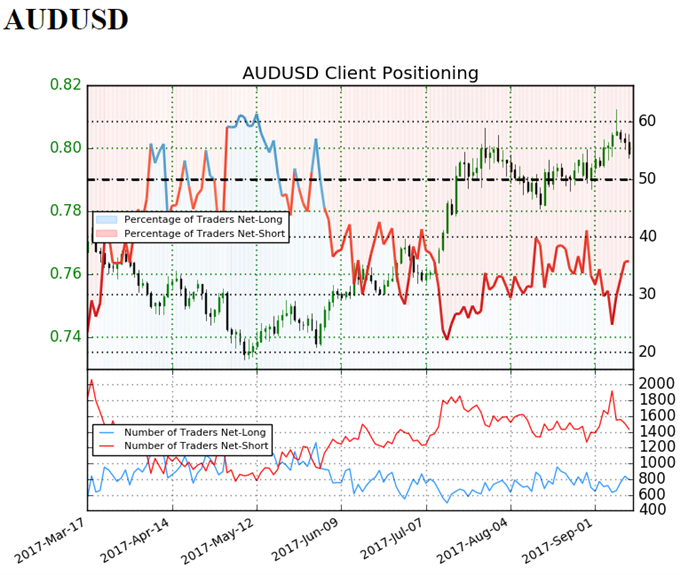

AUD/USD Retail Sentiment

(Click on image to enlarge)

Retail trader data shows 35.8% of traders are net-long AUD/USD with the ratio of traders short to long at 1.79 to 1. In fact, traders have remained net-short since June 04 when AUD/USD traded near 0.7456; price has moved 7.1% higher since then. The number of traders net-long is 2.2% lower than yesterday and 3.7% lower from last week, while the number of traders net-short is 7.5% lower than yesterday and 8.4% lower from last week.