Unexpectedly Higher South American Crops Impact US Bean & Corn Exports

Market Analysis

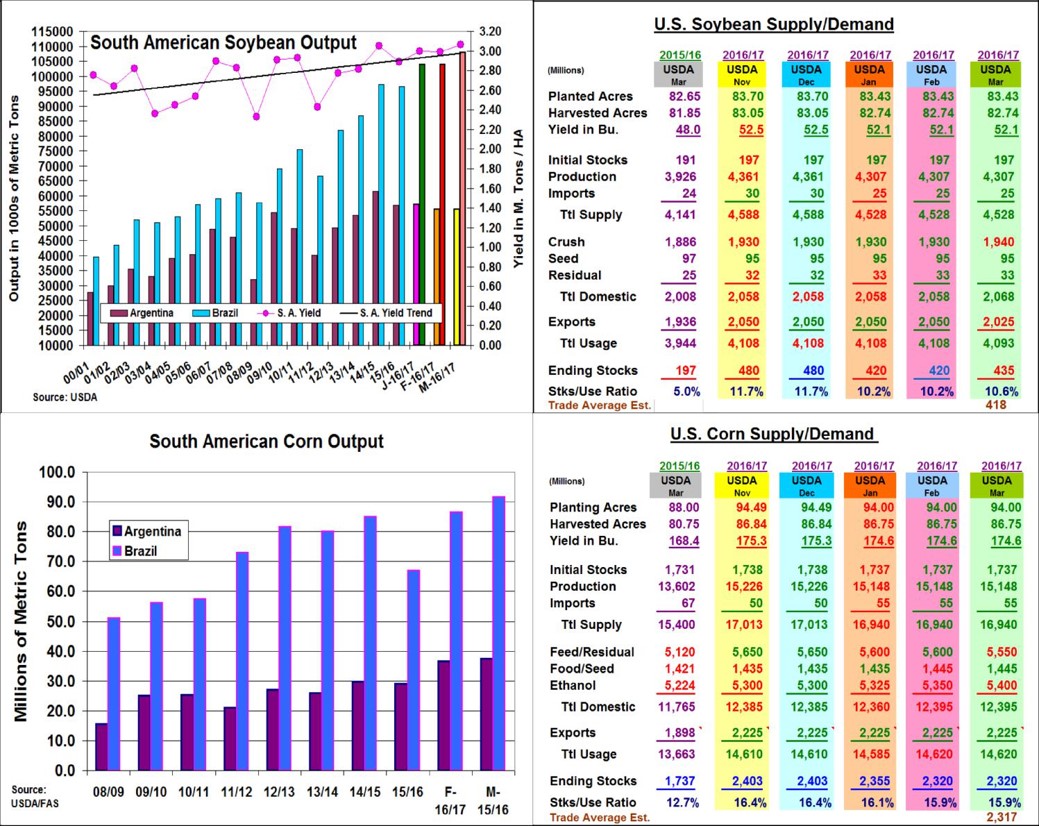

The USDA continued its recent trend of unexpected surprises on their monthly report. This time it was in their South American production estimates when they made some significant increases in the continent’s soybean and corn crop outlook. These larger numbers also impacted the world’s ending stocks and the US balance sheets for the soybeans and corn.

With limited US balance sheet changes being expected, the trade was looking for some modest 1.0 to 2.0 mmt changes in Brazil’s bean and corn crops because the past month’s good weather, Instead the USDA made some dramatic jumps in Brazil’s crop sizes in an appar-ent move to get ahead of our major grain competitor’s potential crop increases after making no changes last month. In soybeans, the World Board upped Brazil’s 16/17 output by 4 mmt to 108 mmt and they jumped their corn production forecast from 86.5 to 91.5 mmt, both rec-ord crop output for Brazil. In Argentina where this grow-ing season has been more erratic, they left this year’s soybean output unchanged at 55.5 mmt, However, the USDA did up it’s corn outlook by 1 mmt to 37.5 mmt

These higher bean supplies did prompted the USDA to up China’s imports by 1 to 87 mmt & increase their world stocks estimate by 2.5 mmt, but they also reduced the US bean exports by 25 million bu. However, January’s larger-than-expected Fat & Oils US crush led the USDA to up this domestic demand by 10 million resulting in just a 15 million rise the US ending stocks to 435 million.

Bean’s negative reaction also impacted the grains despite minimal US balance sheets changes. In corn, an annual review of US ethanol corn usage which upped last year’s demand by18 million bu. likely helped boost 16/17’s biofuel demand by 50 million to 5.4 billion. However, corn’s feed demand was also sliced by 50 million bu leaving corn’s stocks unchanged at 2.32 billion.

(Click on image to enlarge)

What’s Ahead

Today’s hefty Brazilian bean and corn crop outlooks means good/excellent conditions will need to continue for the next 6-8 weeks to fulfill these strong projections. Otherwise, this year’s safrina corn & late season bean yields could drop sharply like last year if rains don’t continue to May. Lower seedings should limit the grains downside while beans higher plantings will limit this market upside before March 31.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more