Ulta Salon Cosmetics And Fragrance - Chart Of The Day

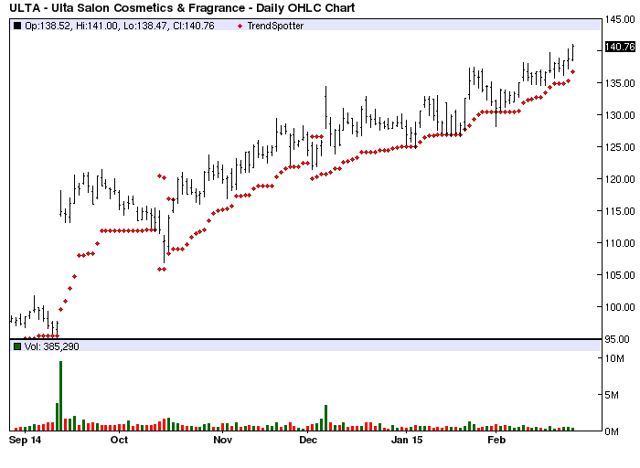

The Chart of the Day belongs to Ulta Salon Cosmetics and Fragrance (NASDAQ:ULTA). I found the company by sorting the All Time High list for the stocks with the highest technical buy signals, then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 12/5 the stock gained 8.55%.

(click to enlarge)

ULTA is the largest beauty retailer that provides one-stop shopping for prestige, mass and salon products and salon services in the United States. ULTA provides affordable indulgence to its customers by combining the product breadth, value and convenience of a beauty superstore with the distinctive environment and experience of a specialty retailer. ULTA offers a unique combination of over twenty one thousand prestige and mass beauty products across the categories of cosmetics, fragrance, haircare, skincare, bath and body products and salon styling tools, as well as salon haircare products. ULTA also offers a full-service salon in all of its stores.

Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 6 new highs and up 3.21% in the last month

- Relative Strength Index 68.11%

- Barchat computes a technical support level at 135.57

- Recently trade at 140.72 with a 50 day moving average of 132.10

Fundamental factors:

- Market Cap $9.06 billion

- P/E 36.91

- Revenue expected to grow 20.20% this year and another 15.40% next year

- Earnings estimated to increase 23.40% this year, an additional 16.40% next year and continue to compound at an annual rate of 20.00% for the next 5 years

- Wall Street analysts issued 5 strong buy, 7 buy and 6 hold recommendations on this issue

The 50-100 Day MACD Oscillator has been a reliable technical trading strategy and should continue to be used for entry and exit points.

Disclosure: None.