Tyson Foods Is Our Top Upgrade Stock

For today's edition of our upgrade list, we searched for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. Tyson Foods (TSN) is our top-rated upgrade this week.

|

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Return |

1-M Forecast Return |

1-Yr Forecast Return |

P/E Ratio |

Sector Name |

|

TYSON FOODS A |

67.75 |

-6.85% |

51.84% |

1.21% |

14.60% |

14.86 |

Consumer Staples |

|

|

SUNCOKE ENERGY |

15.04 |

27.85% |

16.41% |

0.71% |

8.52% |

7.96 |

Oils-Energy |

|

|

PARKWAY PPTY |

20.81 |

17.52% |

28.93% |

0.67% |

8.00% |

15.65 |

Finance |

|

|

HERBALIFE LTD |

63.49 |

12.26% |

17.60% |

0.64% |

7.66% |

12.79 |

Retail-Wholesale |

|

|

BGC PARTNRS INC |

8.9 |

-5.17% |

7.49% |

0.56% |

6.71% |

11.41 |

Finance |

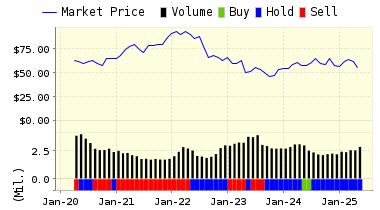

Below is today's data on Tyson Foods (TSN):

Tyson Foods, Inc. is the world's largest fully-integrated producer, processor, and marketer of chicken and poultry-based food products. Tyson is a comprehensive supplier of value-added chicken products through food service, retail grocery stores, club stores and international distribution channels. Although its core business is chicken, in the United States Tyson is also the second largest maker of corn and flour tortillas under the Mexican Original brand and through its subsidiary Cobb Vantress, the top chicken breeding stock supplier.

Recommendation: We updated our recommendation from BUY to STRONG BUY for TYSON FOODS A on 2016-10-07. Based on the information we have gathered and our resulting research, we feel that TYSON FOODS A has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Sharpe Ratio and Company Size.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

68.57 | 1.21% |

|

3-Month |

69.37 | 2.38% |

|

6-Month |

69.64 | 2.79% |

|

1-Year |

77.64 | 14.60% |

|

2-Year |

64.54 | -4.73% |

|

3-Year |

59.42 | -12.29% |

|

Valuation & Rankings |

|||

|

Valuation |

6.85% undervalued |

Valuation Rank |

|

|

1-M Forecast Return |

1.21% |

1-M Forecast Return Rank |

|

|

12-M Return |

51.84% |

Momentum Rank |

|

|

Sharpe Ratio |

1.25 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

29.18% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

23.41% |

Volatility Rank |

|

|

Expected EPS Growth |

5.48% |

EPS Growth Rank |

|

|

Market Cap (billions) |

25.38 |

Size Rank |

|

|

Trailing P/E Ratio |

14.86 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

14.09 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

2.71 |

PEG Ratio Rank |

|

|

Price/Sales |

0.66 |

Price/Sales Rank |

|

|

Market/Book |

2.59 |

Market/Book Rank |

|

|

Beta |

0.23 |

Beta Rank |

|

|

Alpha |

0.52 |

Alpha Rank |

|

Market Overview

|

Summary of VE Stock Universe |

|

|

Stocks Undervalued |

52.77% |

|

Stocks Overvalued |

47.23% |

|

Stocks Undervalued by 20% |

20.78% |

|

Stocks Overvalued by 20% |

15.21% |

Sector Overview

|

Sector |

Change |

MTD |

YTD |

Valuation |

Last 12-MReturn |

P/E Ratio |

|

Industrial Products |

-0.96% |

-1.33% |

17.25% |

5.95% overvalued |

12.85% |

24.11 |

|

Computer and Technology |

-0.56% |

-0.30% |

18.20% |

5.51% overvalued |

8.34% |

29.50 |

|

Oils-Energy |

-0.66% |

1.63% |

21.79% |

3.07% overvalued |

-8.11% |

26.26 |

|

Utilities |

-0.43% |

-1.79% |

9.38% |

2.59% overvalued |

9.48% |

21.49 |

|

Multi-Sector Conglomerates |

-0.91% |

-0.27% |

7.40% |

1.39% overvalued |

1.15% |

20.85 |

|

Consumer Staples |

-0.97% |

-1.62% |

9.20% |

0.69% overvalued |

10.36% |

23.77 |

|

Aerospace |

-0.52% |

-0.12% |

2.53% |

0.24% overvalued |

5.63% |

18.15 |

|

Finance |

-0.11% |

-0.69% |

6.75% |

0.42% undervalued |

3.35% |

16.64 |

|

Basic Materials |

0.04% |

-2.30% |

41.36% |

0.69% undervalued |

45.15% |

28.58 |

|

Business Services |

-1.07% |

-1.25% |

13.15% |

2.21% undervalued |

1.36% |

24.50 |

|

Consumer Discretionary |

-0.46% |

-0.32% |

9.24% |

2.76% undervalued |

1.10% |

23.16 |

|

Transportation |

-0.68% |

0.27% |

11.47% |

3.04% undervalued |

-13.21% |

16.82 |

|

Auto-Tires-Trucks |

-0.21% |

0.77% |

8.21% |

3.85% undervalued |

5.78% |

13.92 |

|

Medical |

0.01% |

-0.01% |

2.74% |

4.26% undervalued |

-6.88% |

26.60 |

|

Construction |

-0.92% |

-0.31% |

31.19% |

4.83% undervalued |

12.27% |

19.88 |

|

Retail-Wholesale |

-0.32% |

0.13% |

0.79% |

5.45% undervalued |

-2.08% |

22.14 |

Valuation Watch: Overvalued stocks now make up 47.23% of our stocks assigned a valuation and 15.21% of those equities are calculated to be overvalued by 20% or more. Seven sectors are calculated to be overvalued.

Disclaimer: ValuEngine.com is an independent research ...

more