Two Out Of Three Ain’t Good

Equity markets closed down every day this week, breaking support and the 6-week trading range while Trump gained in the polls. Call it cause and effect. The S&P 500 dropped almost -2% for the week, down almost -6% from all- time highs. It’s also had a 9-day losing streak which has not occurred since 1980. The standout performance was led by Gold, Copper and Metal Mining stocks, while just about everything else slipped.

Also, noteworthy this week were two robust economic reports showing the unemployment rate back down to 4.9% and our GDP showing growth at 2.9%. No signs of a recession can be gleaned from those two critical reports.

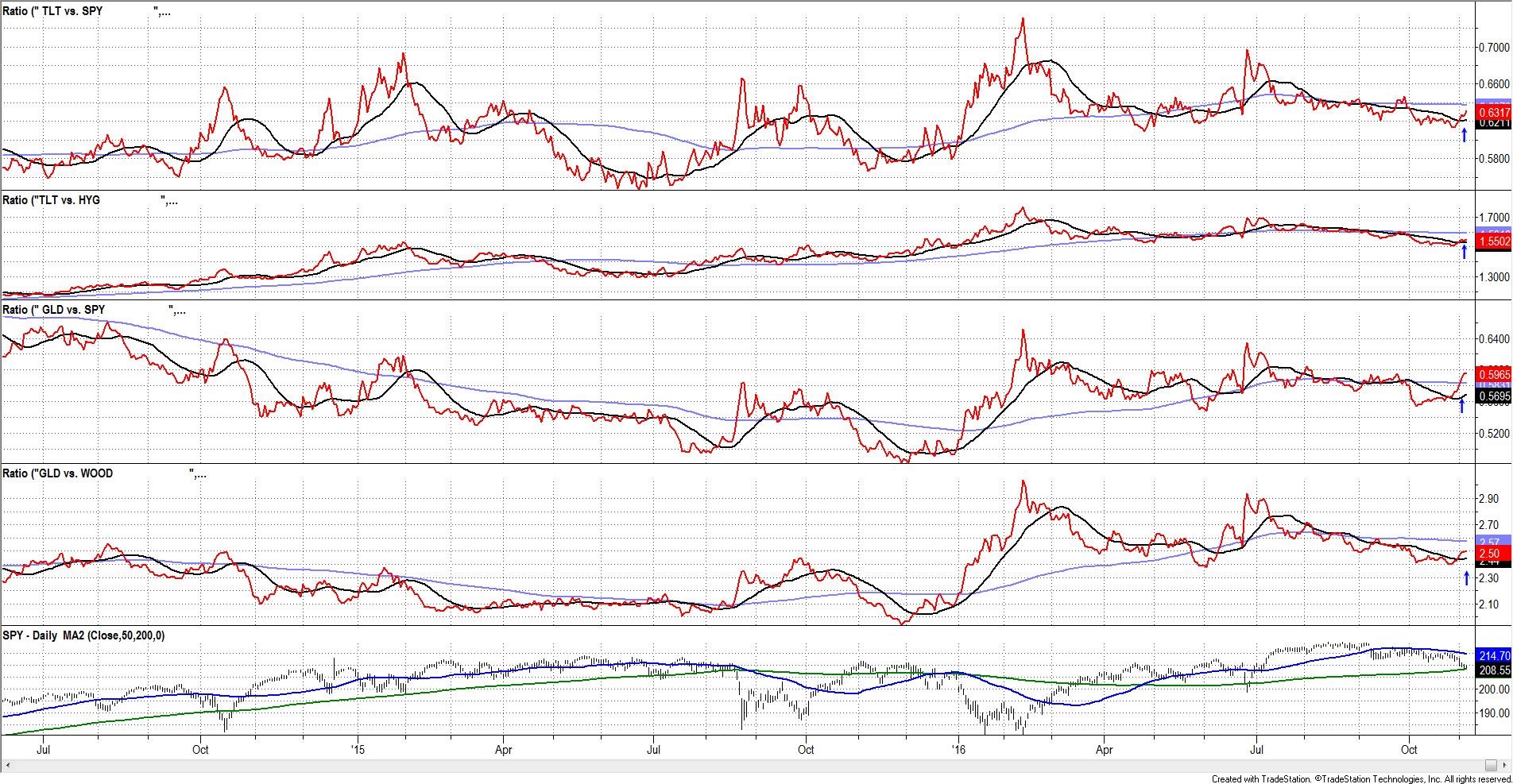

All Risk off indicators lit up this week. It shows gold (anxiety index) gaining versus stocks, high yield debt losing ground versus the safety of US bonds, and bonds gaining on stocks. Utilities, which we flagged last week, continue to gain versus stocks yet another excellent risk off indicator lit a bright red.

RISK OFF is ON!

In England, the Brexit referendum is on hold.It’s unclear if, without a Parliamentary vote, the Prime Minister can trigger Article 50, take a bow and leave the EU. The British Pound roared, but England’s stock market was unable to overcome the pressure from the decline in U.S equities

The legal question in England regarding Brexit and what is potentially brewing here in the US is similar in nature. Disregarding the popular vote is not something the markets like.

If Trump does what he has promised and declares a rigged election if he loses, is not exactly bullish for equities. Political instability and a disenfranchised populace on both sides of the political spectrum does not make for a happy market.

There are three election scenarios to contemplate and each will have a different market impact.

One, a Trump defeat by a slim margin with him refusing to acknowledge a Clinton victory would very likely send equities down until he acquiesces.

Then there is outcome two, which is a Trump victory and if the past nine days is any indication of what the markets think of a Trump victory, a market meltdown could be in the cards.

Outcome three is if there is a clear uncontested Clinton victory or at least a win so substantial that even if Trump contests the vote he would only be perceived as whining and the market shrugs it off.

Most likely, with outcome three there would be an ensuing Clinton relief rally from current levels and it might have some legs. However, with the economy growing and unemployment down the next hurdle for the market will be dealing with a looming Fed rate hike. So, from the looks of it, this week’s title of the market outlook modified from Meat Loaf’s big hit seems appropriate.

Let’s go to this week’s video with some specifics.

Video length: 00:15:25

Disclosure: None