Two Biggest Trends In The Market’s Hottest Sector

The industry we are profiling today has outperformed the overall market for five straight years. A first for any of the 10 major sectors. And, it still has many strong economic tailwinds propelling it higher. Read on to gain actionable knowledge about this red hot sector and participate in the rising tide.

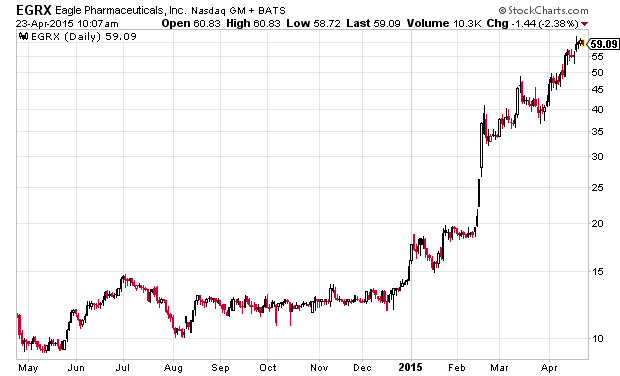

The healthcare sector, especially biotech and biopharma companies have been red hot for some time now. This makes sense. In a world of tepid growth prospects, investors will bid up consistently growing enterprises or hunt for the next big thing that could supply a world of growth. Biotech and biopharma stocks can deliver one or both of these attributes when things fall right. One only needs to take a look at Eagle Pharmaceuticals (NASDAQ: EGRX)to see what can happen when the stars align.

Eagle came public in early 2014 with promising technology to deliver existing drugs in more desirable forms. The stock is up some 350% since being included in the Small Cap Gems portfolio in December. Eagle Pharmaceuticals is a specialty pharmaceutical company focused on developing and commercializing injectable products primarily in the critical care and oncology areas utilizing a streamlined regulatory pathway available from the FDA for companies making different methods for delivering existing and approved drugs.

The big driver of the huge rally is a game changing partnership with giant generic drug firm Teva Pharmaceuticals (NASDAQ: TEVA) for its lead drug candidate. The deal involved a significant upfront payment, substantial milestone payments as well as double digit royalties on sales when the drug hit the market. As a result, consensus earnings estimates have gone from Eagle losing money in 2015 to making over $5.00 a share in profits in FY2016 as well as being profitable in FY2015. Even after a massive rise, Eagle sells for under 12 times next year’s earnings projections and still has upside.

Finding ways to administer existing drugs in more beneficial forms is a common theme in the biopharma space right now. This can mean designing an opioid pain killer to be abuse resistant, finding a way to provide the benefits of a four drug a day regimen from one pill a day, or just discovering a more effective way to deliver a compound to its target area. There are numerous firms working in this space as it is one that has many benefits. The existing drugs already have been proved to be effective and improved versions of these compounds usually are much easier to get approved by the FDA. You also have a defined existing market as well as healthcare professionals that know and are comfortable using the existing compounds.

Another promising area within biotech and biopharma is an increasing amount of partnerships involving small companies pairing with a larger company to develop a compound or series of compounds together. The small company usually provides the unique technology or targeting platform while the established pharma player provides the compound that will utilize the technology as well as the deep pockets that make the developmental effort possible.

This sort of deal was the trigger behind Eagle’s extraordinary rise in 2015. This type of transaction usually provides the small cap company with an upfront amount to enter into the deal, milestone payments as the compound(s) successfully achieve certain endpoints along the approval process as well as royalties on any sales once the drug(s) are approved. The larger company also frequently provides money to help develop the compound(s) as well.

I see this type of transaction proliferating across the small cap biotech and biopharma areas right now. These types of deals have bolstered the fortunes of numerous small cap equities within my portfolio that I have profiled on these pages over the past few months. These include Halozyme Therapeutics (NASDAQ: HALO), Agenus Inc. (NASDAQ: AGEN) and Progenics Pharmaceuticals (NASDAQ: PGNX) and are key reasons I am positive on their longer term futures.

The last trend we will talk about today is probably the biggest recent theme in biotech. It goes by different names like “immuno-oncology”, “personalized medicine” or simply as CAR-T. These are basically T-cell therapies have been under development for quite some time because of the potential for utilizing the body’s own immune system to create a “living drug” delivering personalized cancer therapy but are starting to get traction and are the rage in biotech development right.

These CAR-T methods as they are known (CAR means chimeric antigen receptors) extract, reengineer and reintroduce a given patients T-cells to provide highly personalized in vivo therapy. Genes that recognize specific cancer cells are reprogrammed into the T-cell utilizing a disabled virus.

These sort of therapies hold great promise as if developed successfully they could be much more effective than current treatments which work the same in every patient. Some of the better known names plying their wares in this area include Bluebird Bio (NASDAQ: BLUE),Celldex Therapeutics (NASDAQ: CLDX) and Kite Pharma (NASDAQ: KITE).

I would be somewhat weary of this space despite its great promise. As can be seen from the chart above, these equities have had massive runs over the past six months but some of them have started to break down in April. All of the entities listed above are losing money and will continue to do so for at least the next couple of years, sport multi-billion dollar market capitalizations and are vulnerable should the overall market go into “risk off” mode. Quite a few of these equities are also seeing increased insider selling of late as well.

It might be best to look back at this space if a likely shakeout occurs. The area could end up being the next big thing in biotech. It also could be the next mania à la what happened with the stem cell rage a few years ago that had similar hype and burned a lot of holes in investors wallets as the area has produced a lot less results so far than investors were hoping for.

Disclosure: Long AGEN, EGRX, HALO, PGNX.

For more on how I find these winners and how you can too, more