Treasury Market’s Inflation Outlook Dips From Four-Year High

The Treasury’s market’s implied inflation forecast last week reached the highest level since 2014, reflecting growing concern that pricing pressure is heating up. But the reflation trade has cooled this week, providing support for some analysts who argue that inflation fears are exaggerated. A reality check is due to arrive in today’s January update on the Consumer Price Index (CPI).

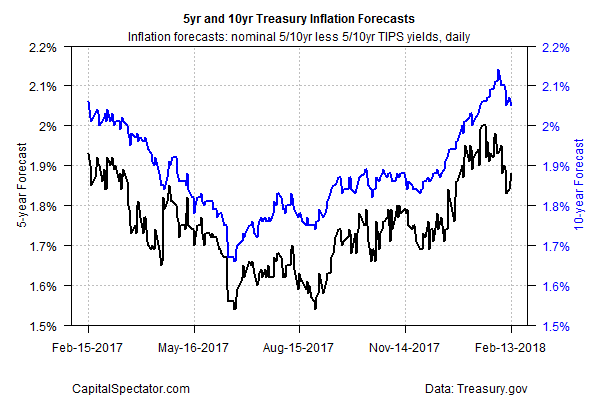

Judging by the latest inflation estimate, based on the difference between the nominal 10-year rate less its inflation-indexed counterpart, the crowd’s outlook has moderated in recent days. This spread dipped to 2.05% yesterday (Feb. 13), according to Treasury.gov data – down from last week’s 2.14%, the highest since Sep. 2014. A similar U-turn applies to the implied outlook via 5-year Treasuries.

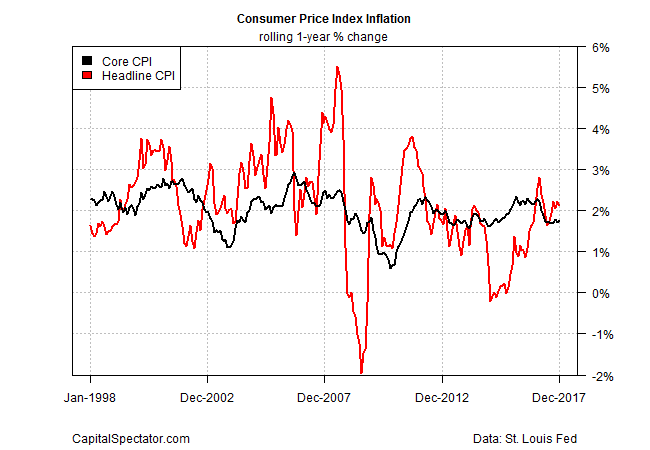

Meantime, economists are looking for a mildly softer inflation report in today’s CPI data. Econoday.com’s consensus forecast sees the year-over-year change for the headline figure easing to 2.0% in January from 2.1% at last year’s close. The annual pace of core CPI, which excludes energy and food, is also on track to dip, cooling to 1.7% from 1.8% and remaining modestly below the Fed’s 2.0% target.

George Goncalves, head of fixed-income strategy at Nomura, says that most forecasters are looking for minimal changes. “There’s no real outlier [in the projections] that suggests we’re going to see a break one way or the other.”

Michael Arone, chief investment strategist at State Street Global Advisors, thinks the recent concern that inflation is heating up is overblown. “Investors have gotten a bit ahead of themselves regarding inflation,” he advises. “Some of these inflation figures will come back down.”

Perhaps, although hedge funds are reportedly making hefty bets that Treasury yields will continue to rise, based on short positions in Treasury futures. Bloomberg reports that short bets for 10-year futures jumped to a record 939,351 contracts, according to Commodity Futures Trading Commission data through Feb. 6.

A softer CPI report could dent that trade. Longer term, it’s all about the economy. For the moment, the outlook remains upbeat for the big picture. The current projection for first-quarter GDP via the Atlanta Fed’s GDPNow model, for instance, sees output rising a strong 4.0%, sharply higher vs. the modest 2.6% rise in last year’s Q4 (based on Feb. 9 data).

Wall Street economists are projecting a softer 3.2% advance for Q1 growth, according to CNBC’s survey data for Feb. 9, but here too the outlook anticipates a stronger tail wind for the US macro trend.

Today’s retail sales report for January will provide more context for judging if the optimism on growth is justified. In turn, the news will offer another clue for assessing the wisdom of expecting inflation to accelerate, or not. Econoday.com’s consensus forecast sees last month’s consumer spending rising by 0.3%, a touch below the 0.4% rise in December. Keep an eye on tomorrow’s update on industrial production and Friday’s release of housing starts for additional data checks.

Based on what we know right now, however, the odds don’t appear compelling for expecting a sharp move in inflation, up or down, in the immediate future. The question is whether this week’s data releases lay the groundwork for an attitude adjustment?

Disclosure: None.