Traders Finally Don The Caps

Well it finally happened. Dow 20K, that is. And yes, there were hats – lots of hats.

Photo Credit: WSJ.com

After struggling with the big, round number since the middle of December, the venerable Dow Jones Industrial Average finally broke above the 20,000 level and closed Wednesday at a new all-time high of 2068.51.

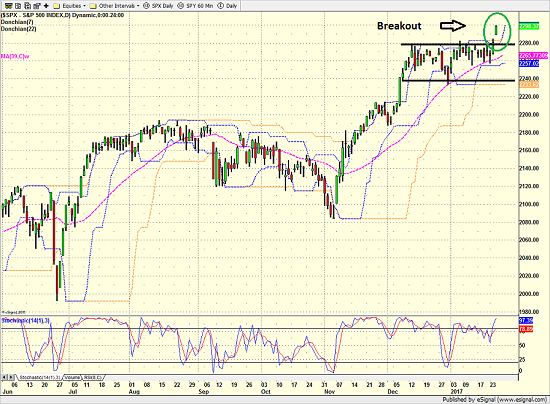

The S&P 500, NASDAQ Composite, and S&P 400 Mid cap indices confirmed the move as all the major indices save the Russell 2000 small caps, broke above their respective trading range ceilings into new high territory. And from a technical perspective, this is a good thing.

S&P 500 – Daily

View Larger Image

The question, of course, is why? Or, perhaps more appropriately, why now?

The answer appears to be simple. Actions speak louder than words. And the executive orders that President Trump has been busy signing this week have reminded traders that the Trump administration intends on making good on the promises made during the campaign. (What a concept.)

After rallying furiously from just before the election (November 7 to be exact) on the “idea of” and “hope for” better days ahead in terms of lower taxes, reduced regulation, and a better economy, the market then stalled in mid- December. Traders worried that the goals of the Trump administration might be too lofty to achieve. After all, Trump would still have to deal with the politics of Washington.

But with executive orders being signed daily designed to actually put plans in motion, the bottom line is traders are feeling better about the prospects for greener pastures.

The latest excitement in the market centered around “the wall” to be erected between the border of the U.S. and Mexico. And as you may recall, Mexico is supposed to pay for it.

This created a rally in U.S. construction and engineering firms. Ironically, the massive Mexican cement company, Cemex (NYSE: CX), has also benefited from all the talk about building the wall as shares have rallied 21.5% in the last 8 days.

So, the materials companies joined the banks and transportation companies as beneficiaries of the “Trump Trade.” This, along with the usual enthusiasm for technology helped push the Dow past the big, round number the media has been focused on. Oh, and the rally in the homebuilders didn’t hurt either.

Now the question becomes, will it stick?

Recall that during the tough times seen in the market during much of 2015/16, all “breakouts” quickly morphed into “fake outs” as traders developed a habit of selling into any/all rallies. And with valuations in the stock market stretched and the President running out of big plans to announce, one has to wonder if the current joyride to the upside won’t meet a similar fate.

But This Time, It Is Different

I know, I know, use of the header above is generally a fast track to losses in the stock market. However, I will opine that stocks are now discounting improving fundamentals. A stronger economy. Lower taxes. Less regulation. This is the stuff that can drive corporate profits above the current expectations. And as such, stock prices can certainly rise.

How far they can go is anybody’s guess. And to be sure, if there is even a whiff of disappointment along the way, the rally could easily falter. But for now, the key is that the new administration has the ability to take action. And since actions are always better than words in this game, the market appears to be applauding.

Disclosures: Modern times demand modern portfolios! more

Thanks for sharing