Trade & Regulations Front And Center

With the first business day of Trump’s presidency, we are seeing two trends which will be countering each other. There still aren’t complete details on the new policies, but the trends are becoming clearer. The trends are decreasing regulations and increasing trade barriers. The trade barriers increasing is a negative on global growth. The U.S. is about to exit the Trans Pacific Partnership and renegotiate NAFTA. Democratic Senators are getting ready to introduce legislation for Trump to sign for the U.S. to leave TPP. Trump is about to sign an executive order to get America out of NAFTA. There will be a major boarder tax put in place for firms trying to outsource production and sell goods in America.

Cutting regulations will be a boon for American business. Trump stated he wants to cut 75% of regulations because he listened to what business leaders told him. Regulations inhibit business activity because they create uncertainty. When the government makes laws which ignore practicality, businesses don’t know how to operate legally, so they simply don’t expand to be conservative. It’s better to be safe than face massive fines for unknowingly breaking an ambiguous law.

The decisions on trade are still uncertain, but we will be getting more information in the next few weeks. Technically, leaving the TPP and NAFTA don’t have to be bad for trade because they can be replaced with better deals which still allow for free trade. The two agreements have separate issues which have different consequences. Because the TPP was just initiated, we don’t have much information to go on about how the U.S.’s leave from it will affect trade. When the U.S. leaves TPP, Trump plans to simultaneously start negotiating new deals with each nation. This can lead to freer trade if the negotiations go well. The two countries Trump has singled out are China and Mexico, so with TPP ending, China will be the country I am most focused on. There’s high political risk for China because it will be changing some of its top leaders in the communist government this fall.

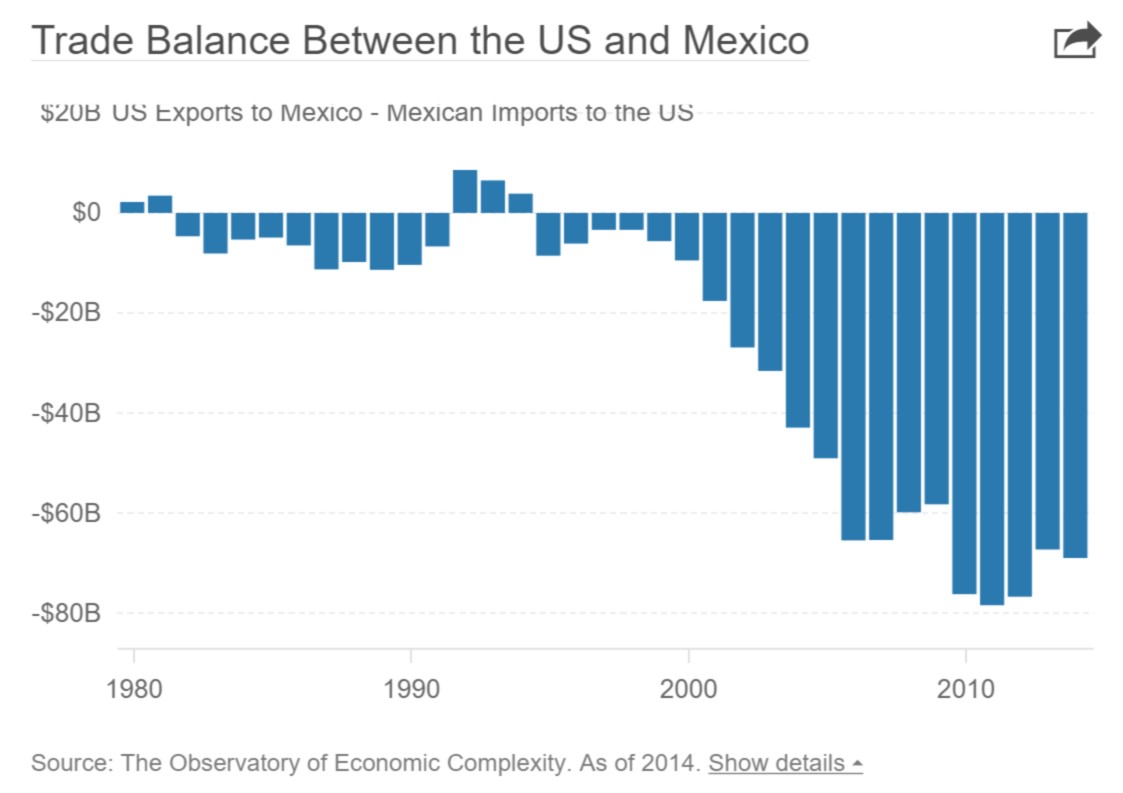

The U.S. leaving NAFTA is more of a problem. NAFTA’s goals when it was signed in 1994 was to limit tariffs, increase investment, and protect intellectual property rights. It reached those goals; repealing it could be a step in the wrong direction. The U.S. manufacturing exports to Mexico and Canada have increased 258% since NAFTA was signed. According to the Center for Automotive Research, punitive taxes between America and Mexico & Canada could cost America 31,000 manufacturing jobs. The chart below shows the reason America is leaving NAFTA. The trade balance is now showing the U.S. having a big deficit with Mexico. However, I believe looking at trade deficits as bad is overly simplistic. The reality is when each individual decision on trade is made by businesses they feel they are getting a good deal. There are positive and negative externalities from these decisions, but no one is getting ‘ripped off.’

(Click on image to enlarge)

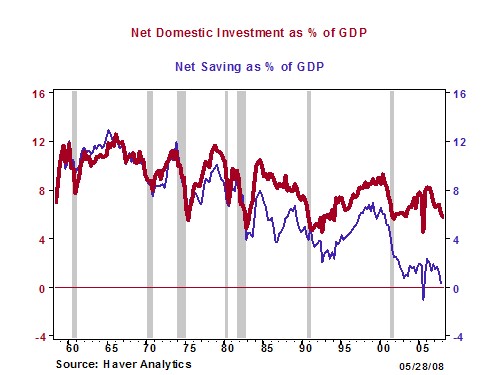

The chart below shows one possible explanation for the trade deficit is American’s savings has lagged domestic investment which is causing America to run a current account deficit. America has experienced GDP growth and standard of living improvements in the past two decades. Therefore, I wouldn’t say free trade has hurt it. The big reason why free trade is being attacked is because in certain industries, such as manufacturing, firms have outsourced their labor costs.

In a free trade system, there will always been some losses by certain industries because they each have to compete on a global scale. The benefits of free trade are not discussed by its opponents. Free trade allows for American consumers to buy foreign made goods at cheaper prices. If tariffs such as a high border tax are put in place, then the prices of goods will increase. Therefore, the big loser in this situation is the consumer. When the consumer is hurt because of higher prices, every firm that makes money off their discretionary spending will be hurt. Retailers and restaurant stocks are the ones to avoid.

Another key point about this topic is related to the one I made in my last article. The jobs lost in manufacturing in America probably won’t come back because they will be lost due to automation. The rule is businesses always try to cut costs, so the result is going to be an elimination of those low skilled jobs. As I said, there may be a re-shoring effect because of this trend as many products are sold to Americans. Manufacturing closest to the sale point makes sense. Also, America may have the most qualified workers to maintain the robots. I’ve noticed a trend where by the time politicians notice a problem, it is already being solved by the free market. America’s energy needs were solved by innovation surrounding fracking and job outsourcing may be reversed due to automation. Politicians tend to take the credit for these free market forces.

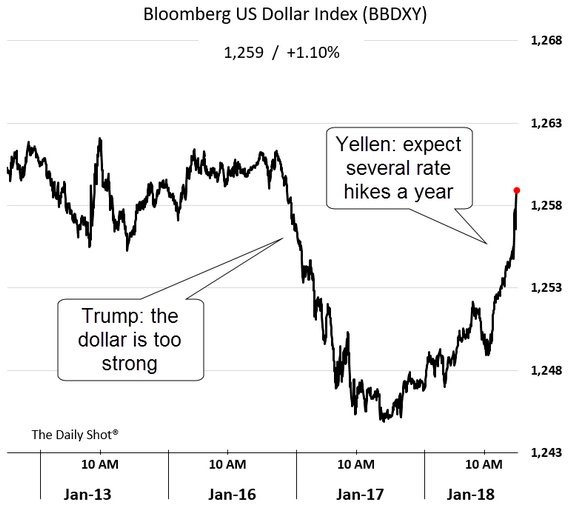

The key uncertainties with trade will be how high the tariffs are raised and which countries they will put on. Mexico and China are the two countries most likely to see tariffs. Another area of interest is how the dollar will react to these new policies. The chart below can become a theme this year. Trump wants a weaker dollar to support exports, but Yellen’s rate hikes/hawkish tone could lead to a stronger dollar. It’s interesting how many of Trump’s policies may actually strengthen the dollar even though he wants it weak.

This brings me to the regulatory cuts. I have been hesitant to expect the rhetoric on regulatory cuts to be enacted because past politicians have used this rhetoric, yet we are in this current state of affairs where America is falling down the list of economically free countries because of strict regulations. However, I may have to rescind my uncertainty in this area because Trump said he met with business people who told him regulation cuts would be favored over tax cuts. If he’s saying possibly over 75% of regulations will be cut, there will be major cuts even if that number isn’t reached. This will help small businesses and the Russell 2000 index the most. The oil and gas industry has been hampered by the EPA’s regulations, so this may be an industry which will out-perform in the next few years.

Conclusion

The new policies which were released will help and hurt business which is why it’s a tough call on how it will affect the stock market as a whole. The initial trade for small caps to outperform large caps may have been right because regulatory cuts help small caps more than large caps and tariffs hurt large caps more than small caps. This is all on a relative basis which I find important to point out because the market should go lower in the future due to overvaluation.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more