Tomorrow’s GDP Report Will Confirm The ‘Jobs Saved’ Economy Remains

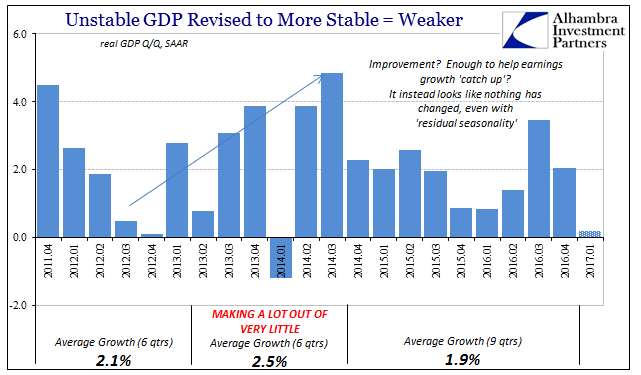

The advance estimate for GDP is scheduled for release tomorrow, and by current estimates it should be a total washout. Yet another first quarter is expected to be a disaster, the fourth in a row and the third straight under the “residual seasonality” regime that was supposed to reveal the hidden economic strength obscured by recent winters. Unlike 2014, however, there was no extended record Polar Vortex, and no massive snowstorms like 2015. With the statistics adjusted anyway, all that is exhausted is the excuses.

The narrative has changed but the economy has not, precisely the global problem. The world awaits a cure for these ills, and will have to continue to wait in good part because of the narrative. While it has shifted to recognize the futility of thinking winter was the problem, it hasn’t shifted nearly far enough to recognize what really is.

To begin with, if Q1 GDP is as low as currently anticipated (the Atlanta Fed’s GDPNow tracking model that has been close in its final publication to each advance GDP estimate figures a truly pathetic quarter, just 0.2% growth) the idea of “improvement” that is driving everything of late loses all rational basis. If it holds like this, it would be a growth rate worse than the worst of last year, meaning near recession conditions. In fact, it was be the worst quarter since Q1 2014 and the Polar Vortex, a very fitting reminder because so much of the economy lately is reminiscent of 2014.

We never truly make any progress because nothing ever changes. As noted yesterday, Ben Bernanke said recently that the outlook has brightened, but that would only be true when compared to the worst parts of last year (and likely not even in terms of GDP). This is a big part of what is holding everything back, these reduced standards that serve to confuse and obscure rather than educate and illuminate. No one wants to be blamed so every small thing is amplified and overly leveraged.

When the ARRA was first passed and implemented, it quickly gained deserved derision for its continuous claim of “jobs saved” because no one could find the expected jobs it was meant to create. It was then, and is now, an appropriate moniker most perfectly describing this economic condition. We are in the “jobs saved” economy, and it is always hyper-analyzed along these lines.

It isn’t just economic stats, either, where this has been applied. I wrote in early March about a BIS report published within its regular Quarterly Review which discussed basically a widespread internal sigh of relief over money market reform in the United States, the notorious 2a7 drama that briefly caught attention for its possible use in benignly describing the same “dollar” problems. The mainstream really didn’t understand the true nature of it, which I described this way:

This is an important distinction, and it suggests why there was a great deal of (legitimate) angst with regard to money market reform (2a7) last year. I’m not referring to the mainstream view of it, where 2a7 became the ultimate bogeyman for everything and anything that didn’t look right last summer and autumn. Primarily, those who referred to money market reform in the media were doing so without having the slightest idea what they were actually talking about. Instead, there has been an internal debate about the non-bank channel and specifically the role of money market funds within it, and it is within this discussion that 2a7 narrowly applied.

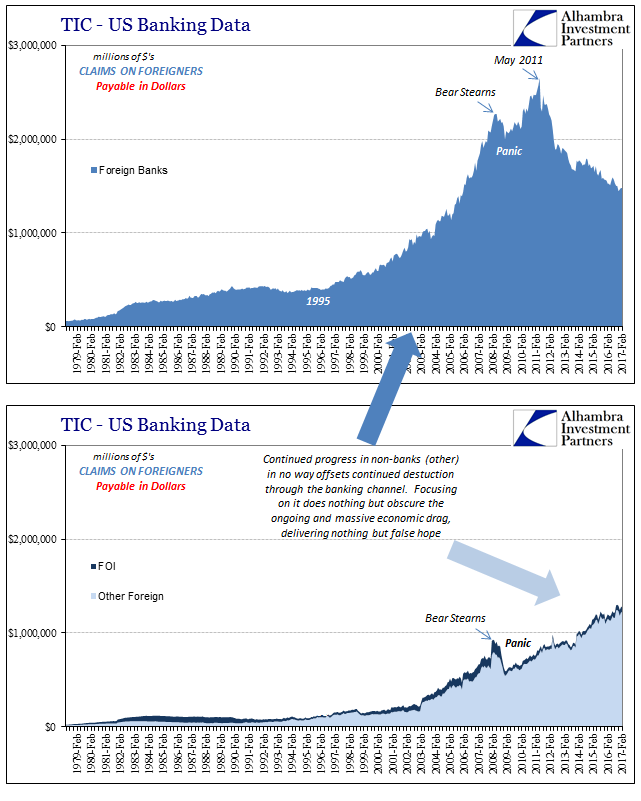

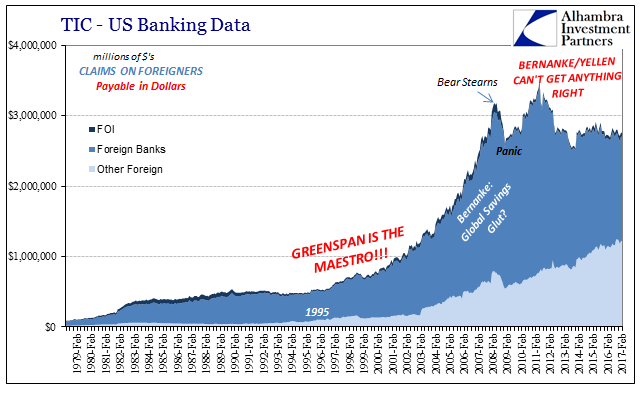

The global “dollar” system is not a monolithic one, and can be carved up occasionally by function or capacity. In this case, there are banks that supply and redistribute “dollars” and funding capacity as well as non-banks that largely undertake just redistribution. The largest group of non-banks is money market funds who were under threat of floating NAV’s due to changes in the 2a7 regulations. They responded to that threat by switching to government securities which were not subject (due to regulatory misconceptions about liquidity and especially what really happened in 2008) to variable NAV’s, but in doing so exposed the one redistribution channel still open in the post-crisis era.

At places like the BIS, there was serious consternation over the possible consequences of that lost capacity, scenarios that by early 2017 didn’t happen. Thus, they declared last month that the world is, “not suffering a dollar shortage as in 2008-09,” as if that was some sort of major success. It is, again, the “jobs saved” standard.

The possibility that the non-bank channel failed to cause panic-style disruption does not in any way change the fact that overall the “dollar” system is still failing. In fact, celebrating the transition of money market funds actually helps obscures the whole global problem because it makes it seem like the deficiencies in the other part aren’t any longer important. What good is a successful test of the non-bank channel when the bank channel has retreated and continues to retreat to a much higher degree? The consequences of that failure manifest quite differently than in cyclical expectations, but that is not how the issue has been framed, leaving out of public view where it very much belongs.

The “dollar” system did the same in 2011, as there was “only” a near panic then rather than a full-blown one like. Should we rejoice that our financial irregularities are getting smaller, or realize the drastic and dire implications that we are still witnessing significant financial irregularities of any size (from panic to 2011 to ‘rising dollar’ doesn’t represent progress, it represents a chronic condition)? The consequences of that particular close call were not at all positive, though they were surely described that way. The entire global economy shortly after started to slow and hasn’t as yet stopped slowing, proving that avoiding another 2008 wasn’t actually a meaningful distinction.

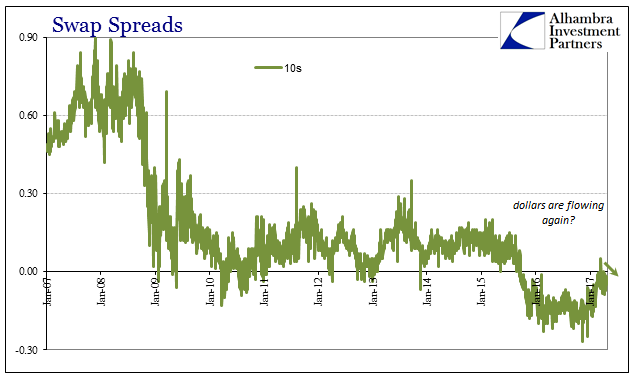

More recently, the (temporary) appearance of positive 10-year swap spreads caused a similar outburst of undue positivity. Without it being negative (though it is again, and sinking of late) as it had for more than a year under the worst of the “rising dollar” it was portrayed as some momentous marker on the road to full recovery. Again, the assumption being that if things are better today than last year, the structural problems must be all erased. It hasn’t been true of anything, let alone swap spreads 10s or otherwise.

The swap market shows us that we are, in fact, nowhere near normal or even the slightest hint of it. What we are witnessing is the same phenomenon as 2013, and less so, where relative progress is mistaken for, and emphasized as, a meaningful change – a category error that is either intentional or drawn from ignorance. It should be perfectly clear that the word improvement as it relates to 2017 only applies to the conditions of 2016, and nothing more than that.

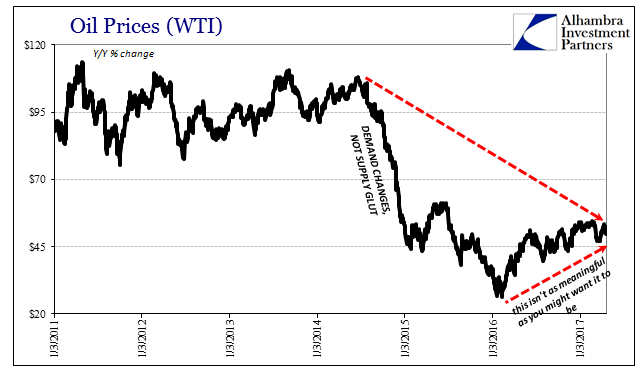

We see it also in oil prices, where fixation over the yearly change as compared to last year’s lowest points does nothing more than mislead interpretation away from the truly relevant comparison that shows oil prices after almost three years still down more than 50%. Because oil prices have nearly doubled from the bottom, that is supposed to mean something but it does only along the same lines as “jobs saved.”

There is a general disbelief attached to all this, where some real good news is so long overdue it scarcely seems possible. Therefore, in its absence various people at various times have displayed this tendency to make a lot out of what is really nothing. And in doing so, or at least trying to do so, it merely reinforces one more time just how bad things are.

If the “dollar” system were at all starting to heal nobody would have cared about 2a7, slightly positive 10s spreads, or residual seasonality. But because nothing has , leaving the global economic/financial system in a really bad place, the smallest, most trivial and frankly irrelevant indications are hyped up because so many aren’t ready to accept how things really are. The issue is not that we might have avoided several times another 2008, it is that we haven’t yet moved past the last one.

That alone is what matters; everything else is unhelpful noise. There are no more jobs left to be saved.

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more