Today The SPY Made A Higher High

- SPX Monitoring purposes; Covered short on 7/6 at 2409.75=gain 1.2%; Short SPX 6/26/17 at 2439.07.

- Monitoring purposes Gold: Neutral

- Long Term Trend monitor purposes: Neutral.

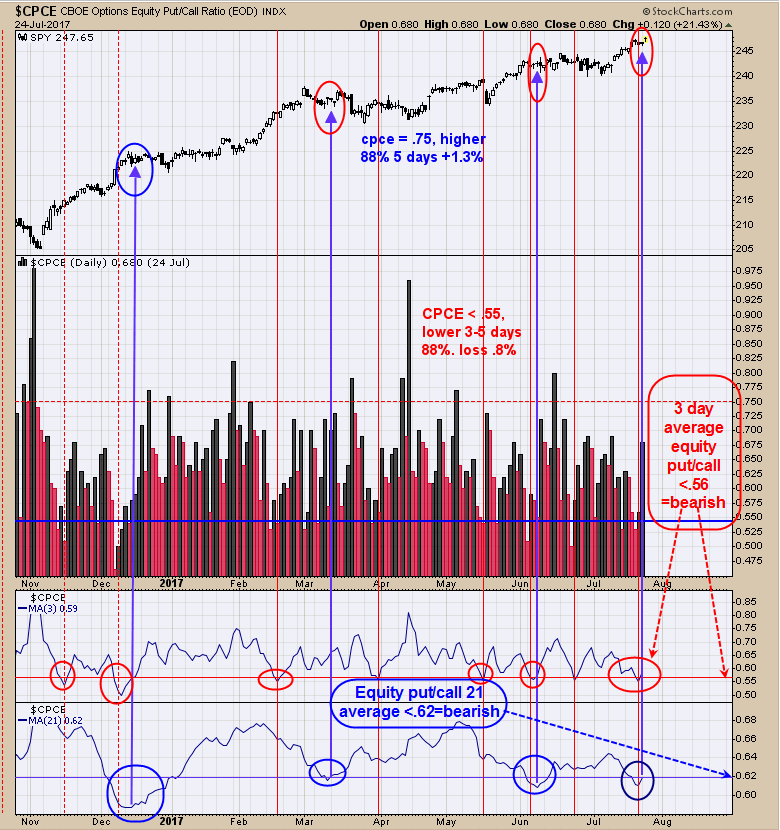

Yesterday we said, “Five of the last six instances since January 2017, when the three period moving average of the Equity Put/Call ratio reached .56 and below, produced a sideways to down market that lasted a week or longer.” The bottom window is the 21 day average of the Equity Put/Call ratio. Readings .62 and below on this moving average suggests a larger consolidation (or decline) is about to begin that usually last several week. The FOMC meeting starts today and runs into Wednesday. With the 3 and 21 period moving average of the Equity Put/Call ratio running at bearish levels, the FOMC meeting may represent a topping period. Covered SPX short for gain of 1.2%.

The FOMC meeting is today and tomorrow and can produce reversals in the market. The second window up from the bottom is the SPY/VIX ratio. A bearish sign is created when the SPY/VIX ratio makes lower highs as the SPY makes higher highs (Pointed out in blue). Today the SPY made a higher high and the SPY/VIX made a lower high (but not by much which can lead to a weak signal). The bottom window is the NYSE McClellan Oscillator which closed near +40 and above “0” and still in bullish territory. We do have bearish signs here but are looking for more clarity.

Its common for the GDX/GLD ratio to lead GDX. Above is the daily chart for GDX/GLD ratio with its Bollinger Band. The Bollinger bands are pinching suggesting a large move up or down is nearing. The Bollinger band pinched back in December 2015 and the first move was down before reversing higher and rallied all the way into August 2016. The eventually outcome will be up (because the COT bullish gold reports) but there could be a head fake first. GDXGLD ratio has been consolidating since August 2016 and the next move should be an impulse wave that could mirror the wave that started back in January 2016. The bottom two windows are momentum type indicators and both are dead neutral. A cycle low is due in late July though early August so we are in that time zone now. Things should start to happen within the next couple of weeks The COT report for June 26 showed the Commercials at 150K short (bearish); for July 7, 107K Short (on bullish side of neutral), July 14 came in at 73K short; July 21 at 74K short; both of which are bullish. The commercials (smart money) think a bottom is close at hand for Gold. We are staying neutral for now.

Disclosure:

None.

Disclaimer: Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past ...

more