Thrilling Thursday – Rally Resumes On Dollar Weakness

Down and down the Dollar goes.

While Americans may have been thrilled with whatever it was that Trump and his lawyer said in yesterday's press conference (pundits are still trying to figure it out), the rest of the World lost faith in the Dollar and sent it to it's worst 24-hour drop since 2001 from just under $103 to $100.75 (and still falling) is more than a 2% drop in the value of the the Dollar and the US indexes, which are priced in Dollars, gained half a point and everyone thinks it's a rally – idiots!

Oil, also priced in Dollar, jumped up from $51 to $53 (and still climbing) and that's up 4% and boy did we call that one wrong yesterday for our first Futures loss of the year. Gold was up 2%, etc. etc. – in other words, the Dollar went down and all the things priced in Dollars went up but, notably, not so much the equity markets. In fact, if you look at the S&P and divided it by the price of oil over the past few months, you get a very disturbing trend:

In fact, since the election, we've lost 17.3% of our buying power and, for the year, 1/3 of our buying power has disappeared while the stocks have "rallied" to record highs. This is what happens in inflationary times – your portfolio may go up in value but, when you try to convert it to Dollars and then try to buy something useful with those Dollars – you find that you've fallen very short.

Why the sharp loss of faith in our currency yesterday? Well, after waiting for two months for Trump to give his first press conference, he said nothing of substance. No infrastructure program, no jobs program, no agenda at all other than repealing Obamacare and that comes with no particular plan to replace it – which could be a disaster for 20M people who will lose their health care.

Then there are the economic issues in the US that the market has been ignoring: Wells Fargo (WFC)'s take on the ICR Retail Conferece sums it up nicely as they call the entire Retail Sector (XRT) "uninvestable." We're heard plenty of guidance cuts in the past two weeks and earnings, so far, have been weak. Tomorrow we have Financial Earnings and we're not expecting them to be exciting either (see our SKF short idea).

We've been calling the market toppy for quite some time and we anticipated inflation with our "Secret Santa’s Inflation Hedges for 2017" where we had our Trade of the Year idea for Silver Wheaton (SLW) to take advantage of the Dollar weakness we expected:

- Sell 10 SLW 2019 $15 puts for $2.80 ($2,800)

- Buy 15 SLW 2018 $15 calls for $4.75 ($7,125)

- Sell 15 SLW 2018 $20 calls for $2.65 ($3,975)

That trade used just net $350 of cash and the margin requirement on the short puts was $1,517 and already the puts are down to $2.25 ($2,250) and the bull call spread is net $2.75 ($4,125) for a net on the spread of $1,875, which is a $1,525 (435%) gain on cash in just 3 weeks. Now you can see why it's our trade of the year!

That trade is "on track" for our expected $7,500 return (a $7,150 gain) so there's no reason for us to settle for "just" 425% – tempting though it may be already to take the profits. In our Long-Term Portfolio, we took a more aggressive stance and our trade idea there is:

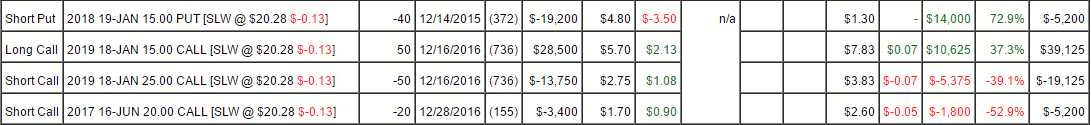

As you can see, we alreayd made a successful short put play back in 2015 on SLW, which is why it was on our radar when the Trade of the Year selection committe met in November. We employed the put-selling strategy we discussed in detail in yesterday's post as we promised to buy 4,000 shares of SLW for $15 in exchange for $19,200 on the put contracts. That would have put us into SLW for net $10.20 ($40,800) and we certainly wouldn't mind being long-term long on SLW at that price.

As it turned out, SLW never sank that low and the contract looks to expire worthless and we'll just keep the $19,200 – we can live with that as well. This December, as we have a nice profit on the puts, we added 50 of the $15/25 bull call spreads at net $2.95 ($14,750) and, just in case we were wrong, we sold 20 June $20 calls for $1.70. Since we sold at net $21.70, we can only lose on the spread if your long spread is $6.70 ($33,500) in the money – that would make us happy too.

As a new trade, the new 2016 spread hasn't moved that much (net $14,800) and you can offset the cost with the sale of 30 2019 $17 puts at $3.25 ($9,750) and that would put you in for net $5,050 on the potential $50,000 spread so the upside potential is $44,950 (890%) though, of course, you have to manage the short calls over time.

Don't forget those short puts obligate you to buy 3,000 shares of SLW at $17 ($51,000) and the ordinary margin requirement on those is $5,132, but that's very efficient when you are looking at a $44,950 return. As long as you really, Really, REALLY want to own 3,000 shares of SLW at $17 – it's a fantastic trade to consider.

Check out our other Secret Santa Inflation Hedges by following the link above or get 100s of trade ...

more

Thanks for sharing