This REIT Yielding 7.4% Should Benefit Investors When Rates Rise

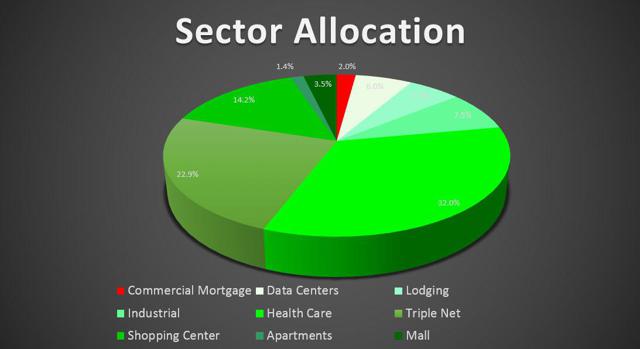

In the April issue of my newsletter and in the Durable Income REIT Portfolio, I have 23 REITs, consisting of 22 equity REITs and 1 mortgage REIT. The sole mortgage REIT in the portfolio is United Development Funding (NASDAQ:UDF), a small-cap company that specializes in providing debt and equity capital solutions to leading developers and home-builders (see my article on UDF HERE).

As the name of my portfolio suggests, I'm focused on durable income, and that means no stocks with dividend volatility. I seek to avoid most mortgage REITs (except a few preferred issues); yet, I see value in the simpler commercial mortgage REITs.

The sole mREIT, United Development Funding (a monthly dividend payer), has been a good choice; but with a market cap of around $551 million, I'm limiting my stake (in UDF) to around 2%. In the quest for yield (and safety), I'm seeking yet another candidate that will enable me to deliver strong income over time.

Just over a year ago, I wrote an article on Blackstone Mortgage Trust (NYSE:BXMT), and I concluded the editorial as follows:

I have BXMT on my research list. That means, I will conduct more due diligence and hopefully meet with management after earnings. BXMT appears to be well-positioned, and I like the fact that the company has a more conservative positioning within the mortgage REIT sector.

Blackstone Mortgage: A Differentiated Approach

Blackstone Mortgage Trust originates and purchases senior mortgage loans collateralized by properties in the U.S. and Europe. The New York-based REIT is managed by Blackstone Real Estate (NYSE:BX), a world leader in real estate investing with nearly $81 billion of assets under management (or AUM) and over $141 billion of owned real estate.

Blackstone Real Estate consists of two operating entities: (1) Blackstone Real Estate Partners is the equity investment platform that has around $72 billion in AUM, including several recent REIT spin-offs - Hilton Worldwide (NYSE:HLT), Brixmor (NYSE:BRX), and Extended Stay America (NYSE:STAY), to name a few. (2) Blackstone Real Estate Debt Strategies has over $9 billion in AUM.

BXMT's affiliation with Blackstone Real Estate is a great competitive advantage, because the company's access to proprietary deal flow and property and market information is a valuable differentiator, given the scale of Blackstone's real estate business.

Continue reading this article here.

Disclosure: The author is long O, DLR, VTR, HTA, STAG, CSG, GPT, ROIC, HCN, OHI, LXP, KIM, TCO, DOC, UDF, EXR, HST, BRX, WPC, HCP, CLDT, MPW, APTS, BX.

more

BRX by a nose..I did a CAGR

BRX BXMT- which has been a better performer? you have a preference?