This Extreme Situation Can Help You Bank Massive Profits

We've seen time… and time… and time again just how large a part human emotion plays in big market moves.

Whether it's classic Greenspan-ian "irrational exuberance" at market tops, bidding up everything from tulip bulbs to dot-com stocks, or – less so these days – despair that catches like wildfire, sending otherwise perfectly sound stocks plummeting with no business case for them to do so.

In other words, emotions drive financial markets (and, importantly, the individual securities on them) "out of whack" – sometimes severely so.

This emotion drives investors to make bad, if not disastrous, decisions, gleefully overpaying at tops and selling at a long-term loss at bottoms.

Nevertheless, if you can hold your nerve, keep a proper perspective, and not go along with the crowd, you'll find that there's massive upside in these extreme situations – especially the one I'm going to show you.

Now, these aren't just rare opportunities. You can find these extremes everywhere in the market, at just about any time.

They show up in broad indexes… specific market sectors… individual stocks and bonds…

And each one is a huge opportunity…

How to Play an "Extreme Continuation" Event

Now, to many investors, filtering through the hundreds of extremes that appear in the market every day may seem like an insurmountable challenge.

There's that emotion again…

But I'm going to let you in on a little secret: The one you've really got to watch out for with "dry powder" is easy to spot.

It has a unique "how often" and "how much" profile.

One of my very favorite trades is playing a strong stock that is in a strong sector and buying it on sale because its price has dropped to a temporary oversold extreme.

It's called an "extreme continuation."

It occurs with moderate frequency, every so often, with moderate-to-large profit potential. It happens across an intermediate time frame – a few weeks.

The "pop" part of this extreme is a continuation of the previous upside momentum. Because of the previous thrust that the stock has experienced, the upside move after a brief but significant pullback can be dramatic – and it can happen in a hurry.

Typically, this type of extreme occurs in two flavors – "strong stock continuation" and "weak stock continuation," which mirror each other.

The difference being, in the strong stock scenario, a security has been trending up – but has then pulled back to a mid-term extreme on minor news (or no news at all). This positions the stock to rocket higher.

In contrast, the weak stock scenario is when a stock that is in a downtrend is pushed up to a mid-term extreme on minor news (or no news at all). This positions the stock to drop like a stone.

Here's How Profitable a Continuation Can Really Be

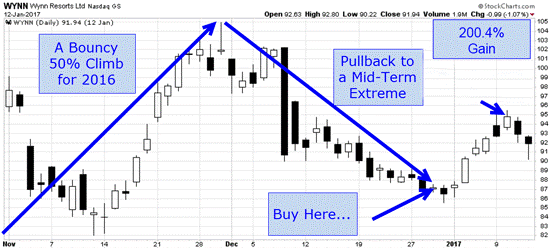

By the end of November 2016, Wynn Resorts Ltd. (Nadsaq: WYNN), a casino company run by its iconic namesake Steve Wynn, had enjoyed a strong rebound year and was up almost 50% on the year.

Then a 17% pullback put this volatile stock in a near-term oversold situation – the rubber band was stretched and ready to snap back to upside. The next-to-last trading day of the year, I told my subscribers it was time to act.

The chart tells the rest of story…

This is just simply the power of harnessing human emotions.

Traders pushed a strong stock down too far and, like a beach ball held under the water, it popped back up to bring us significant profits.

Disclosure: None.