Third Estimate 4Q2016 GDP Revised Upward. Corporate Profits Up

Written by Doug Short and Steven Hansen

The third estimate of fourth quarter 2016 Real Gross Domestic Product (GDP) was revised upward to 2.1 %. This improvement was mainly due to significant upward revision to personal consumption expenditures for services and inventory levels - but with headwinds from trade and government spending.

Analyst Opinion of GDP

It seems GDP keeps getting better. Personal consumption is now stronger and in the normal range historically since the Great Recession. I have been a doubter on GDP improvement continuing into the 4th quarter, but this was a relatively strong quarter.

The market expected:

| Seasonally Adjusted Quarter-over-Quarter Change at annual rate | Consensus Range | Consensus | Advance Actual | 2nd Estimate Actual | 3rd Estimate Actual |

| Real GDP | 1.9 % to 2.0 % | +2.0 % | +1.9 % | +1.9 % | +2.1 % |

| GDP price index | 2.0 % to 2.0 % | +2.0% | +2.1 % | +2.1 % | +2.1 % |

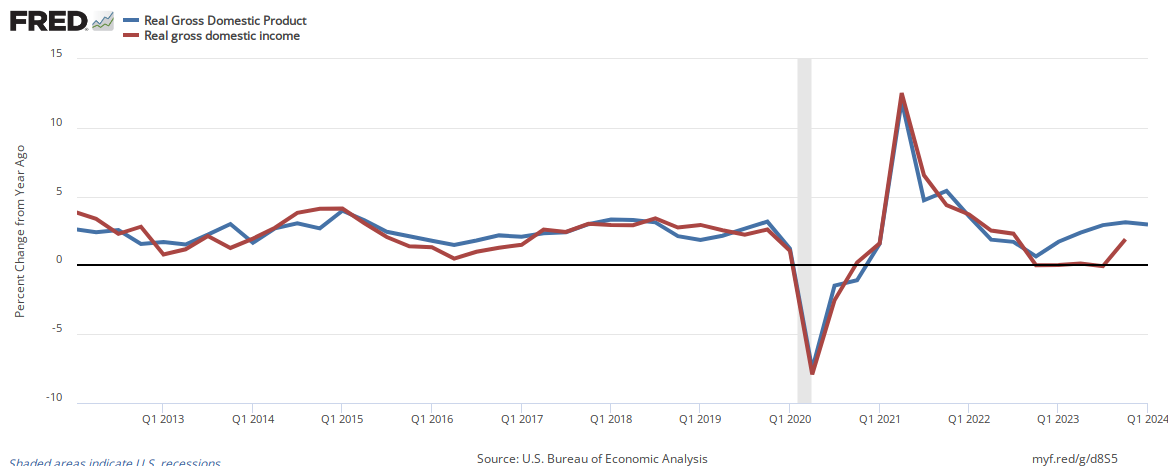

Headline GDP is calculated by annualizing one quarter's data against the previous quarters data. A better method would be to look at growth compared to the same quarter one year ago. For 4Q2016, the year-over-year growth is 2.0 % - moderately up from 3Q2016's 1.7 % year-over-year growth. So one might say that the rate of GDP growth accelerated +0.3 % from the previous quarter.

Real GDP Expressed As Year-over-Year Change

The same report also provides Gross Domestic Income which in theory should equal Gross Domestic Product. Some have argued the discrepancy is due to misclassification of capital gains as ordinary income - but whatever the reason, there are differences.

Real GDP (blue line) Vs. Real GDI (red line) Expressed As Year-over-Year Change

This third estimate released today is based on more complete source data than were available for the "second" estimate issued last month. (See caveats below.)

Real GDP is inflation adjusted and annualized - the economy was statistically unchanged on a per capita basis.

Real GDP per Capita

The table below compares the previous quarter estimate of GDP (Table 1.1.2) with the advance estimate this quarter which shows:

- consumption for goods and services accelerated.

- trade balance declined and reduced GDP by 1.8% (imports grew and exports declined)

- inventory change adding 1.01 % to GDP

- except for inventory growth, there was little change in fixed investment growth

- government spending slowed

The following is Table 1.1.2 before the annual revision: [click to enlarge]

What the BEA says about the third estimate of GDP:

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the fourth quarter of 2016, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter of 2016, real GDP increased 3.5 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.9 percent. With this third estimate for the fourth quarter, the general picture of economic growth remains largely the same; personal consumption expenditures (PCE) increased more than previously estimated

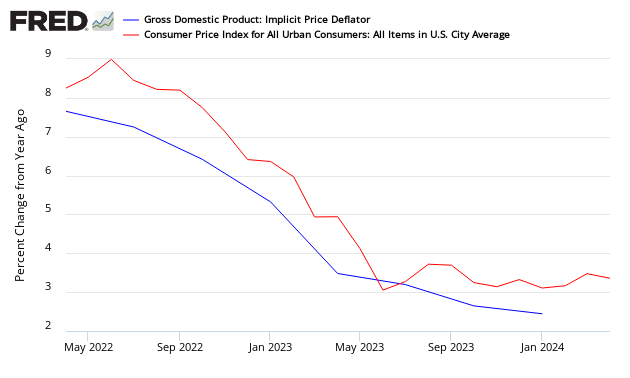

Inflation continues to moderate as the "deflator" which adjusts the current value GDP to a "real" comparable value continues to moderate. The following compares the GDP implicit price deflator year-over-year growth to the Consumer Price Index [this puts both on the same basis for comparision]:

What the BLS says about the revision from the second to the third estimate:

The upward revision to the percent change in real GDP primarily reflected upward revisions to PCE and to private inventory investment that were partly offset by downward revisions to nonresidential fixed investment and to exports. Imports, which are a subtraction in the calculation of GDP, were revised upward.

In the same release, corporate profits data was released showing less growth.

Profits from current production (corporate profits with inventory valuation adjustment and capital consumption adjustment) increased $11.2 billion in the fourth quarter of 2016, compared with an increase of $117.8 billion in the third quarter.

Profits of domestic financial corporations increased $26.5 billion in the fourth quarter, compared with an increase of $50.1 billion in the third. Profits of domestic nonfinancial corporations decreased $60.4 billion, in contrast to an increase of $66.4 billion. The estimate of nonfinancial corporate profits in the fourth quarter was reduced by a $4.95 billion ($19.8 billion at an annual rate) settlement between a U.S. subsidiary of Volkswagen and the federal and state governments. For more information, see the FAQ, "What are the effects of the Volkswagen buyback deal on GDP and the national accounts?" The rest-ofthe-world component of profits increased $45.1 billion, compared with an increase of $1.3 billion. This measure is calculated as the difference between receipts from the rest of the world and payments to the rest of the world. In the fourth quarter, receipts increased $9.1 billion, and payments decreased $36.0 billion.

Overview Analysis:

Here is a look at Quarterly GDP since Q2 1947. Prior to 1947, GDP was an annual calculation. To be more precise, the chart shows is the annualized percentage change from the preceding quarter in Real (inflation-adjusted) Gross Domestic Product. We've also included recessions, which are determined by the National Bureau of Economic Research (NBER). Also illustrated are the 3.22% average (arithmetic mean) and the 10-year moving average, currently at 1.37%.

Here is a log-scale chart of real GDP with an exponential regression, which helps us understand growth cycles since the 1947 inception of quarterly GDP. The latest number puts us 14.8% below trend, the largest negative spread in the history of this series.

A particularly telling representation of slowing growth in the US economy is the year-over-year rate of change. The average rate at the start of recessions is 3.35%. Nine of the eleven recessions over this timeframe have begun at a higher level of real YoY GDP.

In summary, the Q4 GDP Third Estimate of 2.1% topped forecasts but is well below the 3.5% GDP for the previous quarter.

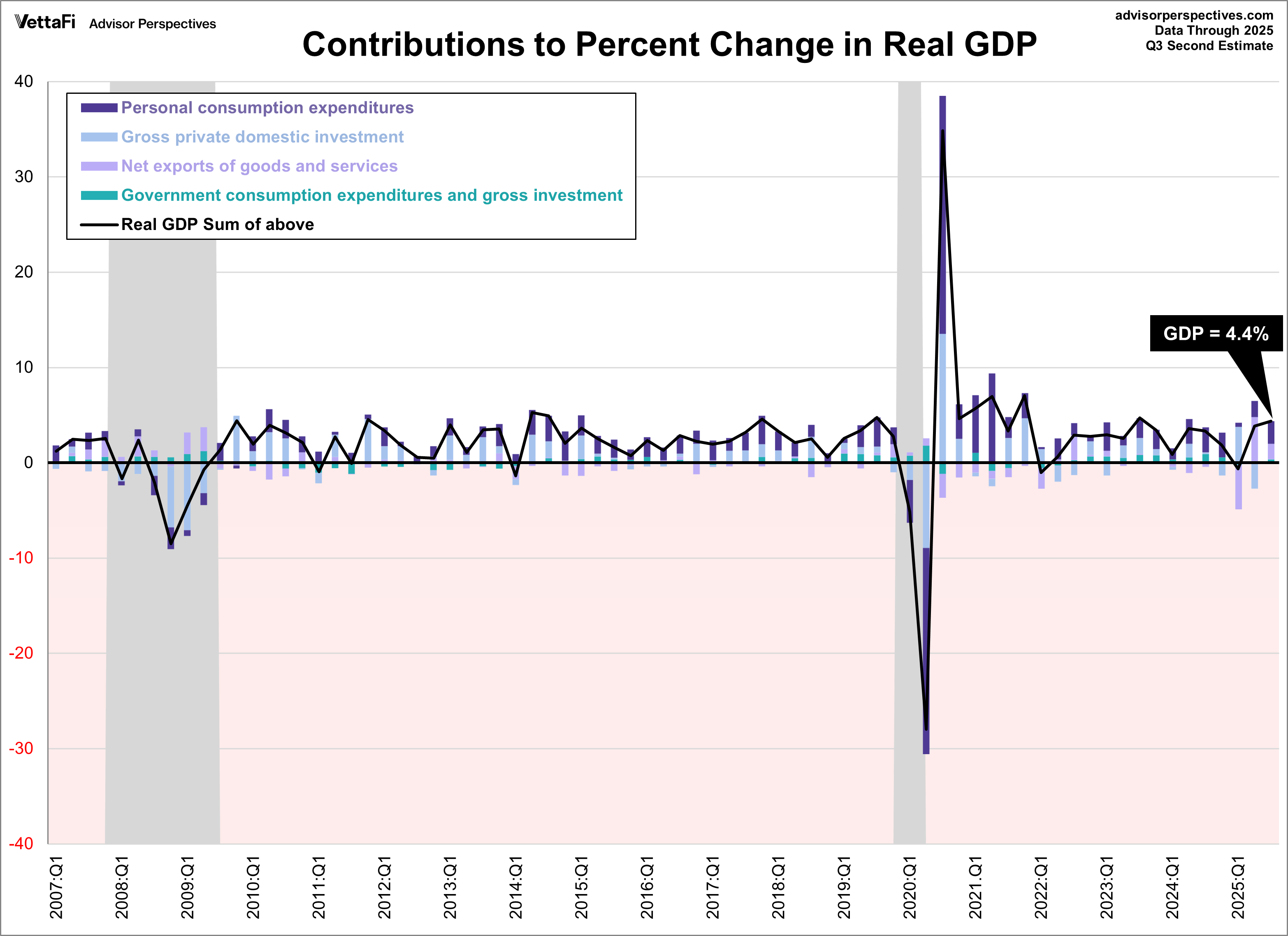

The chart below is a way to visualize real GDP change since 2007. The chart uses a stacked column chart to segment the four major components of GDP with a dashed line overlay to show the sum of the four, which is real GDP itself. As the analysis clear shows, personal consumption is key factor in GDP mathematics.

Caveats on the Use of Gross Domestic Product (GDP)

GDP is market value of all final goods and services produced within the USA where money is used in the transaction - and it is expressed as an annualized number. GDP = private consumption + gross investment + government spending + (exports − imports), or GDP = C + I + G + (X - M). GDP counts monetary expenditures. It is designed to count value added so that goods are not counted over and over as they move through the manufacture - wholesale - retail chain.

The vernacular relating to the different GDP releases:

"Advance" estimates, based on source data that are incomplete or subject to further revision by the source agency, are released near the end of the first month after the end of the quarter; as more detailed and more comprehensive data become available, "second" and "third" estimates are released near the end of the second and third months, respectively. The "latest" estimates reflect the results of both annual and comprehensive revisions.

Consider that GDP includes the costs of suing your neighbor or McDonald's for hot coffee spilled in your crotch, plastic surgery or cancer treatment, buying a new aircraft carrier for the military, or even the replacement of your house if it burns down - yet little of these activities is real economic growth.

GDP does not include home costs (other than the new home purchase price even though mortgaged up the kazoo), interest rates, bank charges, or the money spent buying anything used.

It does not measure wealth, disposable income, or employment.

In short, GDP does not measure the change of the economic environment for Joe Sixpack and Joe Sixpack's kid, yet pundits continuously compare GDP across time periods.

Although there always will be some correlation between all economic pulse points, GDP does not measure the economic elements that directly impact the quality of life of its citizens.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only. The reader is solely responsible for ...

more