These Companies Are Dogs. Buy Them Now. This Way

I am not advocating that you invest solely in the Dogs of the Dow. If you want to do so, however, it is pretty darn easy. Simply wait until the end of each year, then select the ten stocks of the Dow 30 which have the highest yield. Invest an equal amount of dollars into each. That’s all there is to it. Next year do the same thing. Rinse and repeat every year.

There is a certain logic to using this strategy, if only for a portion of your portfolio. The Dow 30 tend to be big, solid companies that aren’t in any (immediate) danger of going out of business. Often the reason the yield on the Dogs is so high is not because their dividends have been increased but because they have disappointed investors or they just aren’t au courant so investors have abandoned them.

To everything, there is a season. If their dividend stays the same or only increases slightly but they are now out of favor their yield will effectively increase as their price declines. But investor tastes are fickle; sooner or later they will return to a particular sector or industry and, voila!, bid those stocks back up again. A recent example is the decline of energy stocks. As it happens, two of the ten Dogs for 2018 are Exxon Mobil (XOM) and Chevron (CVX). If they continue the roll they are on investor/owners will enjoy capital gains as well as very nice dividend income.

The Dogs of the Dow strategy is based upon my and most other serious analysts first rule about stock markets: reversion to the mean. That is to say, markets tend to return to the mean over time. The second rule, best elucidated by Bob Farrell many many years ago, is “Excesses in one direction will lead to an opposite excess in the other direction.” Who knows that Sir Isaac Newton was such a brilliant stock market observer?

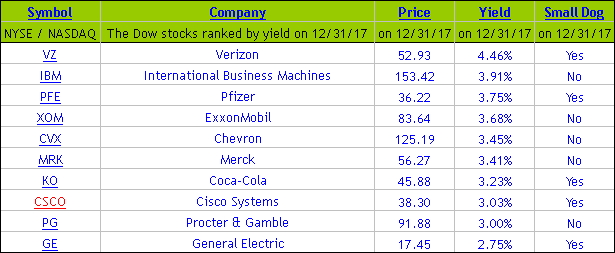

If you are interested in pursuing this strategy, there is an excellent website devoted solely to the Dogs of the Dow (and the “Small Dogs of the Dow” and other variations. The Small Dogs of the Dow are the five lowest priced of the 10 Dogs of the Dow.) It is Dogs of the Dow. Here are a couple charts from their website to whet your appetite:

Chart courtesy of Dogs of the Dow

The first chart shows the 10 Dow Industrials stocks that comprise the highest-yielding of the 30. I personally believe IBM, Pfizer (PFE) and XOM are undervalued right now, while GE is a company that has completely lost its way, diversifying into energy at the top of the energy cycle, keeping the worst of its insurance business while divesting the rest, taking on too much debt, and led by weak and rudderless management. There is nothing more dangerous than a Titanic that can’t see the icebergs and move into smoother waters.

I also don’t see Verizon (VZ) providing much in the way of capital gains as they digest their recent acquisitions. And while I think Coke (KO), Proctor & Gamble (PG), and Cisco (CSCO) are unlikely to move much this year, I can see each of them continuing to raise their dividends as the year progresses.

But if you are a Dogs purist you don’t insert your opinion, you invest in all equally (or in a specific subset unaffected by your opinion of management or prospects.) As a securities analyst, I am clearly not a Dogs purist!

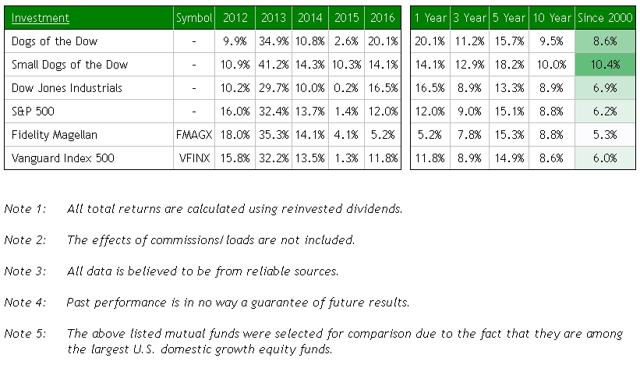

Chart courtesy of Dogs of the Dow

The above chart shows the returns through 2016 of the Dogs, Small Dogs, DJI, S&P 500, and an active and passive representative mutual fund. I’ve written extensively of what I believe is the false hope being preached by many to “just buy a passive index fund and let it be through all market cycles until you take the money out.” The above chart offers yet another example: the massive and massively popular Vanguard Index 500 beat neither of the uber-simple Dogs strategies.

However.

The path I suggest you take right now is not to buy the Dogs and it isn’t just because I think GE will be a massive weight on the strategy in 2018 and some of the others while offering a fine yield, are still ahead of themselves in light of likely earnings increases.

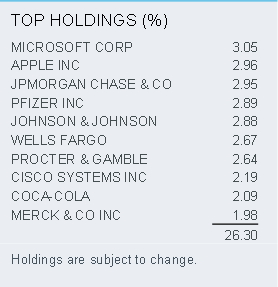

Instead, I suggest you take a look at the iShares Core Dividend Growth ETF (DGRO), a “factor” ETF in which the holdings look somewhat similar to the S&P 500 but the factor used to weight the holdings is anything but passive. That factor is dividend growth. Most dividend ETFs and mutual funds are all about which companies pay the highest current dividends. The same is true of the Dogs of the Dow strategy and all its variations; they are all about trying to derive future valuation increase based upon the static and current dividend yield.

DGRO is different. iShares is looking for companies that have demonstrated consistent dividend growth rather than merely looking at what they currently pay. The managers’ criteria include the payment of dividends, but also…

(1) Five years of uninterrupted annual dividend growth. The emphasis on most recent dividend growth means this ETF will include among its holdings firms in new sectors, like many in the tech sector where earnings are growing most quickly, allowing for greater dividend payouts.

(2) Positive earnings forecasts. Companies selected for inclusion must have a clear runway for earnings growth and must currently pay out less than 75% of their earnings as dividends.

(3) Diversification via inserting a weighting cap on each position. The most any one company can comprise of the portfolio is 3%. This ensures diversification across industries and sectors.

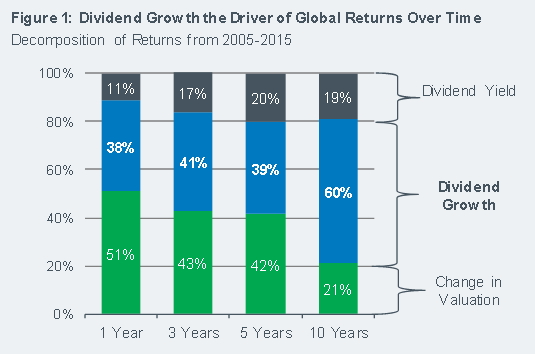

Here’s a visual representation of the power of dividend growth as a percent of total returns from the 10 years ended 2015: (The fund began in mid 2014.)

Chart courtesy of iShares

After a stellar year like 2017, dividend growth might be a smaller proportion than the change in valuation but over time growth in dividends, at least during this time frame, was a more important “factor” than valuation change and considerably more important than the dividend yield itself.

So why discuss the Dogs of the Dow as a preamble to my recommendation you consider DGRO for your further due diligence? The chart above. I want to clearly differentiate this factor (dividend growth) from the factor of dividends paid at the beginning of the holding period. Also, however, I’d like to point out that the DGRO portfolio methodology will inevitably encompasses many Dogs every year anyway.

PFE, PG, CSCO, KO, and MRK are all in the Top 10 holdings of DGRO. The other 5 were unable to fulfill Requirement 1, five years of annual dividend growth, in recent years. That doesn’t make them bad; I really like XOM and IBM for growth in their own right as well as CVX on a pullback. VZ is a fine dividend payer though I see little growth there and GE is, well, GE.

Chart courtesy of iShares

There is nothing wrong with buying dividend aristocrats as long as they at least keep paying their current dividends. But I prefer to capture dividends, valuation change, and growth in dividends. DGRO allows me to do that. And I can always buy my other Dog favorites directly. Or via an ETF; for instance, XOM and CVX dominate energy sector cap-weighted ETFs.

Full Disclosure: I have done just this by purchasing XLE for one of my family accounts and for many clients. XOM and CVX alone account for 40% of this ETF’s holdings!) I am buying ...

more