Them's The Breaks? Challenging Some Lows

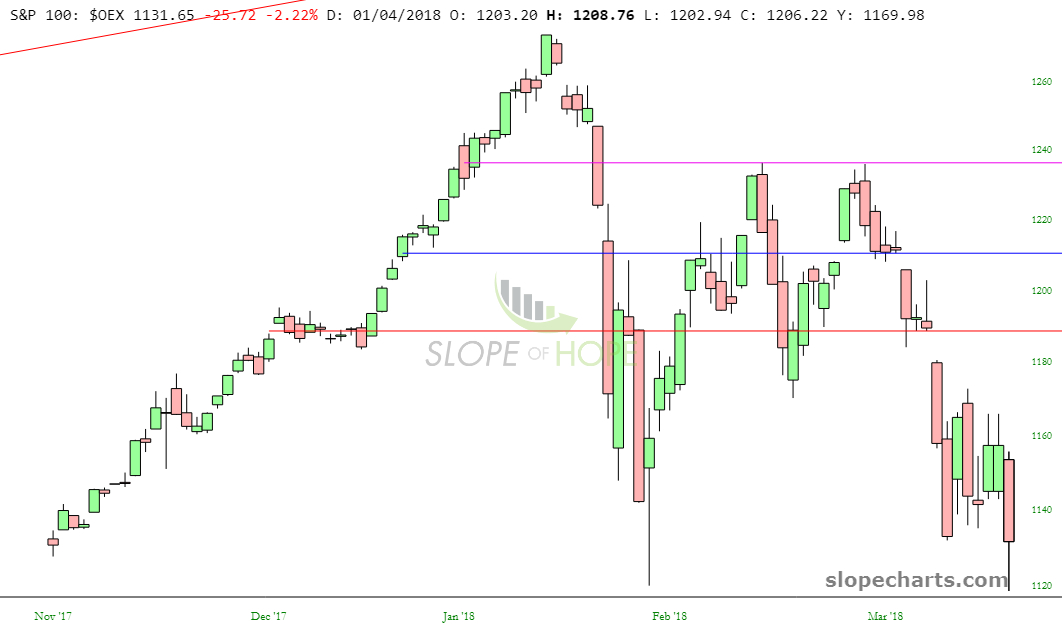

The shift from bullish to bearish since January 26th has been delightfully insidious. Today’s market action (that is, Monday the 2nd of April) created some more progress for the bears, although the breaks of February 9th lows were not across the board. Indeed, looking at some of the big indexes, you can see that we’re getting to the point of “challenging” those important lows, but not yet piercing them:

In some important instances, however, we did break those lows (albeit by the slimmest of margins).

I find that last chart particularly interesting. It’s a terribly well-formed top, and it’s a nice, broad index.

For myself, I remain cheerfully short, with 76 positions. Only three of these are ETFs – IYR, XLU, and DBC. My greatest concentration is definitely in the realm of real estate, and I have lately been keeping a very aggressive posture of about 250% margin.

Disclaimer: This is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. Before selling or buying any stock or other investment you ...

more