The World’s Economic Recovery Has Momentum, But Growth Is Still Is Subpar

The OECD provides one of the more authoritative international economic reviews. Although in its latest publication the global outlook has hardly changed from one prepared three months earlier, it is encouraging that most of the changes for the advanced economies were in a positive direction.

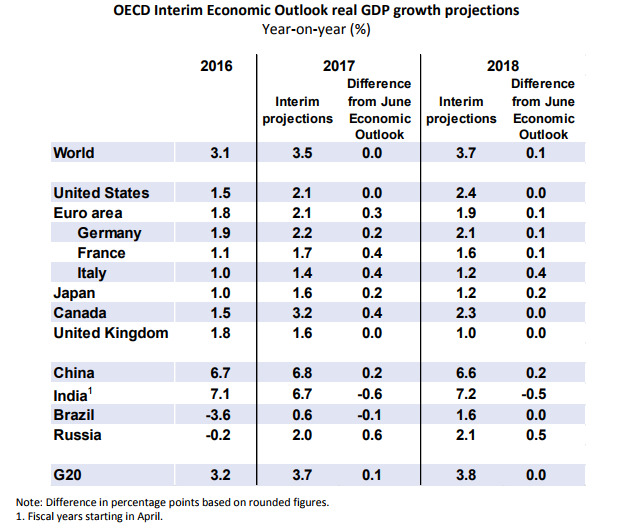

Global GDP is currently expected to increase by around 3.5% in 2017 and 3.7% in 2018 compared with 3% growth in 2016. Moreover, the global economic upturn has become a bit more synchronized across the advanced and emerging market economies.

While at the global level capital investment, employment and foreign trade are expected to expand a bit faster in 2018 than in 2017, nonetheless improvements in these three key indicators are still somewhat substandard in business cycle terms. As a result, wage gains in the advanced economies have also been rather weak, which has contributed to a consumer recovery which is also is unusually slow.

However, the advanced economies are all growing, and projections for the euro area, Japan and Canada have been revised upwards based on an unexpectedly robust growth in the first half of this year.

Indeed, Canada’s economy is projected to grow by 3.2% this year and then slow back sharply to 2.3% in 2018. The U.S. economy, the largest in the world, recorded only 1.5% growth last year, but is expected to expand by 2.1% in 2017 and 2.4% in 2018.

There have also been some positive economic growth surprises for China and Russia, while a few new negative issues have arisen for India’s economic outlook.

After growing 7.1% in 2017, the Indian economy is projected to expand 6.7% this year and 7.2% in 2018. China’s economy is projected to grow 6.8% this year and 6.6% in 2018. India’s economy is expected to once again outpace China’s in 2018.

The UK economy has recently fallen on self-inflicted harder times due to Brexit and political uncertainties. The British economy is projected to slow to 1% real growth in 2018 from 1.6% this year.

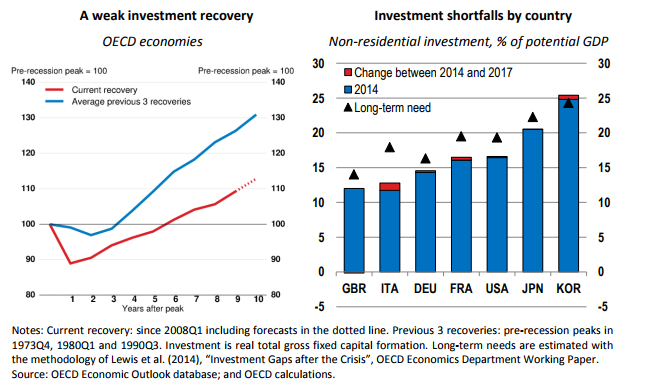

Unfortunately, subpar global growth provides little promise for the medium term. The rationale behind this perspective can be seen in the following two charts.

Capital investment at the global level has been weak, and much weaker than the average of past three global economic recoveries. Moreover, productivity growth continues to be weak in advanced economies and has also slowed in many emerging market economies.

Weak capital spending is often associated with slow growth in jobs and with weak wage gains.

In other words, the missing ingredient in the current global economy is a needed surge in job creating capital spending.

Disclosure: None.