The Trump Economic Narrative Is Just A Head Fake

Nowhere was the Trump narrative of pro-growth and higher inflation embraced without reservation than in the financial markets. His economic policies had inflation written all over them. Tax cuts would put more money in the hands of corporations and individuals to spend. A huge infrastructure program promised a decade of construction that would boost wage income and contribute to greater economic growth and productivity. The boost in military spending would add more fuel to stoke inflation.As for trade policy, higher tariffs would contribute mightily to the CPI in response to the higher cost of domestic production. And, should all this lead to greater Federal government deficits, then we should anticipate an acceleration in inflation down the road.

The financial markets bought this narrative hook, line and sinker. From the day of the election until mid- March, the S & P shot up by 10 per cent and the yield on 10 year bond backed up by nearly 80 bps. The Trump inflation rally was born. Was this for real or was this just a “head fake`` to use a phrase popular in the world of sports?

Writing for the Financial Times, Matthew Klein dubs this narrative as “fake news, if used to explain market news”[1] However one wants to label what has taken place since the election, clearly the Trump narrative is starting to show that it has no legs. Witness the following:

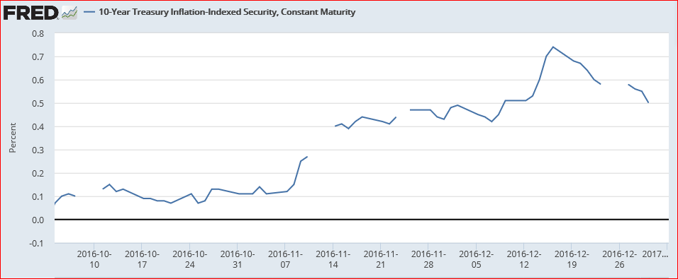

- Initially, the 10-year Treasury inflation –protection bonds, TIIPs, soared from 0.2 per cent at election time to over 0.7 per cent; since mid-March real rates have backed down to 0.5 per cent and trending lower;

- nominal rates have followed suit with the 10 yea10-yearshedding nearly 20 bps from its post-election high; the yield on a 10-year bond is now back to its level of 2015 when deflationary fears were on everyone`s mind ( Chart 1);

Chart 1 10-yr TIIPS

- The recent hike in the Fed funds rate suggests that the Fed is on a path to hold inflation in check and this re-enforces the confidence in the long end of the bond market ; the odds that the Fed will keep inflation under control currently stand at 70 per cent, the highest reading since the 2008 crisis;[2]

- During this past week, investors pulled out $9 bn from funds in invested in U.S. equities; according to data tracked by EPFR, this represents the largest outflow since last June when the Brexit vote took place;

- The corporate bond market is under pressure as well; the premium on high-yield bonds has risen by nearly 60 bps from earlier in the month, according to BAML ; junk bond redemptions experienced one of their worse days last week; all these measures signify an economy that is not growing sufficiently to justify switching into riskier assets; and, finally,

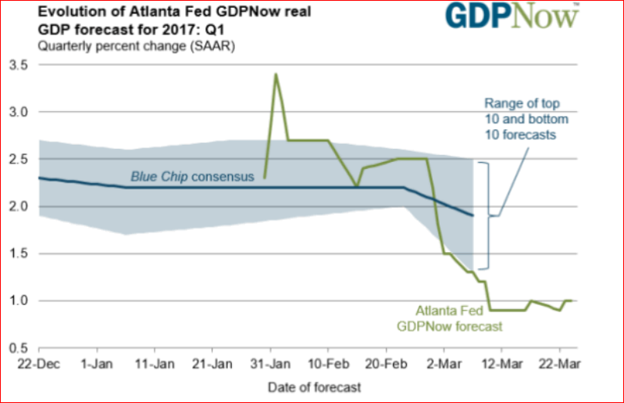

- The economic outlook for 2017 has been steadily ratcheted down; one of the widely followed forecasting models produced by the Atlanta Fed, has steadily downgraded the outlook for Q1 , following a very weak 2016 Q4;first quarter of 2017 is now expected to expand by a measly 1 per cent ; the Blue Chip consensus forecast is also under a similar downgrade ( Chart 2).

Chart 2 GDP Forecasts, 2017

- Initially, the banks were the best performing sector, reflecting the prospects for an improvement in their net interest rate margins; loan growth within the large commercial banking sector has been showing signs of slowing; economic growth is always fueled by an expanding banking sector, so this slowdown is of great concern.

We now come to consider the economic impact of last Friday`s political debacle regarding the GOP`s health care bill. How much the Trump administration`s legislative agenda will suffer because of the failure to replace Obamacare is hard to assess at this early date. Yet, no investor should ignore the possibility that the legislative agenda is in serious danger of future failures. If health care reform was impossible to achieve, and then tax reform, financial deregulation and major adjustments to trade policies are no picnic by comparison. Clearly, investors have to dial into the political forces affecting these reforms before placing their bets.

[1] On Wall Street, March 26, 2017

[2] ibid

Disclosure: None.