The Ritual Of Summer

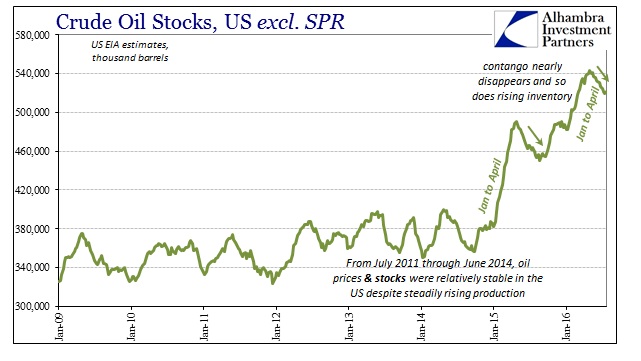

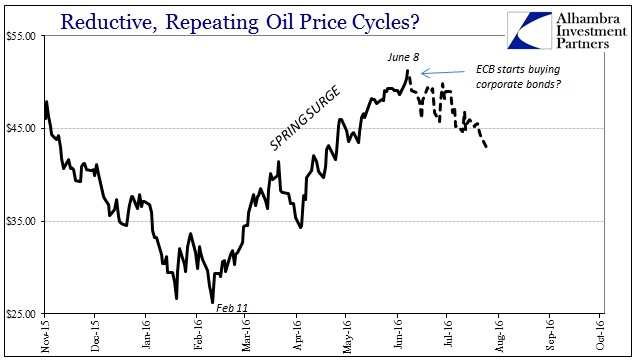

Domestic oil inventory rose in the latest week, updates from the US EIA show. That build broke a streak of nine consecutive weekly draws dating back to mid-May. It is not unusual for oil inventory to rise and fall in various weeks, but given the mechanics of oil prices of late there is an atypical edge and attention to any possible wrong-way indication.

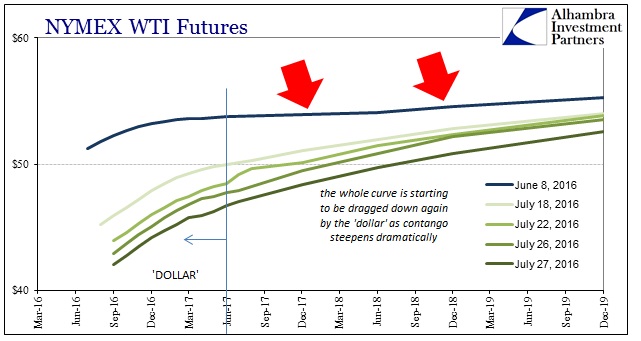

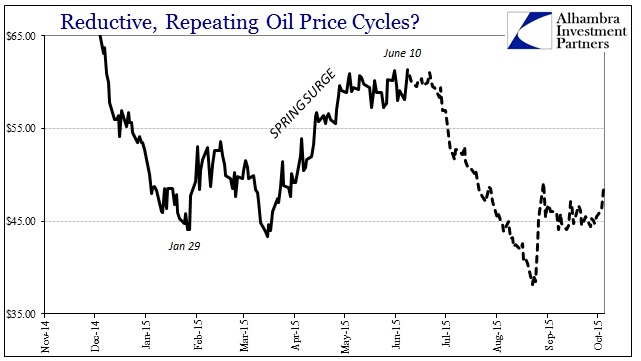

The WTI futures curve has, as noted on many occasions lately, steepened into “dollar”-driven contango which suggests at some point inventories will rise. It wasn’t until mid-August 2015 that the dramatically wider contango of June into July finally found its way into storage, so it might be premature to link the current data to the process. It may not be, either, as guessing oil storage is among the more imprecise arts in a profession full of them.

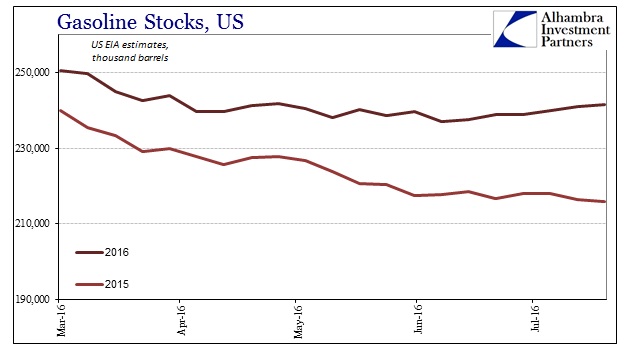

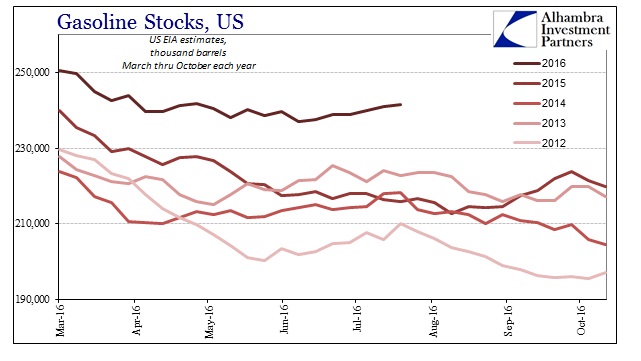

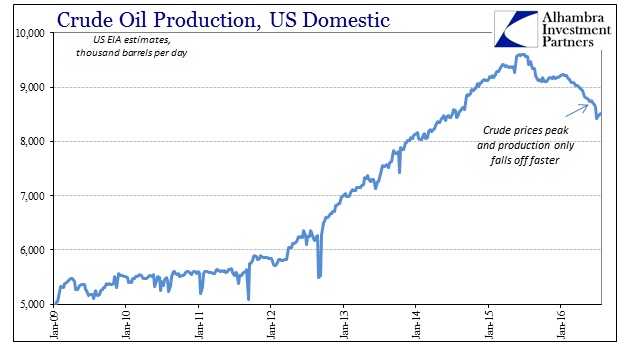

Production also rose in the latest week, but not in any meaningful way, particularly since domestic production dropped off sharply just recently. The only other significant indication from the energy sector is gasoline inventory, which, despite all projections otherwise, continues to rise. Stocks rose for the seventh week of the past ten, five of the past six, at a time when gasoline inventory “should” be falling. The sharp contrast to 2015 is somewhat alarming, particularly given the economic and financial results that were “unexpectedly” delivered by summer.

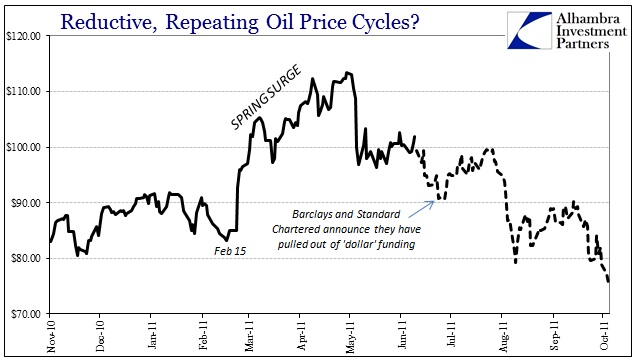

All that, however, is really downstream of what truly drives oil prices. I believe there is much more about WTI in the repo rate or dealer hoarding of collateral than the impossible game of anticipating which way inventory will go in what seasonal capacity. As I wrote this morning, the “more underground” of the evolving eurodollar decay still sets the baseline even on days when the FOMC tries to impose itself.

Central bankers still talk about how they fixed everything, though in 2016 there is a faint but detectible quiver when they do so, yet even from the depths of obscurity we can observe the consequences of that not being close to true. It’s summer once again and oil prices are dropping as repo signals anything but global accommodation.

Disclosure: None.

Agreed the dollar's strength is really only the weakness of other paper money. The rise in US inflation is showing that the ROW is going to feel not just the depreciation of their poorly managed money, but the inflation they have been begging for even if they can not afford it. That will stimulate hoarding which will make the surplus in oil a positive again, although how long such a surplus can last is debatable, and much of it will end up in the hands of those who have currencies that can pay for it.

This may not happen immediately, but the factors leading to currency depreciation and the lack of investment in growth will eventually pull things into balance at the cost of someone. The only way to reverse this is to discourage currency depreciation and stop discouraging capital investment in a time where capital investment continues to decline due to low growth and policies that encourage stock buybacks and dividends over capital investment. Horrific.