The Perils Of Forecasting Interest Rates

With the year coming to a close, investors will be inundated with forecasts for 2017, especially for interest rates. Analysts have lots to sink their teeth into as a result of the rapid rise in long-term rates following the U.S. presidential election. The bond market holds the most attraction, as investors re-assess their portfolios to reflect the rapid increase in rates since November 8th. The most crowded trade, at the moment, is the rotation out of bonds, as investors fear the impacts of expected rising federal deficits, rapid growth and quicken inflation.

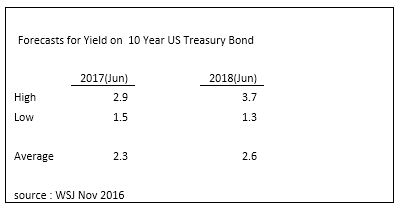

The forecasting derby is now underway. The Wall Street Journal released survey results from 60 economists as to the path of the bell-weather 10-year Treasury bond. The average for the mid-point of 2017 is 2.25%---about 20bps below its current level--- and for 2018 the rate should to 2.56 per cent (see accompanying table). Thus, on average, those surveyed believe that most of the impact has already been priced into the market.

However, the average masks that there is a wide dispersion in expected bond yields. For 2017, the range is from a return to the previous lows of 1.45 per cent to a high of 2.9 per cent. An even wider dispersion exists for 2018, from a low of 1.3 per cent to a high of 3.7 per cent. The dispersion says a lot about the state of expectations for it reveals quite different outlooks for inflation, growth and the impact of government policies on the bond market.

The crowded trade today is favoring further increases in long-term rates. We hear many pronouncements that the 35 years of declining bond yields has come to a halt.From here on out the trending yields will be an upward . Stronger economic growth and higher inflation will dominate the landscape.As the chief economist for Goldman Sachs, Jan Hatzius, argues in the past “policymakers have focused on shoring up the recovery; today, they also must consider the risk of overdoing it.” Other analysts assume that the Trump Administration will ramp up spending, widen the deficit and inflation will ensue . The risk premium associated with a 10-year bond, currently around zero today, will turn positive--- hence the forecasts of nearly 4 per cent for the long bond by 2018. For the moment, this is the consensus view which continues to hold sway.

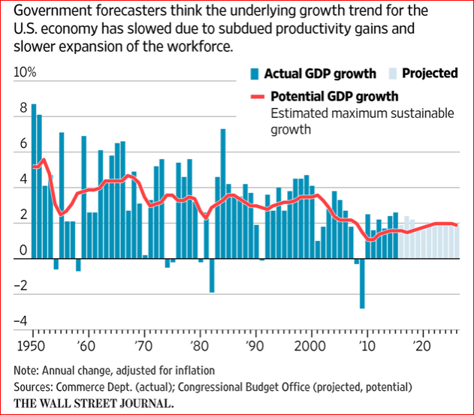

Other analysts, however, anticipate that long bond yields will fall in the next 12-18 months. In support of this position, they argue that forces that pushed yields down to the lowest level in mid-2016 will continue to be in play.They believe that the underlying trend for the U.S. economy is a continuation of moderate growth, slow productivity gains and a slower expansion of the workforce---- all factors that contribute to a lower projected potential GDP growth (see accompanying chart).

Nowhere is there an expectation that real growth will register on average 4 per cent for the next 5 years. Moreover, there are major international forces that will continue to exert downward pressure on U.S. long-term rates. They include:

- Excessive savings rates in the emerging markets;

- Additional capital outflows from Asian economies;

- Widening interest rate spreads that favor buying U.S. fixed income assets;

- A strong USD affecting U.S. trading partners; and

- A continued slowdown in world trade.

There have been other false starts in which rates shoot up, temporarily, only to return to their long-term trend. In 2013, after the Federal Reserve announced the end of its bond-buying program---the so-called ‘taper tantrum’ -- rates backed up, only to come down and test new lows.

There is no doubt that the rise in bond yields has changed the investment landscape. But it is far too early to call a decisive rotation out of bonds or a general reversal of the long-term downward trend in yields. The fact that there is a wide dispersion of forecasts—especially in an industry that tends to respond to groupthink--- suggests that it is too early to call an end to low rates.