The Oil Situation - Wednesday, July 25

So far we are up 78% in out DTO short….

I think there is still plenty more gains in store for it.

“Davidson” submits:

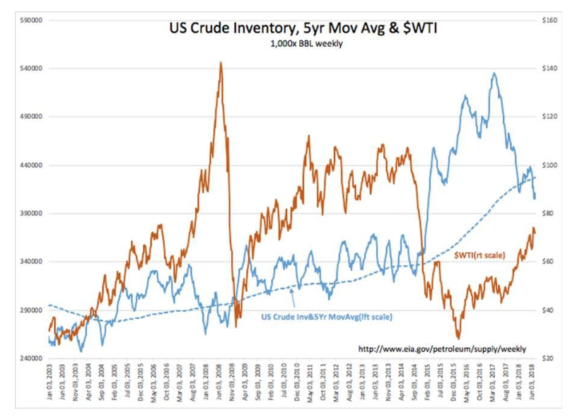

The current US Crude Inventories, 5yr MovAvg Inventories and $WTI have been related since 2003. Speculators tend to drive $WTI higher when current crude inventories fall below the 5yr MovAvg (a perception of Demand exceeding Supply) and drive prices lower when current crude inventories rise above the 5yr MovAvg (a perception of Supply exceeding Demand).

If past shifts in market psychology repeat, the current US Crude Inventories ~406mil BBL are well below the 5yr MovAvg of ~437.5mil BBL should result in higher oil prices as speculator psychology shifts.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more