The Medium-Term Trend - Wednesday, May 24

My indicators are generally positive towards the market, but I am feeling increasingly cautious. At the moment, I am much more inclined to take profits rather than buy as the major indexes hit new highs. The problem is that everyone else is feeling the same, and this is helping keep the market at the highs.

I have to keep reminding myself, though, that I do much better when I follow the indicators. So, what to do?

I continue to hold the best performing areas of the market, but the size of the holdings is small. I have cash on the sidelines, and a few shorts of the worst performers.

As the longs dip below the 50-day, I am quick to sell. And, if the shorts pop up above the 50-day, I am quick to cover.

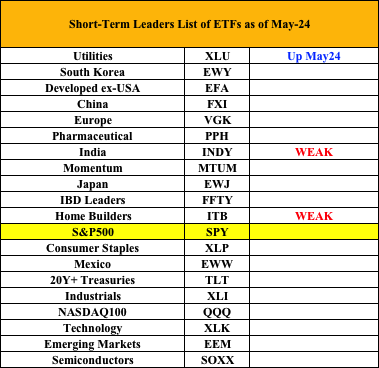

The Leader List

Many of the ETFs that I monitor look like they might be starting to top out based on the momentum indicators. In addition, leadership is defensive with Utilities in today's top spot. In addition, Staples and Treasuries are performing well.

In the short-term, it looks to me as though this Europe ETF might be a bit extended and ready to take a rest.

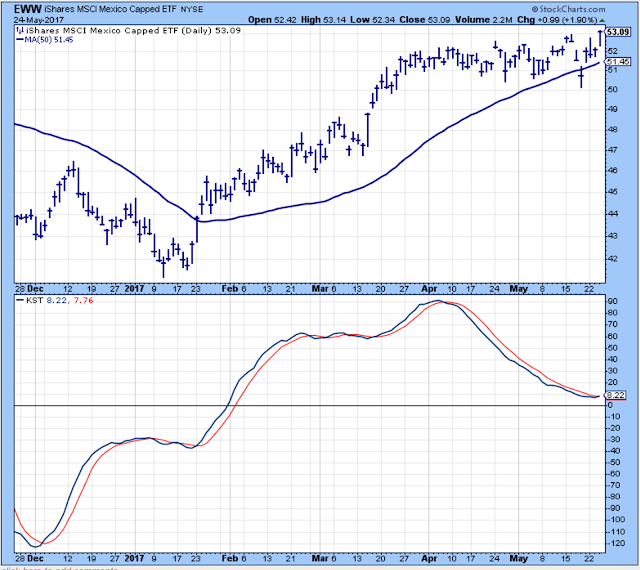

On the other hand, this Mexico ETF might be ready for another leg higher.

Outlook

This week's Value Line Survey is upbeat.

The Survey continues to mention a concern about valuations, but it is encouraged by employment, consumer spending and the uptick of inflation. The Survey's GDP estimate is 3% growth for Q2.

Even more encouraging, according to Value Line, is that the bulls are buying stocks on every market dip.

The long-term outlook is positive.

The medium-term trend is down as of May-17.

The short-term trend is down as of May-17.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, ...

more