The Longer-Term Trend - Saturday, May 27

John Murphy posted a terrific article yesterday about growth vs. value. He states that value does best when economic growth picks up, and you can see this using the growth/value ratio.

The economy struggled in 2015, and growth solidly outperformed during this period. However, the economy bottomed out, and then started to improve late 2015. As a result, value outperformed for all of 2016.

When the calendar flipped to 2017, growth took over again and has been shooting straight up ever since which makes sense based on the surprisingly weak Q1 GDP number.

After such a strong run for growth stocks they are now probably priced to the point where there will be profit-taking.

The question posed by John Murphy is... will the economy start to pick up so that the available cash will flow into value stocks such as financials and energy?

Mike Burk posted an article this morning warning that new 52-week highs are not confirming the new highs in the major indexes as shown in the chart below. (He is also concerned that the small caps are underperforming the large caps.)

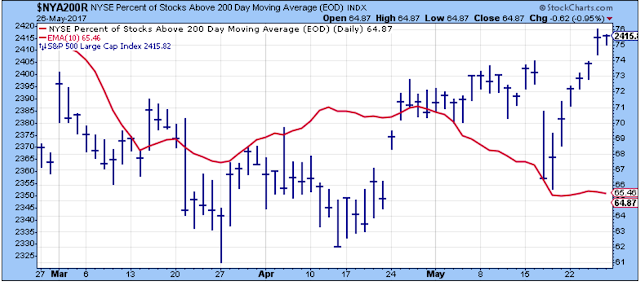

The chart below is similar using the NYSE stocks above the 200-day moving average (as pointed out by John Murphy).

My favorite, the NYSE bullish percent, looks even worse than the other two charts.

Both Murphy and Burk are warning that although the indexes are posting new highs, the market internals are weakening.

I would agree that caution is required at the moment. The recent run up in stocks does not seem to be on solid footing.

The important variable is the economy. Q1 GDP was weak, but has Q2 started to pick up? If so, we could start to see the broader stock market participate which would push the indexes even higher. Otherwise, we get the market correction we all have been waiting for.

My guess: the economy has improved in Q2, but by just enough that we continue to muddle along. Another guess, the major indexes start to come down, but not by as much as we think they should or want.

The Leader List

Below is the list of short-term market leaders based primarily on momentum and relative strength.

Outlook

The long-term outlook is positive.

The medium-term trend is up.

The short-term trend is up as of May-25.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, ...

more