The Longer-Term Trend - Saturday, June 24

I am raising some cash, taking some profits, and stepping aside until the general market presents a much better opportunity.

The short-term swings in the market are confusing at the moment. It seems as though severe sector rotation has replaced the normal market ups and downs.

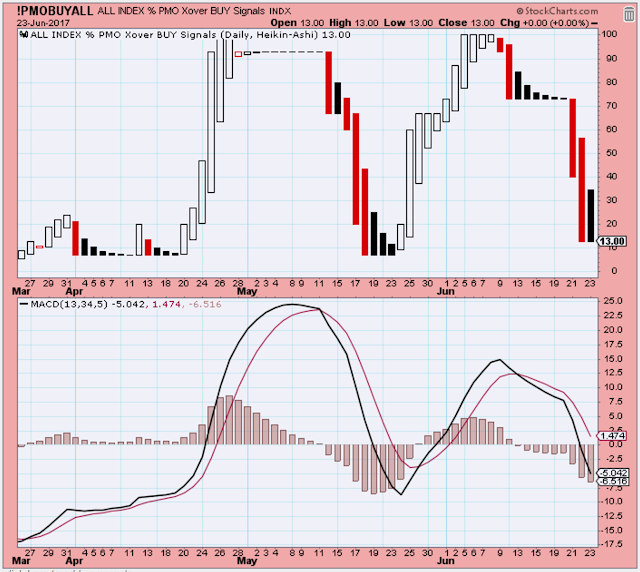

At the moment, based on the PMO index, with most stocks showing short-term weakness, you would expect the major indexes to be presenting a better buying opportunity.

Maybe after so many years of seeing each market dip turn into a surge to new highs, I wonder if investors are just done with increasing cash levels. Instead, whenever a sector starts to turn sour, they just shift money somewhere else.

I don't like it. It isn't healthy to not have periodic market declines. The current market is an old forest that hasn't had a fire in years, and is now vulnerable during the summer fire season.

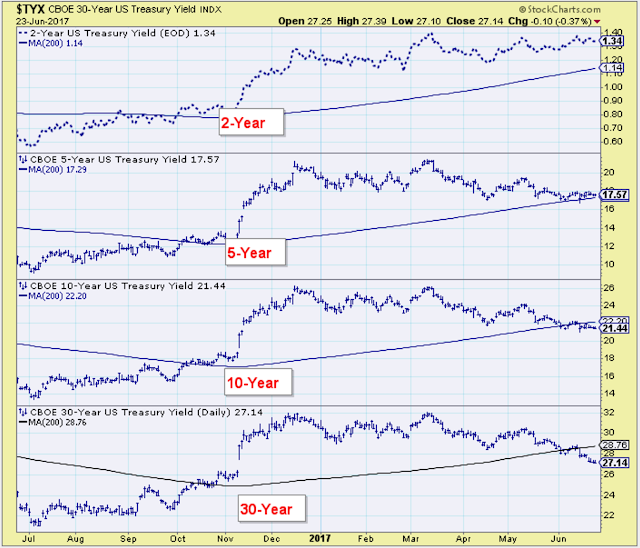

The week ended with an elevated number of buying climaxes, and many of them were financials which are responding to long-term rates that look like they are headed lower.

The bottom panel below is the ECRI economic index. It has been in decline all year, and with no sign yet of leveling off.

The ECRI has a way to go before it signals a recession, but if it continues to dip then I would expect a significant pick up in market volatility.

Maybe it is time to just take a look at an old fashion momentum chart, and just sit back and wait for a more favorable-looking weekly set up.

The Leader List

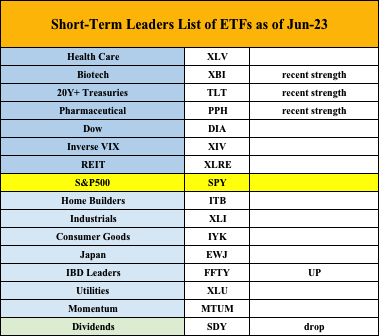

REITs and Biotech were strong Friday. Consumers, Financials, including Regional Banks, were weak.

This is not the look of an ETF that is ready to make a lot of money for investors in the short-term.

Is this chart getting ready for a run at new highs, or is it preparing for another leg down? I expect the general market to follow this chart .. up or down.

It seems as though all industries related to the Consumer are now under pressure. This doesn't look good after hitting a new high just four weeks ago.

The broad and pronounced weakness in consumer stocks is another indicator hinting that the general market is preparing to sell off.

Outlook

Of all the charts I presented today, the one I like best is the weekly chart of the world index that shows the MACD past the top of the range. Maybe we are in a period where trying to finesse the short-term is just a waste.

I am taking profits, raising cash, swimming at the beach, and waiting patiently for the next significant opportunity.

The long-term outlook is positive.

The medium-term trend is up. Overdue for a correction.

The short-term trend is .. not sure.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more

thank

Generally, I would only buy high PE stocks that are growing revenue and profitability and whose debt is shrinking or non-existent. On the low PE side, I'd only buy them if either revenue or profitability is growing and the debt in their balance sheet is dropping.

That said, it's hard to find a golden Easter egg, but you can still find them if you look hard enough.