The Longer-Term Trend - Saturday, Aug 19

The Long-Term Outlook

Semiconductors are critical to health of the general market, so it is worrisome that they look like they could break down. So far it is a sideways correction.

If this index does break down, it will be something to watch. I think it raises the long-term caution flag if it breaks support at about the 140-level. This index deserves a rest.

Regional Banks broke down a couple weeks ago, although it hasn't broken down below the bottom of the range that goes back to last November.

Weakness in this group indicates that short-term rates are not likely to rise significantly. I won't get too worried based on this chart unless it breaks down below the 51-level or so.

This is one of my favorite market indicators. When it points lower you know the market is under some selling pressure.

It seems to me that as long as this indicator is above zero, then the market behaves fairly well. When it dips below zero, that is when it is time to watch for serious signs of selling, but also for signs of a good buying opportunity.

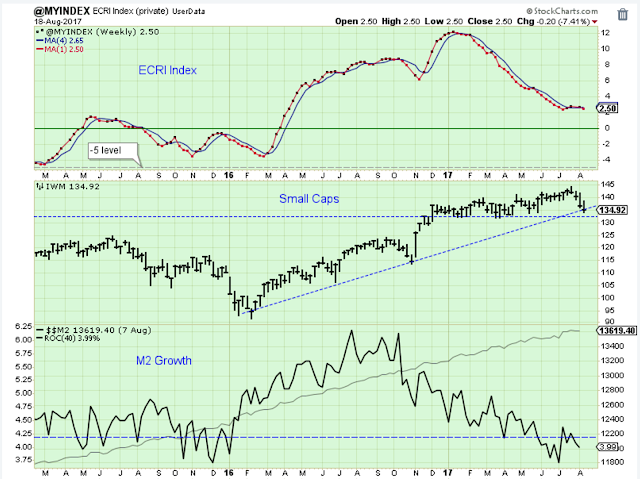

This is the chart that helps tie the health of the economy to stock prices. The ECRI continues to be a bit weak, but it might be leveling off which favors stock prices longer-term.

The small caps continue to hold above support, although this is quite a multi-month sideways trading pattern.

The weakness in the growth of the money supply is a serious concern, and you might notice that the weakness in M2 growth coincides with the sideways movement of the small caps. This panel does not favor higher stock prices.

The Leader List

This is the weekend long-term leader list. During the week I show the show-term leaders.

I have been trying to reduce the number of trades I make, so lately I have been more focused on the weekly, longer-term charts.

Most of the stock indexes listed above look ready for a correction. But a few are still showing some strength such as the Latin America ETF.

Outlook

The broader market has been very weak even though the major indexes have held up fairly well. The short-term indicators are oversold, so watch for signs that the selling is ready to pause.

The long-term outlook is positive.

The medium-term is down as of Aug-10. Looking for a low mid to late September.

The short-term trend is down as of July-28. Watching for signs of a new short-term uptrend.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more