The Ishares US Home Construction Reaches A New Level Of Outperformance

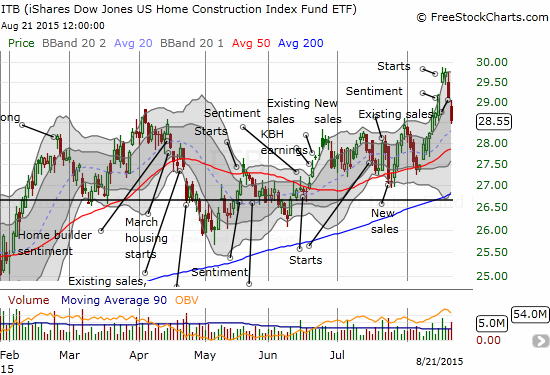

My case for managing risk by peeling back some of my holdings in homebuilders turned out to be quite timely. In what has become a near regular pattern for the iShares US Home Construction (ITB), sharp selling has quickly followed a strong run-up and rush of excitement in homebuilders. The sellers and bears are almost as stubborn as the buyers who helped send ITB to a new 8-year high earlier in the week.

iShares US Home Construction (ITB) begins another pullback after a strong run-up

Source: FreeStockCharts.com

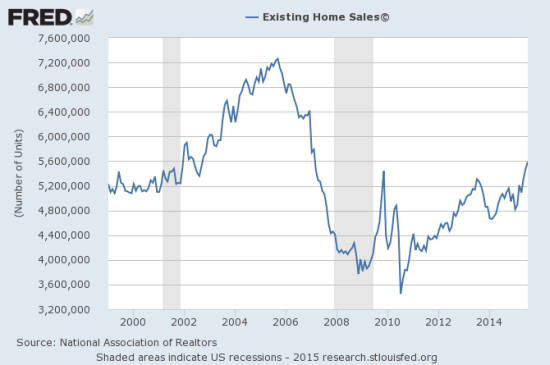

While it may appear that news of existing home sales helped drive ITB lower, it was more likely general market malaise. Existing home sales reached a new post-recession high in July.

At a post-recession high, existing home sales are now back to where the last housing cycle BEGAN

Source: National Association of Realtors, Existing Home Sales© [EXHOSLUSM495S], retrieved from FRED, Federal Reserve Bank of St. Louis, August 22, 2015.

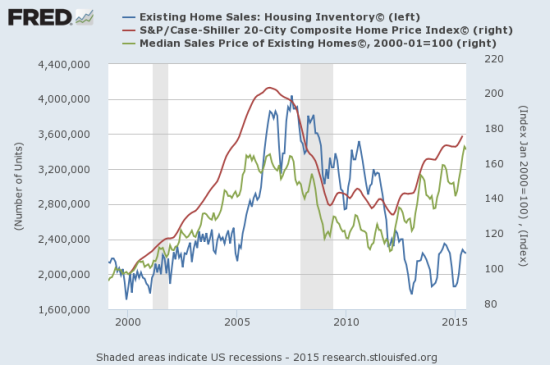

Supply and demand are still out of balance in the aggregate. Unsold inventory dropped 4.7% year-over-year and sits at 4.8 months of supply. While prices rise partly as a result of this imbalance, supply has still not responded in terms of number of units. Filling this gap is one of the opportunities that still lies ahead for homebuilders.

The total number of unsold homes in inventory remains around post-recession lows as prices steadily rise.

Source: National Association of Realtors, Existing Home Sales: Housing Inventory© [HOSINVUSM495N], retrieved from FRED, Federal Reserve Bank of St. Louis, August 22, 2015.

S&P Dow Jones Indices LLC, S&P/Case-Shiller 20-City Composite Home Price Index© [SPCS20RNSA], retrieved from FRED, Federal Reserve Bank of St. Louis, August 22, 2015.

National Association of Realtors, Median Sales Price of Existing Homes© [HOSMEDUSM052N], retrieved from FRED, Federal Reserve Bank of St. Louis, August 22, 2015.

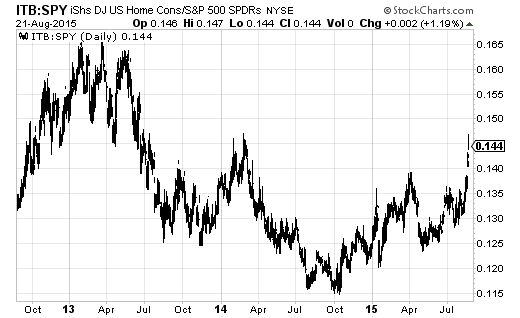

While ITB fell 2.0% on Friday and sits 4.0% below the newly minted 8-year high from last week, the S&P 500 (SPY) fared a lot worse. The index’s 3.2% loss on Friday capped a whopping 6.3% loss over for 4 straight days of selling. This divergence produced a new level of outperformance for ITB over SPY. The ITB/SPY ratio rose back to levels last seen during the early optimism over the 2014 spring selling season.

The iShares US Home Construction (ITB) last performed this well against the S&P 500 (SPY) in early 2014

Source: StockCharts.com

If the current market and global economic malaise dissuades the Federal Reserve from hiking rates this year or at least persuades the Fed to soften expectations for further rate hikes, homebuilders will become a natural go-to trade/investment. The market must wait another 3 1/2 agonizing weeks to get its next dose of Fed-speak. In the meantime, one more jobs report will arrive to cause yet more debates about the odds for a September rate hike. Along the way, volatility in the market should remain high and provide plenty of time for picking spots for the next buy-the-dip opportunity on homebuilders.

While my eye is trained on $28 for ITB (around the 50-day moving average), two individual stocks have already made sharp reversals to potential buying points: KB Home (KBH) and Meritage Homes (MTH). Not surprisingly, these are also stocks that have recently underperformed relative to other homebuilders in ITB.

I am still waiting on September earnings for KBH. However, fans of KBH are getting yet another chance to buy the builder at its pre-earnings price.

KB Home (KBH) has quickly retreated back to its post-earnings low on the recent sell-off

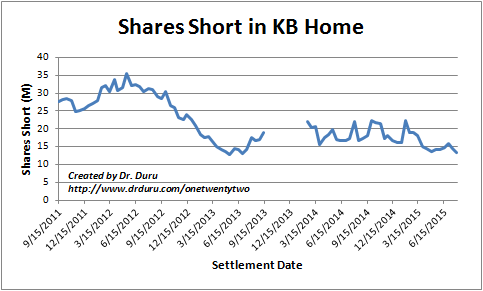

A break below the recent lows would likely motivate more selling, particularly given short-sellers have tended to chase KBH downward. Short interest in KBH is a very large 23% of float. Interestingly, the shares short are actually back to levels last seen when KBH made a post-recession peak in early 2013. This peak occurred after a tremendous run-up in the shares. (I did not collect shares short data during the period of the gap shown in the chart below).

Bears on KBH have retreated to lows last seen in early 2013

Source: NASDAQ.com

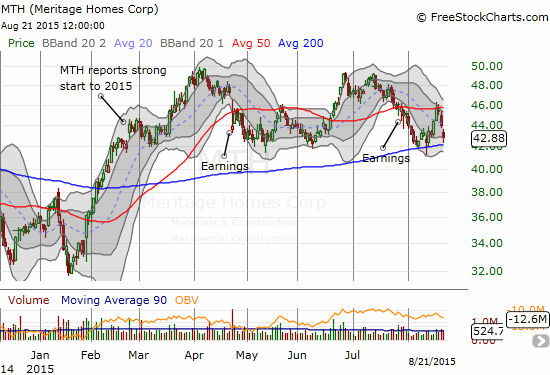

Meritage Homes (MTH) is another stock revisiting important levels. MTH’s last rally stopped cold at the 50-day moving average (DMA). In April, June, and July, MTH failed to break the post-recession high set back in 2013. The stock is now back to 200DMA support.

Meritage Homes (MTH) has lost its momentum from the announcement of a strong start to 2015.

Source for stock charts: FreeStockCharts.com

MTH is one of a small number of homebuilders that sold off after its last earnings announcement and has yet to recover. I suspect a tough crowd penalized MTH for announcing that “abnormally heavy and persistent rain in Texas and Colorado” forced the company to push out 200 home closings into 2016. Other builders with heavy presences in these states did not make such declarations. This disparity in performance reminded of the heavy penalty KBH paid a few earnings cycles ago when it was the only major builder blaming logistical issues with city governments for poor sales flow. Still, I think the selling in MTH was overdone given otherwise stellar earnings and revenue performance. The stock tops my list, after ITB, for the next round of buying.

Like KBH, MTH has an outsized volume of bets riding against its fortunes with short interest at 17% of float. Unlike KBH, shorts have recently ramped UP on MTH to new highs. This activity suggests a positive catalyst could send MTH skyrocketing higher again. (I did not collect shares short data during the period of the gap shown in the chart below).

Bears are crowding around Meritage Homes (MTH)

Source: NASDAQ.com

The general sell-off in the market could continue to drag down homebuilders. I am staying patient with buying the dip as I still have a sizable core holding of builders. There is a strong chance the market will bounce in the coming week. However, for buying more homebuilder stocks, I am looking beyond that bounce and anticipating a resumption of weakness going into the September Federal Reserve meeting.

Be careful out there!

Disclosure: No positions.

I know Manhattan is it's own little microcosm, but it definitely has entered bubble territory. Most transactions are cash buyers at outrageous prices. If you walk around the city at night these pricey towers have mostly dark windows. Foreigners have driven the market sky high because they are using Manhattan properties as their own little off-shore banks. They rarely even visit the properties. Even if it is a bubble, the foreign buyers see it as lower risk than keeping their money in their own country in a local bank or financial institution. So far they have been right, as currencies are being devalued around the world. But trying to get their money out may become problematic if multi-million dollar apartments go no-bid. The presumption is that the USD will be the last man standing. But high end real estate as well as very high end art can become illiquid more easily than other assets. You can't pay the bills with real estate or art. And the prices are already so high that even the super rich are beginning to balk at the prices.

My instinct is to stay away from real estate. Home builders could easily get stuck with inventory if they don't build at the right price points in the right locations.