The Global Outlook Dims, The US-China Trade Rift Makes Matters Worse

“The steady expansion under way since mid-2016 continues, with global growth for 2018–19 projected to remain at its 2017 level. At the same time, however, the expansion has become less balanced and may have peaked in some major economies. Downside risks to global growth have risen in the past six months and the potential for upside surprises has receded.” (IMF, World Economic Outlook, October 2018)

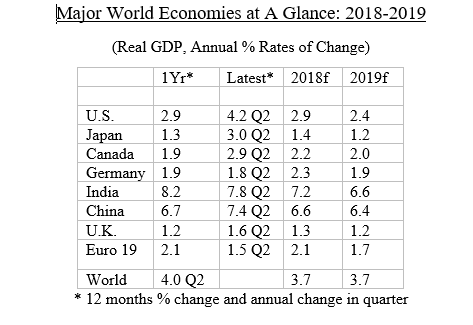

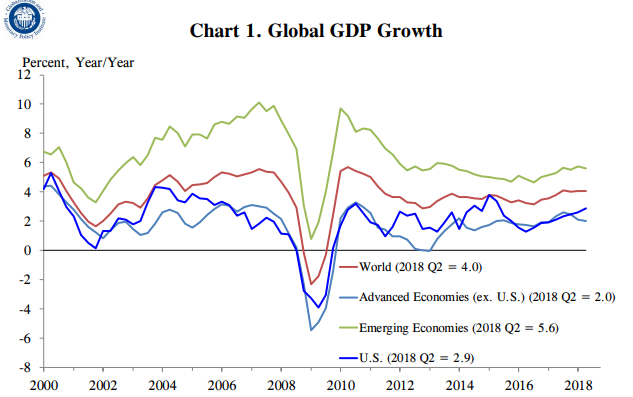

World economic growth has been a bit softer this year than originally expected, even though the US economy has performed very strongly. While the advanced economies mostly reported strong, synchronized growth in 2017, nonetheless a slower, more divergent trend has emerged this year.

While economic growth improved in the US this year (2.9% in Q2 y/y), growth has sharply slowed in the UK economy (to a 1.2% pace in the second quarter).

Growth in the euro area slowed as well, and as a result the IMF sharply reduced its euro area projections for 2018 to 2%, significantly lower than the 2.4% pace last year. Moreover, except for India and China, most other industrial countries are growing in a rather similar growth track, with the US at the top of the pack and Britain and Japan at the bottom.

The world economy posted a very respectable 3.7% growth rate last year. However, the global economy had much more going for it last year than is currently the case.

Prior to the intensification of US led trade tensions, the IMF expected the world economy to grow 3.9% in 2018. Recently the IMF reduced its growth forecast for the global economy in 2018 and 2019 to 3.7% — a 0.2% reduction in both years.

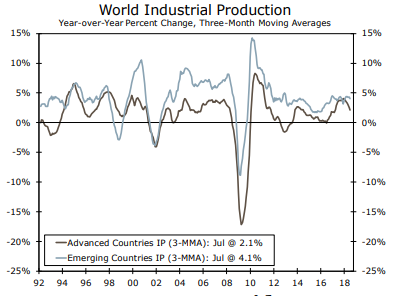

The rationale for the downgrade in projected world growth is readily explainable. In general, growth is expected to weaken in the advanced economies due to rising trade tensions, higher oil prices and a tightening in monetary conditions. Indeed, recent data is already showing a weakening in trade, manufacturing and capital investment spending.

Moreover, the outlook for the emerging market economies is not nearly as rosy as it appeared earlier in the year. Several large emerging market economies are facing significant challenges due to high levels of corporate and sovereign debt, much of it denominated in US dollars. This made their economies extremely vulnerable to recent Fed interest rate hikes, which weakened their currencies and forced some of them to sharply increase interest rates.

The projecting plateauing of future global growth in the 3.7% annual range has occurred partly because of number of the advanced economies are already close to full employment. As well, the earlier price deflationary fears have clearly dissipated, even in Japan.

Ironically, despite the likelihood of further interest rate increases in 2018 and 2019, the Trump tax cuts are expected to keep the US economy relatively buoyant until 2020. Of course, when this stimulus ultimately runs its course, and as growth in China’s economy continues to slow, global growth must also moderate further.

The IMF’s Latest International GDP Projections

Disclosure: None.

This report explains what is sort of intuitive, without pointing out specifically that it is the poorly thought out trade tariffs that are the cause of much of the problem. Although fiscal irresponsibility in some European countries has certainly has contributed a bit