The Gap Is Top Strong Buy Upgrade

For today's edition of our upgrade list, we used our website's advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. The Gap (GPS) is our top-rated upgrade this week and it is a STRONG BUY. Boot Brands (BOOT ) and Tailored Brands (TLRD) are our other STRONG BUY upgrades for the day. We also have Sandy Spring (SASR) and Noble Group LTD (NOBGY) as BUY upgrades for today-but note that Noble does not have full valuation and forecast data and has been included to fill out our list.

|

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Return |

1-M Forecast Return |

1-Yr Forecast Return |

P/E Ratio |

Sector Name |

|

GAP INC |

24.59 |

-17.69% |

40.11% |

1.18% |

14.19% |

12.30 |

Retail-Wholesale |

|

|

BOOT BARN HLDGS |

8.95 |

-27.10% |

36.85% |

1.09% |

13.05% |

14.51 |

Retail-Wholesale |

|

|

TAILORED BRANDS |

11.77 |

-39.25% |

-8.69% |

1.08% |

13.03% |

7.01 |

Retail-Wholesale |

|

|

SANDY SPRING |

39.47 |

5.77% |

41.57% |

0.52% |

6.28% |

17.73 |

Finance |

|

|

NOBLE GROUP LTD |

6.5 |

N/A |

42.86% |

0.97% |

11.63% |

8.28 |

Multi-Sector Conglomerates |

The Gap, Inc. (GPS) is a global specialty retailer which operates stores selling casual apparel, personal care and other accessories for men, women, and children under the Gap, Banana Republic and Old Navy brands. The company designs virtually all of its products, which in turn are manufactured by independent sources, and sells them under its brand names.

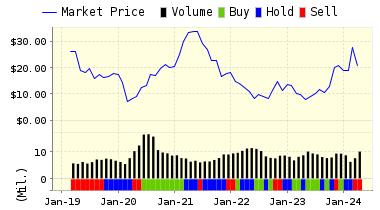

The stock continues to be a favorite of our models and has now been upgraded to STRONG BUY. This comes on the heels of an upgrade to BUY back in April.

As we have noted a lot of late, retailers like the Gap have been beat up over the past few years by the "Amazon effect" as more shoppers avoid malls and such and do their shopping from the comfort and convenience of their homes.

At least for today, we see that our models sense value and a buying opportunity here. Three out of our top-five upgrades today are from that battered sector. This wouldn't be unprecedented, the news about Target (TGT) has been bad lately, but they posted decent earnings--of the not as bad as expected category, and their shares have surged today.

The Gap reports tomorrow, and we will see if they can repeat the path demonstrated by Target with their latest earnings. Look for numbers that are "less bad" --or in other ways show that the company is turning around and weathering the retail storm successfully. Critical for their results will be the performance of Old Navy as that brand, with its lower prices, has been the star as the more expensive stores--like Banana Republic--founder.

VALUENGINE RECOMMENDATION: ValuEngine updated its recommendation from BUY to STRONG BUY for GAP INC on 2017-05-16. Based on the information we have gathered and our resulting research, we feel that GAP INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.

Below is today's data on The Gap, Inc. (GPS):

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

24.88 | 1.18% |

|

3-Month |

24.39 | -0.83% |

|

6-Month |

24.46 | -0.52% |

|

1-Year |

28.08 | 14.19% |

|

2-Year |

22.47 | -8.62% |

|

3-Year |

20.99 | -14.65% |

|

Valuation & Rankings |

|||

|

Valuation |

17.69% undervalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

1.18% |

1-M Forecast Return Rank |

|

|

12-M Return |

40.11% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

-0.05 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

-1.68% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

33.48% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

10.62% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

10.42 |

Size Rank |

|

|

Trailing P/E Ratio |

12.30 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

11.11 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

1.16 |

PEG Ratio Rank |

|

|

Price/Sales |

0.67 |

Price/Sales Rank(?) |

|

|

Market/Book |

3.59 |

Market/Book Rank(?) |

|

|

Beta |

0.90 |

Beta Rank |

|

|

Alpha |

-0.01 |

Alpha Rank |

|

Disclaimer: ValuEngine.com is an independent research ...

more