The Flight From Equity To Bonds Takes A Firmer Hold

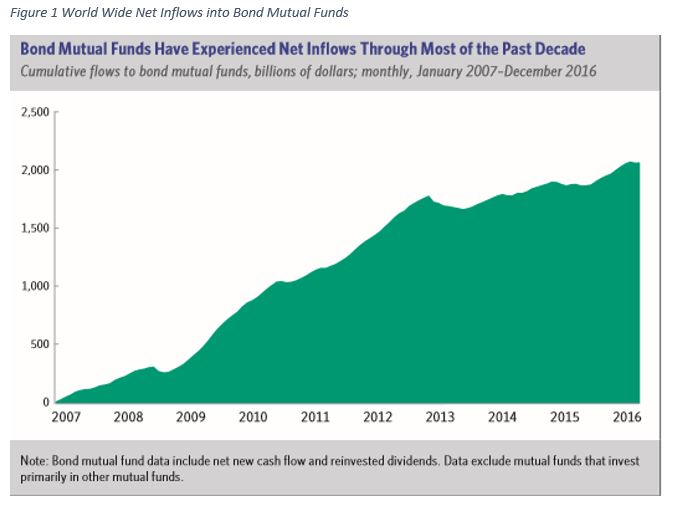

A funny thing happened on the way to higher interest rates - investors stepped up their commitment to bond funds at the expense of equity funds. Worldwide bond mutual funds have experienced a steady net inflow since the 2008 financial crisis (Figure 1).

Many managers warned clients to stay clear of bonds for fear that rising rates would result in capital losses. Central banks, especially the Fed, made it known that it was their intention to ratchet up short term rates in their quest to normalize rates. This put investors on notice that they risk losses especially on longer dated bonds as yields rise. However, these warnings were not heeded by bond investors. It has been a steady drumbeat since 2008 in favor of bonds.

Source: ICI Fact Book, 57th Edition

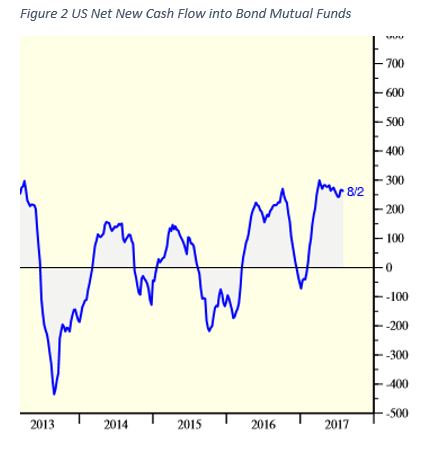

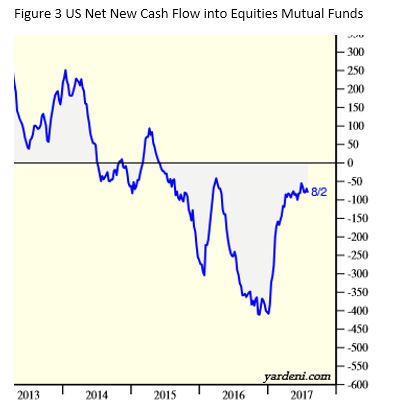

More interestingly, as the equity markets achieved new highs during the first half of 2017, equity funds suffered redemptions while bond funds continued to add to assets under management (Figures 2 and 3). It is estimated that on an annualized basis nearly $300 bn of new money found its way into US bond funds in the first half of the year.

Source: ICI, quoted in Yardeni Research.

What is behind this shift into fixed income and away from equities? In its latest report, Investment Company Institute(ICI), argues that:

Demographics influence the demand for bond mutual funds. Older investors tend to have higher account balances because they have had more time to accumulate savings and take advantage of compounding. At the same time, as investors age, they tend to shift toward fixed-income products. Over the past decade, the aging of Baby Boomers has boosted flows to bond funds. Although net outflows from bond funds would have been expected when long term interest rates rose over the second half of 2016, they were likely mitigated, in part, by the demographic factors that have supported bond fund flows over the past decade.[1]

In addition, bond investors have not bought into the central bank’s expectation that inflation will accelerate. The banks have been forecasting, erroneously, for nearly a decade that consumer inflation will hit the target of 2%. This has been the mantra that has driven the Fed to indicate that it will continue to pursue a path of rising interest rates, despite falling far short of the target.

Credit spreads have narrowed considerably, leading investment advisors to steer clients in the direction of US Treasuries to minimize risk. And, many equity investors are worried about relatively high equity valuations at a time when the monetary authorities are signalling that rates may rise. All in all, bond investors feel comfortable adding to their positions.

[1] 2017 Investment Company Fact Book

Disclosure: None.

Disposable income is growing, but at a far slower rate than before the Great Recession.