The Fed’s Bathtub Economics Brigade Blathers On

In case you are wondering what the meaning of "some" is—-don’t bother. It’s just the same old Fed ritual incantation, chanted in 2/2 "cut time". That means there are only two beats to each of its monthly meeting measures—–employment and inflation.

Like in the musical world, each beat is a half-note. But they might be better described as half-assed notes. The denizens of the Eccles Building are using BLS junk statistics to measure both variables. They don’t have a clue that they are rhythmically chanting a pretentious chorus about nothing more significant than short-run economic noise.

We got a load of evidence on that point with this morning’s Q2 GDP release and the accompanying benchmark revisions reaching back to 2012. What these fresh reports show is that this “recovery” has been even more of a dud than was previously evident, and that the Fed’s monthly claims that the US economy is inching toward some kind of Keynesian full-employment nirvana are pure rubbish.

In fact, our monetary politburo is driving the US economy in the opposite direction. That is, toward dis-employment of its true, wealth-creating economic resources—–human labor, entrepreneurial talent and market driven gains in economic factor efficiency.

Contrary to yesterday’s self-congratulatory statement, all is not well and its not getting weller. Instead, what we really have is net business destruction, faltering investment in productive assets, massive unutilized and under-utilized labor hours, falsified capital market prices, grotesque mis-allocation of investable funds, euthanized savers, zombified business enterprises, rampant financial engineering, stock-option addicted C-suites, massive waste of VC capital and stupendous over-valuation of every asset class that can be monetized, manipulated or margined.

Indeed, if we step back from the Fed’s two-note incantations and monthly economy weather reports, what we get is a truly troubling trend in the US economy’s core metric. Namely, it appears that real final sales—-a serviceable aggregate measure which is free of transient inventory fluctuations—–have nearly ground to a halt.

To wit, today’s Q2 number of $16.2 trillion represents just a 1.03% annualized rate of gain from the $15.0 trillion level posted seven-and-one half years ago at the pre-crisis peak in Q4 2007. There is no 30-quarter business cycle expansion that tepid anywhere in modern history books; and even that anemic number requires you to believe that the 1.5%/year implicit price deflator used by the Washington statistical mills to calculate real final sales for this same period accurately measures inflation.

Down on main street actual inflation is far higher. As my colleague Lee Adler demonstrated yesterday, consumer inflation has consistently been in the 2-3% range when you adjust for real world rents alone—–and that is to say nothing of removing all the inflation-obfuscating gimmicks like hedonic adjustments, geometric means, basket substitution of spam for ham etc.

If rent were counted accurately, headline CPI would be 2.2%, year over year, not 1.2%. Core CPI (excluding food and energy) would be +3.1%, not 1.8%.

This means that in the very period since the Fed leapt into its money printing panic by slashing the discount rate in August 2007 at the first signs of cracks in the housing and credit bubble it had created, real economic expansion has slumped into a totally new realm. We now measure it in fractions, not integers.

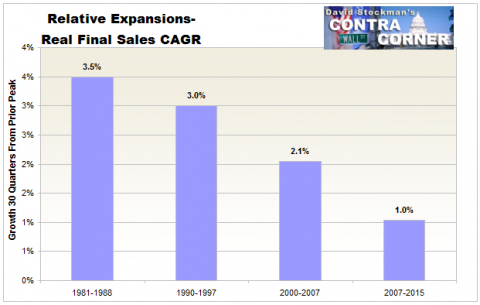

The significance of that is readily evident when the Fed’s recent handiwork is compared to previous 30-quarter business cycle expansions.

After the dotcom peak in Q2 2000, real final sales grew at a 2.1% annual rate through 2007. Likewise, during the 30-quarters after the mid-1990 peak, real final sales rose at a 3.0% annual rate. And during the equivalent period after the Q2 1981 peak in the Reagan era, real final sales expanded at a 3.5% rate.

So we are in the sub-basement of historical experience, and its not because the Great Recession was so deep, either. In fact, during the three years ending in Q2 2015, real final sales have grown at only 1.9% per annum. Yet during that time the monthly statements took endless bows for the Fed’s dexterity in divining precisely the “appropriate policy accommodation” to induce optimum macroeconomic performance.

Actually, it’s far worse. Despite all the mumbo-jumbo about its deft policy accommodation, the growth rate of real final sales during the last three years excluding health care and exports is actually only 1.6%. In a moment we will remind that the Fed’s frenetic money-pumping had nothing constructive to do with the more robust 2.7% growth rates in these latter two sectors, but the larger point is hard to miss.

Namely, that these three years (mid-2012 to mid-2015) should have constituted the blast-off phase of this business cycle if the Fed’s Keynesian ministrations were to earn any credit at all. But what we got by the Commerce Department’s own attestation was a fissile—-an economy listing toward stall speed.

In this context, note the timeless scholasticism of the Fed’s latest statement. The US economy is again held to be slouching toward full-employment, but is still in need of a remedy——zero money market rates—–that once upon a time was thought to befit only a dire plunge in activity.

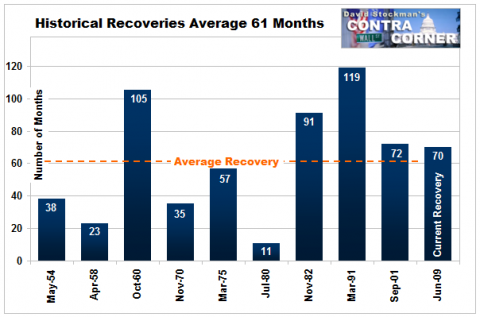

So someone needs to tell these academic scribblers that they have not outlawed the business cycle, and this one’s about over. As a matter of pure statistical averages, they are now rolling the dice. We are in month 74 since the official end of the recession, putting this expansion near the top of the post-war class, and that’s a problem in itself.

Until the turn of the century, the global economy was ordinarily a tailwind to US cyclical expansion because the rice paddies of Asia were still devoted to, well, rice. Likewise, the central banks of the outside world—typified by the Bundesbank—–would never have dreamed of stoking the kind of credit and asset investment binges that have emerged in the form of China’s red capitalism and its convoy of credit addled raw materials and intermediate components suppliers.

So this US cycle expansion is being braced with torrential headwinds resulting from the deflationary bust that is gathering force all around the planet. Therefore instead of obsessing about its purported data-driven acuity, the monetary politburo might better focus on the facts of the calendar and the storm-clouds gather all about the continental horizons.

It might also look at a powerful economic vector that it never, ever blathers about in its meeting statements. Namely, the state of domestic inventories.

For crying out loud, they are screaming that the cycle end is near.

So what has the Fed actually accomplished during these last seven years of furiously pumping “aggregate demand” in order to fill the US economy to its full employment brim? Spoiler alert: Virtually nothing where its ZIRP and easy money “accommodation” might logically make a difference.

Consider three components of personal consumption expenditure—-purportedly the driving force that makes the Keynesian world go round. During the last 30 quarters, nominal spending on medical services has risen at a 4.1% annual rate compared to 2.1% for non-durable goods and 1.8% for durable goods.

Now that’s exactly backwards! Were the Fed’s flood of cheap money actually being transmitted to main street, durables should be booming, the credit card spigot should be driving non-durables and health care shouldn’t matter. That’s because people don’t borrow to go to the hospital—–even if they sometimes end up buried in debt after they get the bill.

Stated differently, health care spending is driven by the public treasury and now the Obamacare mandates, not central bank induced borrowing and spending. In fact, the only debt expansion in the health care industry has been the massive borrowings used to fund M&A deals—–that is, to recycle cash to Wall Street speculators and the sliver of society that owns most of the financial assets.

Disclosure: None.