The End Of The Buyback Blackout Period Is Helping Stocks

Buybacks Helping Stocks

There were a lot of reasons stocks fell during the Q1 earnings season. The results were great, but stocks were in the midst of a sentiment shift catalyzed by the unwind of the short volatility trade. Since then, fears of geopolitical strife and trade wars have hurt performance. One of the lesser discussed possible causes of the weak market was the buyback blackout period which occurs during earnings season.

Let’s clear things up about buybacks. They don’t cause equity bubbles because they are simply returning cash to shareholders in a tax efficient way. They are procyclical, but so is most corporate activity. Dividends are less cyclical than buybacks because firms take pride in keeping them steady. However, coming along with that consistency is the fact that most companies don’t raise their dividends as much as they could during expansions.

Procyclical activity looks great during the beginning and middle of the cycle, but terrible at the end of the cycle. You can’t just focus on the one time buybacks are bad to make an argument against them. Borrowing money to buy back stock is risky behavior which could hurt the liquidity of a firm for short term gain. However, that’s a function of leverage which can be utilized for M&A activity as well.

There was a need for clarification because the bears love to blame buybacks for equity bubbles, citing the 2008 financial crisis where buybacks accelerated into the crash and then fell afterwards. That’s circumstantial evidence. Just because buybacks are relatively new doesn’t mean every single change in the market has been caused by them.

(Click on image to enlarge)

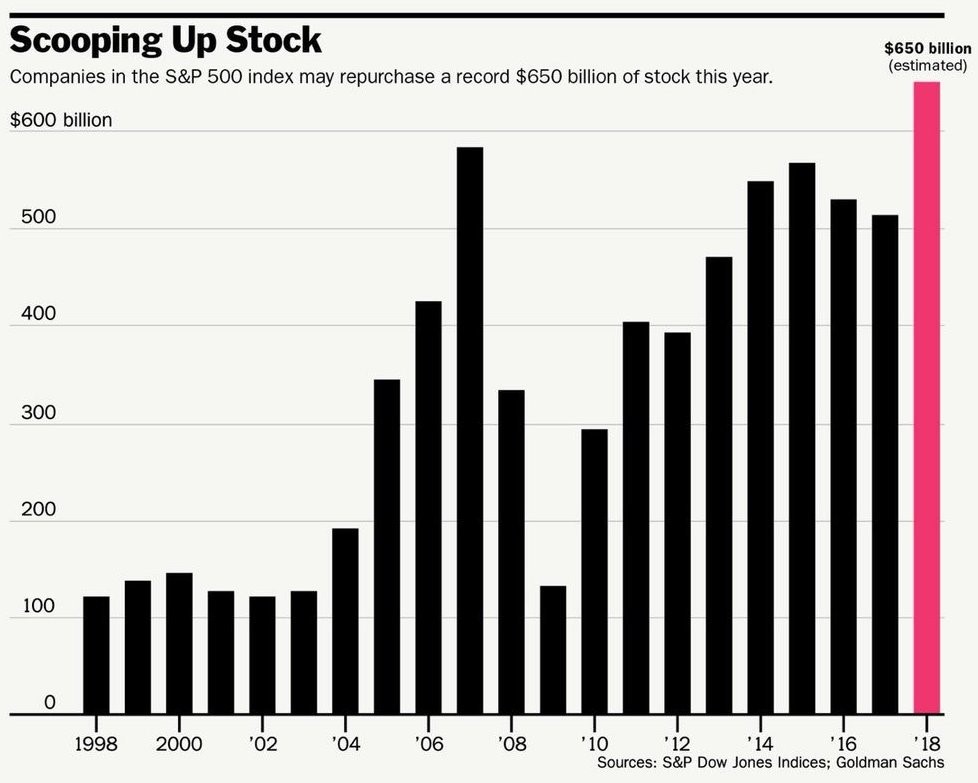

Now that the blackout period is over, the renewed repurchases are helping boost stocks. As you can see from the chart above, buybacks are projected to be $650 billion which is more than the peak in 2007. Since this is in nominal terms, it’s not surprising to see buybacks beat the last cycle peak since profits are higher.

The size of the stock market is also larger, meaning the increase doesn’t entirely boost the percentage influence buybacks have on the market. The buybacks were 0.6% of the S&P 500 market cap in Q4 2017. They will clearly be more influential than last year because of the size of the boost in relation to the increase in stock prices. It’s easy to return cash to shareholders when a firm gets a major influx of profit growth because of tax cuts.

It’s impossible to accurately predict the size of the next downturn at this stage of the cycle. We have inklings of potential issues, but we aren’t sure which ones will cause a crisis. However, what we do know is the current size of buybacks in relation to earnings is smaller, meaning there is less leverage. The buybacks and dividends were 88% of operating earnings in Q4 2017. At the peak during the financial crisis, the ratio was about 140%. To be clear, the leverage picks up substantially when earnings fall quicker than buybacks. However, for now corporations are in decent shape.

Expectations For M&A and Capital Returns

Capital returns can be like a snowball which picks up size as it increases down a hill. Buybacks and M&A activity will be increasing along with corporate profit growth as you can see from the chart below. The chart also shows how dividends often lag earnings growth as firms don’t want to put them at risk of being cut.

(Click on image to enlarge)

It’s Popular To Be Bearish Again

Last year’s theme of a global synchronized expansion was terrible for equities regardless of whether the economy improved or fell. High expectations can either be met or missed; there’s little room for a beat. The best option would be perennially low expectations with rising stock prices, but that’s impossible. Therefore, there needs to be a correction in stocks and expectations when they get too exuberant before another rally takes place. We saw the excitement level turn to fear in the past few months which is shown in the chart below. As you can see, the index of expectations for the global economy has gone from near the cycle high back to zero. Obviously, if there is a recession, then expectations will need to be lowered further. In fact, if there’s a really bad recession even lowered expectations won’t prevent a further decline in equities.

(Click on image to enlarge)

In the current situation, we have a weakening global economy excluding America. The S&P 500 can be positive without a rebound in global growth, but if there is a rebound, stocks will soar because the expectations are so low. In that situation, the difference between the performance of the Russell 2000 and the S&P 500 would shrink. It’s interesting to see that the tech stocks are doing so well even though they are the most exposed to international markets. This means the big cap stocks excluding tech are underperforming.

Since the big tech stocks make up the largest companies, the mega cap stocks are rallying along with the microcap names. The IWC microcap ETF is up 7.3% in the past month. It’s up 5.9% from its prior all-time high in March. Even the S&P 400, which is a mid-cap index, is doing well as it is only down 1% from the January peak. The underperforming sectors in the S&P 500 are consumer staples and the financials. The consumer staples are down an astounding 15% since January 26th.

Conclusion

Buybacks are helping equity performance after stocks were down during earnings; they were hurt by the blackout period where no buybacks are allowed. The good news for stocks is expectations for international growth are low. The bad news is there isn’t any indication yet that Europe and Japan will improve. Brazil is in a political crisis which hurts growth while India is one of the few emerging markets seeing accelerating growth. The S&P 500 index is underperforming the mid caps, small caps, micro caps, and the Nasdaq. It doesn’t need consumer discretionary and financials to rebound to move up, but if they did, the S&P 500 would instantly hit a new record high.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more