The Earnings Recovery Remains An Illusion

While analysts hail “the best earnings season in 13 years,” the market has delivered a solidly lackluster response. Over the past month, the S&P 500 is down roughly 1% despite a string of earnings beats.

With valuations this stretched, the market no longer appears willing to reward companies merely for beating quarterly expectations. Perhaps more investors now understand that GAAP net income numbers omit valuable information. They include non-operating items, are subject to manipulation, and don’t account for the cost of capital.

GAAP earnings don’t drive valuation. What investors should focus on are economic earnings, which make adjustments to exclude non-operating items and account for all sources of capital, both on and off the balance sheet.

Our analysis of the latest 10-K and 10-Q filings for the S&P 500 shows that the GAAP earnings growth in the market has not translated to an increase in economic earnings.

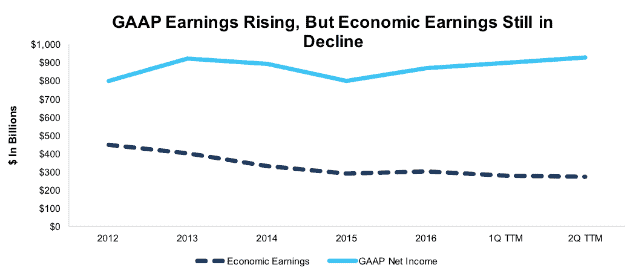

Figure 1: GAAP Earnings Offer Misleading Trend in Profits

Sources: New Constructs, LLC and company filings.

Through the first two quarters of 2017, GAAP earnings are up $61 billion from their 2016 levels, while economic earnings have declined by $28 billion.

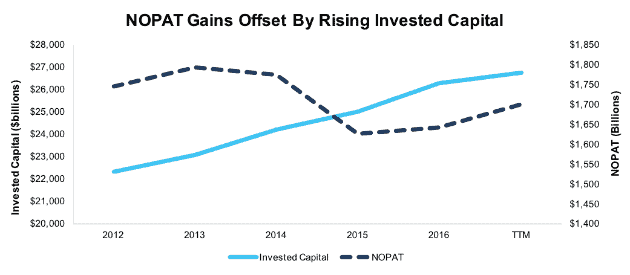

Figure 2 shows the source of the discrepancy between GAAP and economic earnings comes mostly from invested capital growth that has outpaced growth in NOPAT. Companies are generating more operating profits, but they require an ever-larger invested capital base to do so. In other words, companies are growing their balance sheets faster than they are growing profits.

Figure 2: Trends In Net Operating Profit After Tax & Invested Capital For The Broader Market

Sources: New Constructs, LLC and company filings.

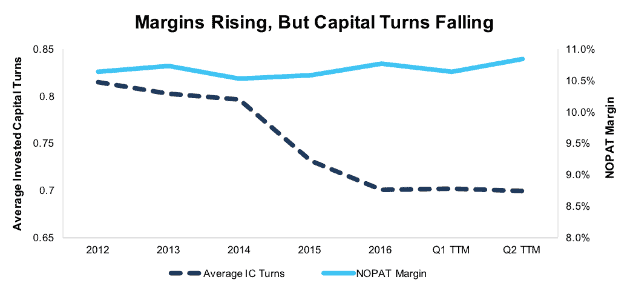

Figure 3 expands upon the trend shown in Figure 2. Companies are earning more profit for each dollar of revenue, but they’re also having to invest more capital to earn that revenue. When investors such as Jeremy Grantham argue that margins are higher today than in the past, they miss the balance sheet side of the story. Declining capital turns more than offset the rise in margins.

Figure 3: Trends in Capital Turns and NOPAT Margins

Sources: New Constructs, LLC and company filings.

Companies are investing more capital per dollar of revenue, and that capital is becoming more expensive. Even though interest rates have stayed fairly low, as we predicted, they have risen slightly over the past year. This rise, in addition to rising equity values, has increased the Weighted Average Cost of Capital (WACC) for the S&P 500 from 5.4% in 2016 to 5.8% currently.

Since economic earnings are calculated as (ROIC-WACC)*Invested Capital, rising WACC leads to declining economic earnings.

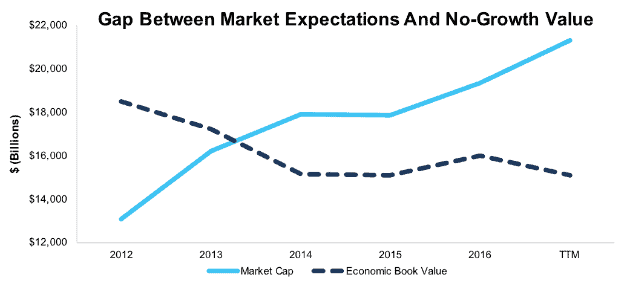

WACC is also the discount rate for future cash flows, so rising WACC decreases economic book value. The value of equities decline as future profits become less valuable today. Figure 4 shows how economic book value has declined so far in 2017 even as the S&P 500 continues to rise.

Figure 4: Market Cap Rising, Economic Book Value Falling

Sources: New Constructs, LLC and company filings.

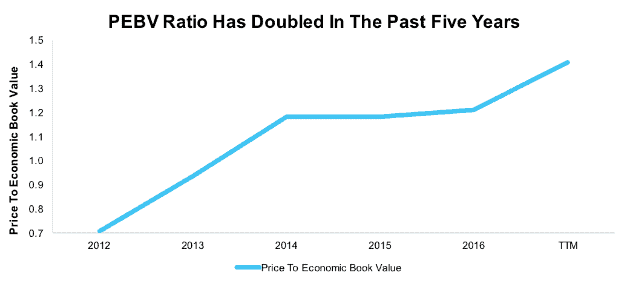

Figure 5 calculates the ratio from Figure 4. It shows that price to economic book value had doubled over the past five years.

Figure 5: Rising Price-to-Economic Book Value Ratio

Sources: New Constructs, LLC and company filings.

The combination of rising valuations and falling economic earnings is a troubling trend for investors.

One Stock To Buy In A Troubled Market

Investors should look for stocks that go against this market trend of rising valuations and falling economic earnings. There are still some attractive stocks available for truly diligent value investors.

One stock that stands out in this market is Clorox (CLX: $136/share). Clorox has grown its economic earnings at a compounded annual rate of 3% over the past five years and 7% over the past ten years. Even better, it ties executive compensation to economic earnings. Investors can feel secure in the knowledge that Clorox’s management incentives are well aligned with shareholder value creation.

Clorox is also valued at a discount to the broader market. While the S&P 500 as a whole has a PEBV of 1.4, Clorox trades at a PEBV of just 1. This ratio implies that the market expects Clorox to never grow cash flows from its current level. With a strong history of long-term economic profit growth, Clorox looks well-suited to beat the market’s pessimistic expectations. CLX offers investors excellent risk-reward in a challenging market.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.