The Dow

The failure of the Dow to close above 17007 confirms that we are not yet ready to take off to the upside. We needed a closing ABOVE 17007 to firm up the market stating definitively that the August low would hold and new highs were ahead. We needed a minimum closing ABOVE 16632 to firm up short-term support. The closing BELOW16632 does not provide a Monthly Sell Signal, it is a warning that the Dow remains vulnerable going into September. Only a Monthly closing BELOW 15550 would have been a MAJOR SELL SIGNAL. That key support has been held. Consequently, the close of August was not strong enough to avoid a retest of the lows. Therefore, the Dow did not finish in a position that would imply NEW LOWS ahead just yet and there was no confirmation of a bullish development.

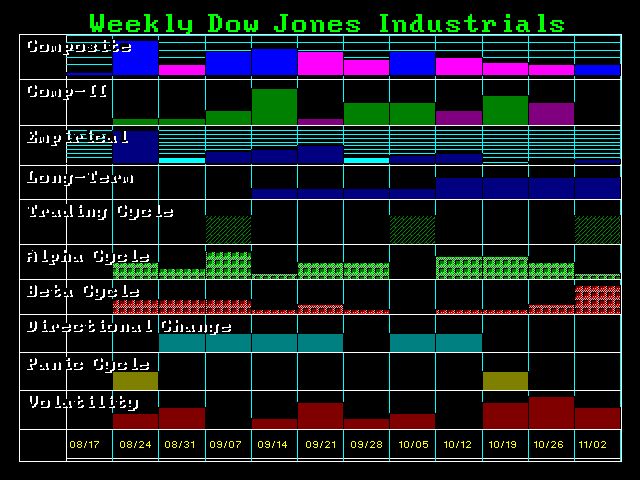

The forecast array showed the week of the 24th as a Panic. However, the Long-Term turning point targets the week of the September 21st. That will more likely than not now become an important turning point as it grows in intensity. This is not over until Obama sings.

We are at least going to see a retest of the lows and produce a lower weekly closing unless we start to close significantly higher on a weekly basis above at least the 17875 level. Otherwise, a weekly closing below 16008 should signal a revisit of the lows during September. Only a breach of last year’s low will warn of the sling-shot move setup. What would be very bearish would be a rally to retest the highs without new highs during the week of September 21st. That would then warn of a crash.

As for all those who will call for the end of the world and a 1929 type depression, they are only looking at those charts and are clueless as to how everything else is setting up. Nothing is in line for such an event. Keep in mind that it was that event that created big government and socialism. This time government is in crash mode, not the private sector. It will be politicians who do the jumping this time. For the stock market to crash like that capital would then run to bonds. Just how low do you think interest rates would go – negative 20%? Come one. This is a 5000 year low in interest rates so we will have to flip out to the upside. There is no choice in this regard.

Disclosure: None.