The ‘Dollar’ May Only Ever Rhyme

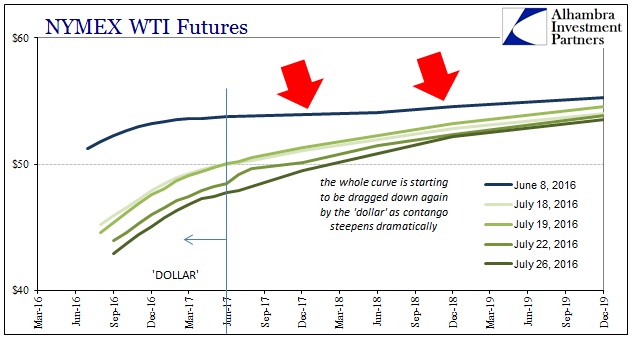

It isn’t just that oil prices are falling, that is only one dimension of the full oil spectrum concentrating in the spot market. The more interesting and important information is contained within the whole WTI futures curve. As “dollar” funding pressure has built up since the front month peak on June 8, it has steepened the curve into deeper contango; raising expectations for even more crude heading toward storage in the near future.

That process continues, but in the past few weeks the entire WTI curve has again been influenced by the front. As we have seen in prior episodes, the “dollar” “wins” by pulling down the shorter maturities first so that those expectations for storage become paramount at the back end (so much oil inventory reduces the willingness of anyone who might be willing to buy and store crude to sell at a future date, therefore a lower price further into the future).

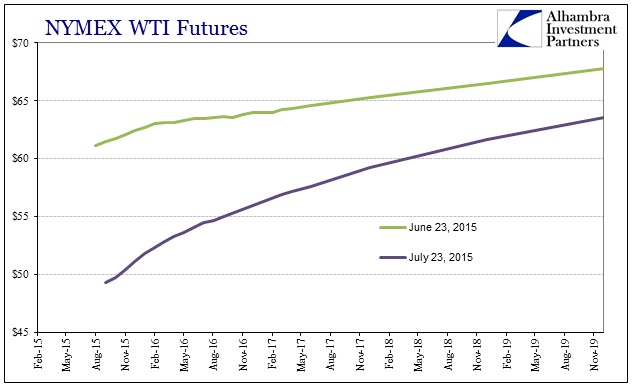

This is all familiar stuff, of course, as the same thing occurred June to July last year. While the scale was a bit larger and more condensed in terms of time (primarily, I think, due to the fact that second surge in oil inventory to start 2016 may have kept a lid on how far oil prices could retrace after February 11, China or no China), the effect on the whole WTI curve is immediately recognizable heading toward the events of last August.

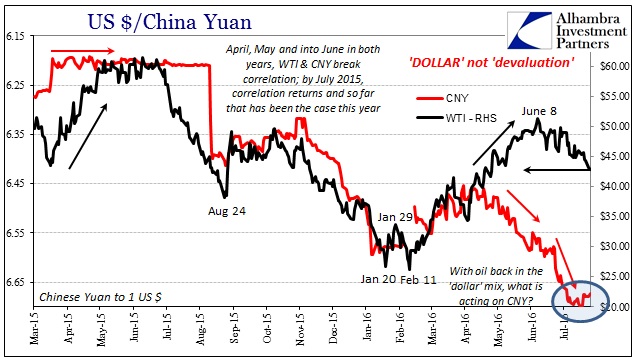

So what seems like clear “dollar” influence should be corroborated by other “dollar” proxies, particularly those that have been especially helpful in sorting out the eurodollar condition during the “rising dollar” period: CNY and JPY. Nothing, however, is ever that simple. Though seasonality and pattern repetition are undoubtedly underlying influences, history only rhymes.

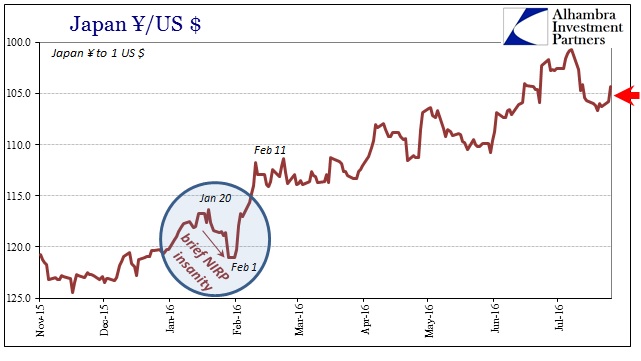

If we take the action in crude oil prices to be a measure of the “dollar”, then we would expect to find CNY falling, too. It isn’t. In fact, CNY has been rather tame and sideways since around July 11. That Monday, the exchange rate to the dollar was just under 6.70. It was also the day that Japanese rumors rekindled 2013-style love of central banking (if only in rump format). Since Japanese banks have been, I believe, a (perhaps “the”) significant source of “dollar” liquidity in China, a hard reversal like that might explain CNY’s much calmer demeanor since then.

It would also make sense in the context of oil, separating the Asian “dollar” mechanics from general eurodollar sense of overall tightening. But then you get contradictions like trading this morning that severely challenge or possibly blow up the theory.

JPY is up sharply as the “market” is suddenly nervous that “stimulus” rumors in Japan might not end up as lovingly as first thought two weeks ago. JPY traded as high as 104.05 overnight, from 105.89, though it has rebounded lower in early European trading. Without JPY support, it stands to reason that CNY would be sharply lower in sympathy, at least lower to some extent. Instead, yuan trading has been particularly non-volatile all day, with a definite and steady upwardbias.

If there is no support from Japan, that leaves the PBOC as the primary suspect; raising the possibility that maybe it wasn’t Japan since mid-July acting on CNY; or it was some combination of Japanese banks and PBOC intervention. It is only one day so far, but the sudden divergence in expectations might propose the PBOC pegging CNY again. The reason for it might simply be oil prices; as oil acts as a primary market catalyst among expectations for tighter correlation with pretty much everything, falling CNY under those circumstances has already proved especially dangerous.

To limit the fallout, the Chinese central bank just might restart “dollar” activities even though doing so at this point would likely be especially onerous (having still to unwind the full measure of past interventions). But that is the point; the period of maximum danger and disruption is where everything starts moving in the same direction at the same time with same intensity. For several months, from April to June 8, oil prices separated from CNY (in what I still believe were largely Chinese activities then) which made the further drop in yuan less intensely destructive.

It could be that simple, meaning that with oil now back on the same side as CNY the PBOC has decided it cannot afford to wait to see how it all turns out; they already have a very good idea what happens having experienced it twice in the past year. Or it could be Japan; or some as-yet unknown trend or force. This might be too much to make out of just one day, and unconcluded trading at that, but it is intriguing nonetheless and it does fit within the 2016 paradigm of nervous,perhaps desperate central bankers with itchier trigger points. It might yet be another complication to potentially factor as the “dollar” rhymes.

Disclosure: None.