The US Dollar And Oil

“Davidson” submits:

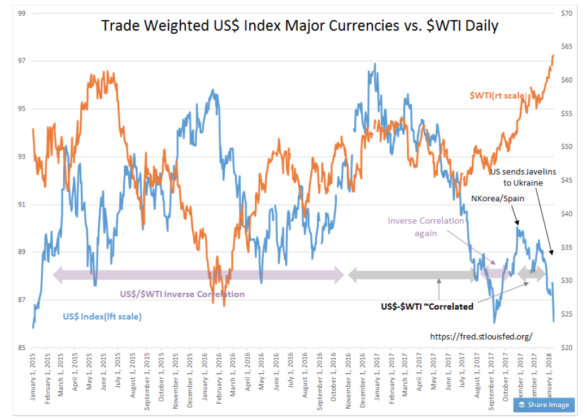

US$ has dropped past 2 days and the inverse to $WTI while not lock-step is prominent.

US$ is in part coupled to global capital returns and how safe/strong investors believe capital returns are likely to be. When the US protects Democratic institutions globally and the rule of law, the US$ falls as capital leaves ‘safe-haven’ US$ denominated assets for markets elsewhere.

Oil prices have been inversely tied to the US$ since 2003. The same inverse correlation appears to be in place today having been in/out of this correlation Nov 2016-most of 2017.

A falling US$ is a strong economic positive globally. A win-win for all.

(Click on image to enlarge)

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more