The Delusions Of MAGA And The Return Of Honest Bond Yields, Part 4

<< Read More: Sell The Rips---The Delusions of MAGA, Part 3

<< Read More: The Delusions of MAGA, Part 2

<< Read More: The Delusions of MAGA

In the wee hours this AM, the yield on the 10-year treasury note hit 2.993%. That's close enough for gubermint work to say that the big 3.00% inflection point has now been tripped. And it means, in turn, that the end days of the Bubble Finance era have well and truly commenced.

In a word, honest bond yields will knock the stuffings out of the mainstream fairy tale that passes for economic and financial reality. And in a 2-3% inflation world, by honest bond yields we mean 3% + on the front-end and 4-5% on the back-end of the yield curve.

Needless to say, that means big trouble for the myth of MAGA. As we demonstrated in part 2, since the Donald's inauguration there has been no acceleration in the main street economy---just the rigor mortis spasms of a stock market that has been endlessly juiced with cheap debt.

But the Trump boomlet in the stock averages has now hit its sell-by date. That's because today's egregiously inflated equity prices are in large part a product of debt-fueled corporate financial engineering---stock buybacks, unearned dividends and massive M&A dealing.

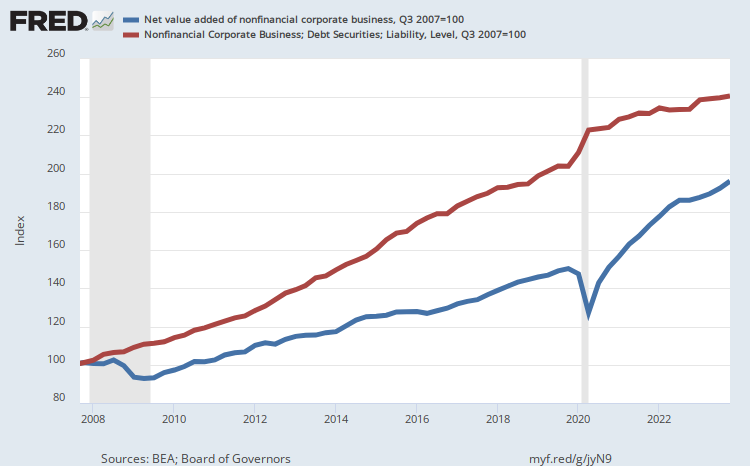

Thus, since the pre-crisis peak in Q3 2007, value added of the nonfinancial corporate sector is up by 34%, but corporate debt securities outstanding have risen by 85%; and the overwhelming share of that massive debt increase was used to fund financial engineering, not productive assets and future earnings growth.

In a world of honest interest rates, of course, this explosion of non-productive debt (i.e. the cash went to Wall Street, not to main street output capacity or productivity) would have chewed into earnings good and hard.

In fact, during the past 10 years, net value added generated by US nonfinancial corporations rose by just $2 trillion (from $6.1 trillion to $8.1 trillion per annum), whereas corporate debt rose by nearly $3 trillion (from $3.3 trillion to $6.1 trillion). So it should have been a losing battles---with interest expense rising far faster than operating profits.

But owing to the Fed's misguided theory that it can make the main street economy bigger and stronger by falsifying interest rates and other financial asset prices, the C-suite financial engineers got a free hall pass. That is, they pleasured Wall Street by pumping massive amounts of borrowed cash back into the casino, but got no black mark on their P&Ls.

(Click on image to enlarge)

No longer. As bond yields march relentlessly higher, corporate earnings are going to be hammered by rising interest expense-even as C-suites and boards get called to account for having borrowed trillions in order to feed financial engineering payments back into the maw of Wall Street.

Taken together, these developments are going to wreck havoc with Wall Street's increasingly hideous earnings growth hockey sticks. That's because the share shrinking effect of stock buybacks and largely cash M&A deals is going to dramatically abate, while interest expense per share is fixing to soar.

On the first point, there were 264 billion S&P 500 (ex-financials) shares outstanding at the pre-crisis peak in 2007 compared to only 239 million or 10% less at the end of 2017. Accordingly, upwards of one-third of the gain in per share earnings during the last decade was owing to share shrinkage, not aggregate profits growth; and that's definitely not going to be repeated in an environment of secularly rising yields.

Secondly, even if the 10-year UST rate settles at only 3.75% and the rest of the yield curve rises accordingly, it will have the effect of increasing pre-tax interest expense for the S&P 500 by about $44 per share; and thanks to the new 21% tax rate, that will show up as a $35 per share hit to EPS.

Needless to say, we can hear the Wall Street hockey sticks being splintered into fireplace kindling already. And not just account of ignoring soaring interest expense alone.

Two-year forward consensus earnings estimates, in fact, are just plain ludicrous, and bear virtually no relationship to past trends or the headwinds evident everywhere.

As to the embedded trends, we pointed out in Part 2 that corporate earnings growth over the last decade has not been much to write-home about---even with the freebie on interest expense.

To wit, reported earnings for the S&P 500 came in at about $110 per share for the LTM period ending in December 2017. That represented a mere 2.4% annual growth rate from the prior cycle peak of $85 per share ten years ago during the June 2007 LTM period.

Yet the Wall Street hockey sticks are now pointing to $169 per share of S&P 500 earnings for the December 2019 LTM period. That amounts to a 26.7% per annum growth or 11X the actual growth rate of the past decade!

The only way to get to such numbers, of course, is to exaggerate the impact of the corporate rate cuts; ignore the interest expense time bomb; and assume that a geriatric economy can somehow rear-up on its hind legs in year #9 and #10 of a tepid recovery and grow by leaps and bounds.

Yet as Lance Roberts cogently points out in a recent post, the street is confusing the cut in the statutory tax rate with the impact of the tax bill on actual effective tax rates. Accordingly, he believes the impact of the tax cut is likely to be---one a one-time basis--about $10 per share, not the $20 per share apparently embedded in current estimates.

Lance also points out that earnings are currently getting a lift from 2017's weak dollar, but that will be soon reversing, as well. Given that more than 50% of S&P 500 sales and earnings are in non-dollar currencies, the translation effect by 2019 will amount to a considerable headwind.

Compared to the year just ended, therefore, the net effect of currency, taxes and interest expense will be to reduce the $109.88 per share posted for the LTM period ending in Q4 2017, as shown in the chart below.

Accordingly, it might well be asked how do you get to the $168.64 per share shown for Q4 2019 in just 24 months? Even a Clark Kent economy couldn't go that vertical from a standing start.

(Click on image to enlarge)

The obvious answer to the above question is that it never will. And that's why the Donald's MAGA meme and his foolish embrace of the final post-election spasm of the stock market bubble is heading for an imminent demise.

The fact is, the US economy is exceedingly weak on a structural basis and does not remotely have the resilience to withstand the yield shock coming down the pike, nor the stock market meltdown it will trigger.

And we have no doubt that the stock option obsessed occupants of the corporate C-suites will again make haste to throw labor, inventories and fixed assets overboard with malice aforethought once the market breaks, and earnings are hit with the headwinds of rising interest expense and FX impacts.

To be sure, the usual suspects are again out in force on bubblevision offering a way out. Their response to today's 3.00% moment of clarity is that the Fed is on the verge of making a great "mistake", and that Powell and his Posse will see the error of their ways before it is too late.

That is, call off the four rate hikes and the $600 billion annualized bond-dumping program.

We think they are dead wrong about what the Fed is likely to do in the months ahead and are making the wish father to the thought---or at least to the urge to buy-the-dip one more time.

But even aside from what the Fed may do, the question recurs: After 10 years on the zer0-bound, do these cats really believe that short-rates should remain negative in real terms, which is exactly what we have today with the funds rate of 1.62% and year-over-year CPI inflation at 2.2%?

Or do they really think that 3.25% on the 10-year UST, which is a typical year-end 2018 target, makes sense when deficits are now clearly on an irreversible path toward $2 trillion per year, and upwards of 10% of GDP?

After all, inflation break-evens have been rising stoutly and now stand at 2.2%. That means, in turn, that Wall Street is implicitly targeting a mere 1.0% real yield on the benchmark bond rate.

(Click on image to enlarge)

Needless to say, we do not buy the shucking and jiving that has dominated bubble vision all day as the 10-year UST pushed it nose up against the 3.00% red line. The only mistake the Fed is making is that it crushed interest rates to the zero bound in the first place, and then held them there far, far too long.

On the other hand, the mistake the Wall Street talking heads are making is to over-estimate the strength of the US economy based on mainly hopium and cocked up BLS data; and therefore, ironically, to under-estimate the Fed's determination to plunge forward with its monetary normalization plan.

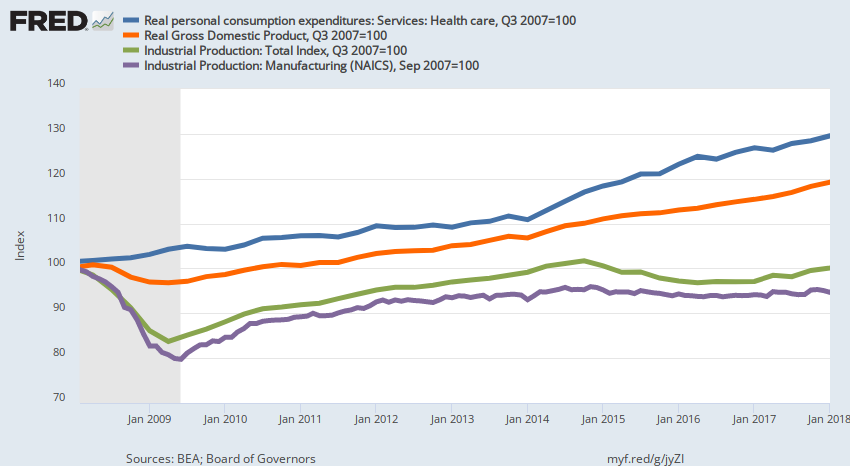

Here is just one example of why the Keynesian consensus at the Fed and on Wall Street is missing the forest for the trees. To wit, we have now completed a full-10 year span since the Q4 2007 pre-crisis peak, and real GDP growth has averaged a mere 1.43% per annum gain.

But that's not the half of it. The cumulative gain over that 10-year period amounts to 15.3%, but that was accompanied by a 0.5% gain in industrial production, and a 5% drop in the output of manufactured goods.

What saved the day for even the tepid gains in real GDP was soaring increases in government transfer payments and health care spending---with the latter growing in real terms by 29% in real terms.

Health care spending, of course, is overwhelmingly financed via the government fisc----including Medicare, Medicaid and state and local programs and the $300 billion per year of tax expenditures which enable employer health plan spending.

So even the fragile expansion which has occurred since the great financial crisis, will be hard to extend in the face of the monumental fiscal crisisjust around the corner. Throw a bond yield shock and a C-suite instigated recession on top of that already structurally weak economy and you have something that does not even remotely resemble MAGA.

(Click on image to enlarge)

In Part 5, we will provide even more detail on the rapidly worsening fiscal equation, but for now suffice it to say that roughly 35 years ago---when your editor was a great dealer younger and perhaps more foolish---he had the nerve to tell Ronald Reagan that he was about to preside over a fiscal calamity. This treasured photo perhaps captures the spirit of the moment.

For all his faults, Ronald Reagan had enough common sense to recognize fiscal reality, and that no nation can borrow its way to prosperity. So after the deficit broke toward 10% of GDP in the fall of 1981, he reluctantly signed three consecutive tax bills that saved the day, and closed the deficit sufficiently for the monetization policies of Alan Greenspan to do this rest.

Needless to say, the Fed is now out of dry powder and the current incumbent in the Oval Office is no Ronald Reagan.