The Coleman Francis Of Markets

I’m a big fan of Mystery Science Theatre 3000, and from that series I learned of a famously-bad movie director named Coleman Francis whose movies were “often criticized for their abysmal production values, repetitive plot devices, murky picture quality, and stilted acting.”

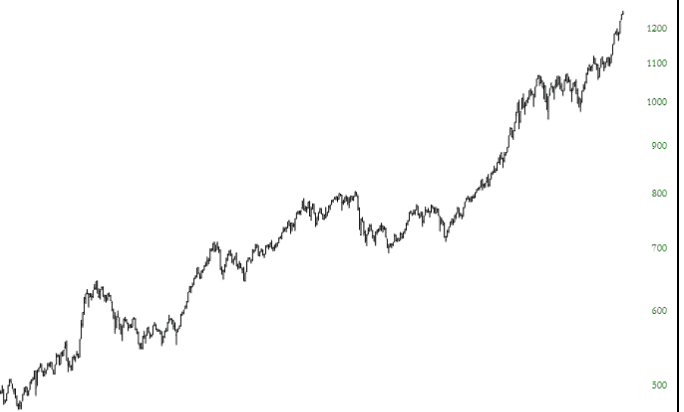

I must say that I’m reminded of the late Coleman Francis when I look at the equity market, because it’s become as boring as one of his movies. But what can one say about a market that looks like this, except that it sure has gone up a lot:

(Click on image to enlarge)

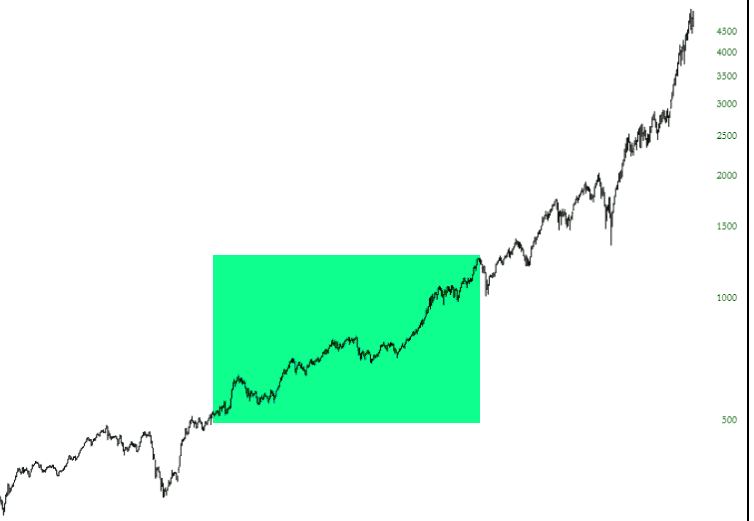

Oh, wait a moment. Hold the phone! That isn’t the current market! In fact, it’s the Nasdaq from the middle 1990s. Let’s take a look at what happened afterward (I’ve tinted in the area I just showed you):

(Click on image to enlarge)

So as you can see, persistently (and annoyingly) perpetual rising markets can keep going for a long, long time. Although, c’mon, we’re in our 9th year of this nonsense.

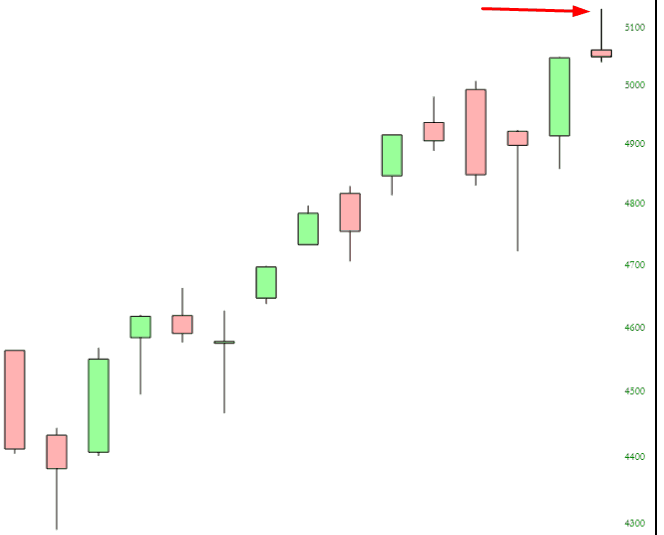

I would also note that when the market, at long last, did peak, the old saw about how nobody rang a bell was certainly the case. I’ve pointed out the tippy-top of the market below, before it lost about 80% of its value. As you may notice, there’s nothing particularly freakish about that particular day of trading that would warn everyone to get out.

(Click on image to enlarge)

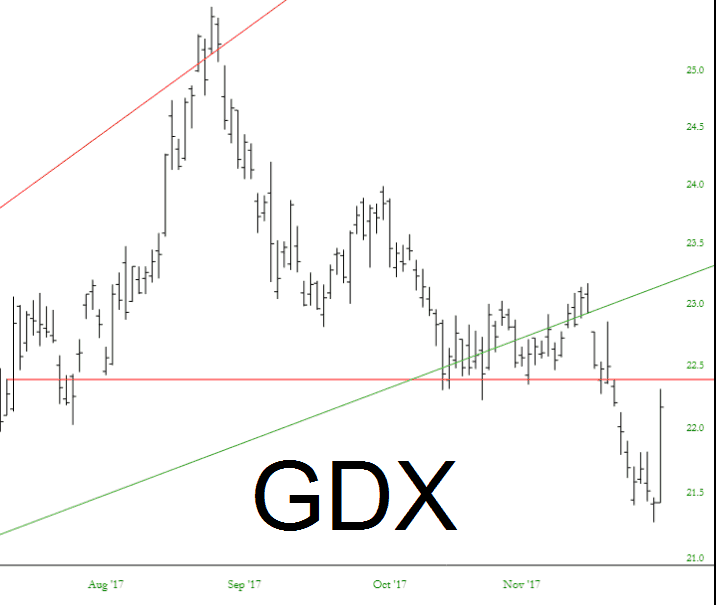

One of the few interesting charts out there has nothing to do with equities – – it’s the precious metal miners symbol GDX. This fell hard since early last week, but it bounced big today. I think it’s simply setting itself up for another fall (take note of the red horizontal).

(Click on image to enlarge)

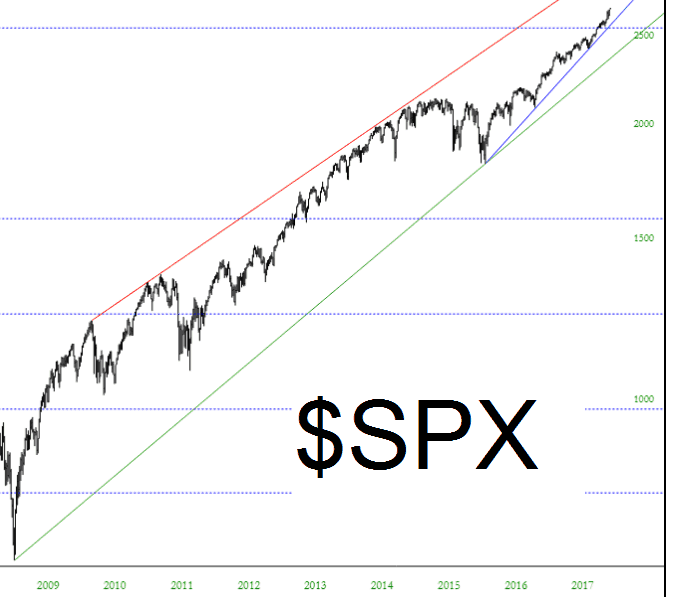

As we look at the S&P 500 below, we can rest assured that the tens of trillions of dollars of debt the central banks of the world have undertaken has been extraordinarily effective. It seems to be agreed by one and all that a bear market can never take place again in human history, since the banks will simply apply the same solution which has worked all these years (more debt to buy more assets) to keep this thing in the air in perpetuity. Maybe. It sure hasn’t broken for nine years yet.

(Click on image to enlarge)

Disclaimer: This is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. Before selling or buying any stock or other investment you should consult ...

more