The Bubble Gets Bigger

Today the market extended its gains to extraordinary levels. Goldman Sachs has been behind much of the latest Dow gains as its stock is 6% off its all-time high it set in October of 2007. The Dow is price weighted so each move in Goldman Sachs matters a great deal since the stock is in the 200s. The NYSE is finally nearing the highs it made in 2015; it has lagged the other major indices which have all made new highs this year. One of the most impressive rallies in the past few weeks since Trump was elected has been in the regional banks. Trump’s promise for deregulation has caused the previously beleaguered industry to finally reach past its 2007 highs. The strength of this rally (as I’ve shown with the arrow) has me nervous as the market wants to price 4 years of gains in 4 weeks. The KRE Regional Bank ETF is up 28% since November 4th.

The big question the market is wrestling with is whether the changes Trump is making will justify these higher valuations. In my opinion, they can help the long run productivity problem, but not the short run cyclical problem. Stocks are expensive no matter what Trump does, but they will be better investments than ever after we have a selloff.

Trump made two cabinet picks today which were both excellent choices. He picked Oklahoma Attorney General Scott Pruitt to head the EPA. This pick would be the equivalent of selecting Ron Paul to be the chairman of the Federal Reserve because of the criticism Pruitt has levied towards the agency. This follows through on Carl Icahn’s criticism of the EPA, namely that it has gone beyond its core purpose and has been enacting anti-business regulations. Smart regulations should undergo a cost benefit analysis before being enacted, but a lot of the regulations have ignored the potential harm they could have to businesses.

Scott Pruitt has sued the EPA over the Clean Power Plan which is an Obama administration plan to limit carbon emissions. This isn’t a surprise because he is a climate change sceptic and is from Oklahoma, so he is very much in favor of the fossil fuel industry. He even sued the EPA over its regulations on the emissions of methane gas from oil and gas producers. He also came to the defense of Exxon Mobile (XOM) when it was under fire for possibly failing to disclose material information on climate change.

This is great news for the oil and gas stocks. Any regulations regarding emission standards and pipelines all cost money to comply with. That cost will be eliminated. Because the firms in the oil and gas industry know what they are getting with Pruitt, they will probably try to get as many new projects passed as possible. Much has been made about whether American fracking firms can compete with the Saudis because the Saudis have such low oil drilling costs. With energy regulations declining, the breakeven prices for the frackers will be lowered. The headline risk that Exxon (XOM) faced from progressive officials wondering if it covered up information on climate change will no longer exist as there won’t be any more witch hunts against these firms. As you can see from the chart, today oil stocks rallied even as the price of oil fell. This may have occurred because of this new cabinet pick.

This pick is bad news for alternative energy stocks. In this case, I’m referring mainly to solar companies and Tesla (TSLA) which now is technically a solar company itself because it bought Solar City (SCTY). Green energy tax breaks and subsidies may be eliminated. If the regulations cause frackers to produce more oil at lower prices and this causes the price per barrel to decline over the medium term, it means alternative energy companies will face more competition. Another thing to keep in mind is if costs lower for natural gas as well and more production occurs, it will wipe away any of the benefits coal will get from Trump’s regulation overhaul. The cheap price of natural gas is the main reason coal has been in decline under the Obama administration. The Republicans like to blame the Democrats for the decline in coal usage, but it’s actually the free market which has hurt coal more than the regulations.

The other cabinet position which was filled was the leader of the Small Business Association. The CEO of the WWE, Linda McMahon will take this role. These appointments along with the others he has made have me wondering what direction Trump will go in for filling the two empty seats at the Federal Reserve. I’m moving my expectations more towards him picking individuals who support the free market. If he picks a critic of the Fed to be the chairperson when Yellen’s term runs out, it will be a game changer. The current Fed is discussing buying corporate bonds and stocks during the next recession, but if Trump picks a free market person to be the next chair, then we may see a hands-off approach. This would be great for the long run, but it would prick the asset bubbles in the short run.

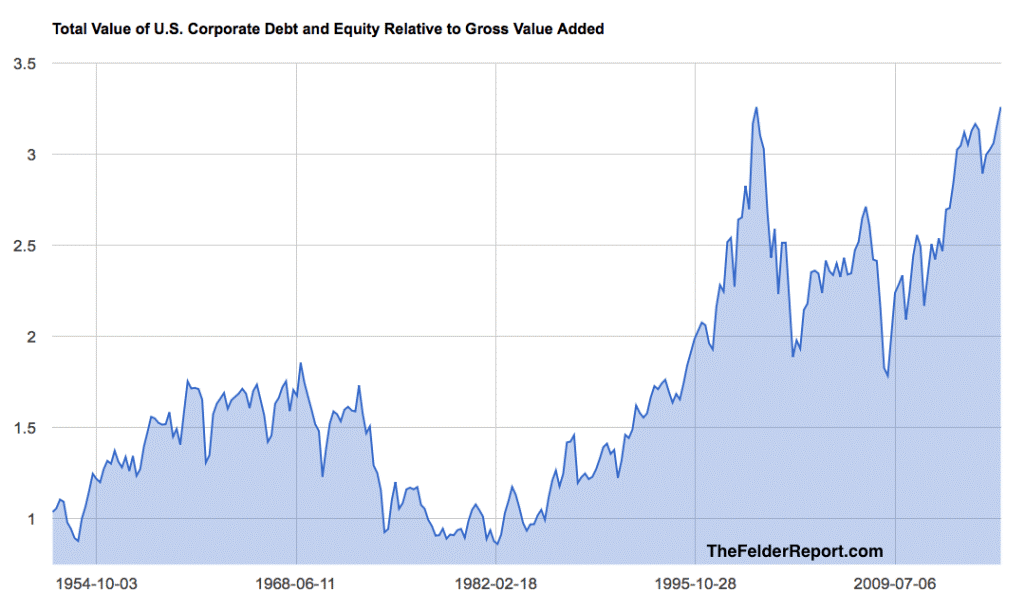

Speaking of asset bubbles, I will return to my original question for this article. How much should the stock market rally because of these positive moves by Trump? I argue it shouldn’t rally in the short run at all because it is too expensive. The chart below shows my point. The total value of corporate debt and equity relative to gross value added shows stocks are as expensive as they were in the dot com bubble era which had the highest valuations ever.

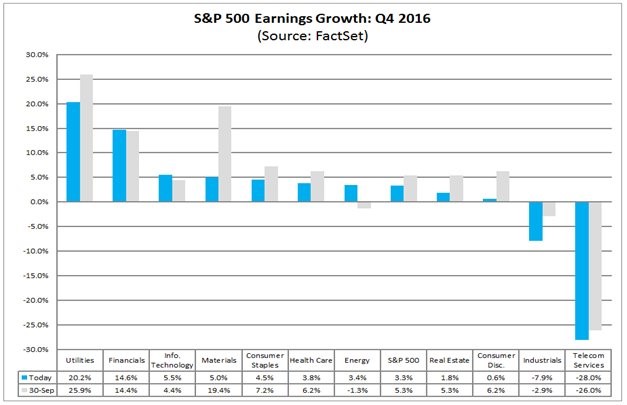

Either earnings must be strong in 2017 or stocks will have to fall. As you can see from the chart below, earnings expectations are for growth to be 3.3% in Q4. I expect this estimate to fall a little bit more before the results come out in a month. Then earnings will beat in this never-ending game of limbo where estimates are lowered just enough for firms to beat them.

Conclusion

Trump’s policy initiatives will help long term productivity, but cannot prevent the business cycle from rolling over. The market is acting like Obama’s tough regulatory environment caused stocks to underperform. Stocks rallied under Obama and rallied since Trump was elected. When stocks rally on good and bad news, it’s called a bubble. The question is when it pops. I clearly have no idea because I though the pop was going to happen this February.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more

Thanks for sharing