The Beginning Of The End For Tech’s Biggest Dominators

Google (GOOG). Amazon (AMZN). Microsoft (MSFT). Facebook (FB). Apple (AAPL).

If you had invested in them in their early pre-IPO stages, you would have made more money than you’d know what to do with.

Early investors in Google earned 150,000% in profit.

Early investors in Amazon saw their stakes return 81,000%.

Early investors in Microsoft saw gains of 92,000%.

Early investors in Facebook made 200,000%.

And early investors in Apple collected a 51,000% win.

These companies have a stranglehold on the tech sector. And they seem as strong as ever.

But appearances can be deceiving.

Technology is at the beginning of a major era-defining crossroads. Five years from now, the tech landscape will look completely different.

Different tech sectors will emerge and dominate. Different companies will be leading the charge.

For early investors – those who know what to look for – it represents an enormous opportunity.

And it’s happening RIGHT NOW.

Not the First Time

The reason I know? I’ve seen it before…

When Hewlett-Packard, Kodak and Xerox were flying high, all three were top-25 Fortune 500 companies. Now they’re fading fast.

Many other companies that were dominant 10 to 20 years ago have experienced similar fates.

Wang. Fairchild Semiconductor. SGI. Digital Equipment. Sun Microsystems. Atari.

They’re either on their way out or are completely gone.

There aren’t many exceptions. IBM is one. It had to completely reinvent itself, pivoting from a manufacturer of “International Business Machines” to a consulting company.

Companies simply don’t last as long as they used to. In 1958, S&P 500 companies had a 61-year lifespan. Today, they’re dying off in less than 18.

What’s true for companies in general is particularly applicable to tech companies. Keeping up with technology advances is much harder than, for example, a retailer’s challenge of keeping up with fashion trends. (And let’s face it, scores of retailers have failed to meet that challenge.)

But what’s going on here can’t be waved away by a dismissive acknowledgment that tech companies come and go.

There’s more to it… in fact, much more… a pattern that clues you in to the timing of these shifts – to when a company’s time to shine is up.

If you understood the pattern? Well, then, you’d be on your way to discovering a series of once-in-a-generation investment opportunities.

From Mainframe to Mobile

Take IBM.

It made its living off mainframes, then made the transition from mainframe to mini-computer. It not only survived, but thrived during these two ticks of the technological clock.

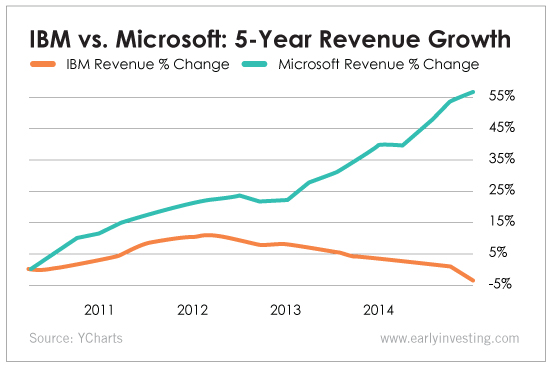

During the third tick – PCs – not so much. IBM’s revenues fell. And Microsoft grew dominant. This chart shows what happened…

Microsoft rode the huge PC desktop wave for all it was worth. And it seamlessly moved to dominate the next tick – client/server networks (a dedicated server to access resources, such as files, for the client).

It looked like Microsoft would be around forever. But all good things come to an end. Microsoft was singularly ill-prepared for the next tick – the massive shift into cloud and mobile.

And, like IBM before it, Microsoft suffered slowing revenue growth…

Apple was there to ride the new wave of mobile device users. Other tech companies also took advantage.

Amazon’s AWS served the hundreds of applications using the cloud. Instagram built a mobile-first photo app for smartphones and was acquired by Facebook for $1 billion. The cloud enabled Workday to replace Oracle’s PeopleSoft for employee data… and Salesforce to replace Siebel for customer data.

Microsoft has been left behind. Who’s next? Google? It’s spending billions to develop the technological backbone behind the “next big product” – whether that’s artificial intelligence, virtual reality, drones or something else entirely that we least suspect.

Two Ticks and You’re Out

Tech’s recent past shows it’s rare that a tech company can thrive beyond two ticks. Google search is still immensely popular. But it’s also beginning to lose its grip on some search areas – like consumer purchases, where Amazon has surged ahead.

Mobile and cloud technology is still going strong. Yet the end of its dominant run is not far off.

Homes will be increasingly connected independent of your smartphone. Cars will be too… as will your work place… and most public places.

The scenario in which mobile devices will lose their dominance is already underway.

As for the cloud, artificial intelligence will increasingly search the cloud using proprietary and open-source algorithms and analytical tools.

Once again, we’re about to adopt a new computer platform that will upend the entire tech industry. These tectonic shifts happen once every 10 to 15 years.

The legacy tech companies will be challenged to adapt. Many won’t. They’ll fade into nothing… or into something much less impressive.

And in their place will emerge the next Google, Amazon or Facebook. Startups are filling the pipelines of dozens of emerging technologies.

You couldn’t invest in these companies pre-IPO when their shares were unbelievably cheap. It was against the law.

Now you can. It’s just dumb luck that the government lifted the ban on investing in startups just as a new generation of tech startups has begun taking the place of the older generation.

You can’t use government restrictions as an excuse to miss investing in this next crop of future tech giants. It’s a once-in-a-generation opportunity, and it’s available to EVERYBODY.

Disclosure: None.