The Bank Of Japan Throws A “Curve” Ball

Pity the central bankers these days as they struggle to find ways to stimulate growth through unconventional means. Japan has been leading the way for more than a decade with aggressive rate declines, quantitative easing (QE), initially involving government bonds (JGB) and then extending to corporate bonds and selected equities. On September 21, 2016 the BOJ announces a major change in monetary policy. Turning its attention away from controlling the money supply through QE, the BOJ will target the yield on the 10-year government bonds directly at 0 per cent which is slightly above its recent trading range. The intention is to steepen the yield curve at the long end and thereby retrieve the yields from negative territory. The BOJ is taking aim at the shape of the yield in the hope of rescuing all those institutional investors from the world of negative long term yields.

What lies behind this unconventional move?

To begin with, there are two ways in which the BOJ can influence the yield curve. One way is to intervene in the market place by becoming a major buyer of Government of Japan bonds ( JGBs). QE involves buying a fixed amount of government bonds over a set time period at the prevailing market prices. In effect, the Government is a price-taker. QE is managing the price ( yield) of bonds through supply management.

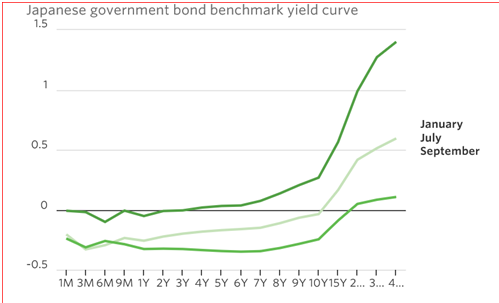

As Figure 1 demonstrates, since the beginning of the year, the entire Japanese yield curve has both shifted downwards and has flattened. Both directional moves are signs of weakness in the economy and generalized deflation. Whether QE or the market conditions that produced a negative yield curve is open to debate. At any rate, the result is not desirable for pension funds, banks and insurers. The BOJ had to find another way to achieve its target of 2 percent inflation without harming deposit-taking institutions.

Figure 1 Japanese Yield Curve

Another way to intervene is for the BOJ to set price targets for the purchase of long term bonds. That is, the BOJ becomes the price-setter for the market. The BOJ will now become a willing buyer, provided the price is right. BOJ now believes that setting price targets is a more effective way in which to influence the yield curve in a desired direction. Finally, the BOJ threw another “curve” ball in announcing that it will accept inflation exceeding 2 per cent before it will act. It will be looking for hard evidence that deflation will not return and so it is prepared to maintain a very dovish stance even when the inflation target is reached.

Often-cited as a precedent for price-setting is the U.S. experience in the years 1942-51 when the Treasury established a ceiling on 2.5 per cent for long-term Treasury bonds. Moreover, the Fed was able to do so without actually buying the bulk of the outstanding bonds. However, that was at time when U.S. Treasury market was totally dominated by domestic buyers, whereas now Treasuries are traded throughout the world, not just within the U.S, with entirely different trading dynamics.

Will This Policy Work?

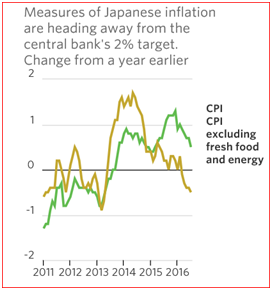

Like all other major central banks, the BOJ is struggling to get domestic inflation to 2 per cent. It seems that the BOJ has thrown everything , including the kitchen sink, at the problem of deflation. Their task is immense as Figure 2 reveals. Core CPI is falling and has been for the past two years, despite an aggressive QE program coupled with a negative bank rate. It is not all obvious that this latest shift in policy will turn this situation around, yet the BOJ feels that it has no option but to assume this variant of QE.

Figure 2 Japanese Inflation Rate

The policy shift has other implications, such as

- Along with its extensive asset buying program, price targeting will give the BOJ an added tool for bending the yield curve in the direction it wants;

- No longer will there be an issue of whether there will be sufficient quantities of JGB to purchase. Now, the Government will be able to issue as many bonds as it deems necessary for its fiscal programs, knowing the 10-year bond yield will be held steady at zero per cent.

- Targeting the 10-year yield at zero will likely reduce the volatility in the JGB market. Recently volatility has been cited as one factor explaining the back up in world bonds yields earlier this month. Investors now know that the BOJ will not sit idle and allow the 10- year to go below zero.

- Agreeing to hold long term rates down, even when inflation exceeds the 2 per cent target suggests that the BOJ is resigned to maintaining long term rates at zero for many years to come.

- Finally, there could be unintended consequences for the USD/Yen exchange rate. Should the spread between the US-Japanese 10-year yields, say, widen in favour of Japan, the Yen will strengthen and this will be not be welcomed by Japanese exporters. The BOJ will have to continue to walk this interest/currency balance beam.