The 4 Leading U.S. Land Drilling Services Stocks Ranked By Expected Return

The land drilling services companies have been severely beaten down by the downturn in the oil market over the past four years. As the price of oil began to plunge in 2014, the onshore oil producers drastically reduced their production activity, which greatly impacted the oilfield service providers.

Fortunately for these companies, the efforts of OPEC and Russia have largely eliminated the supply glut from the oil market. In turn, the price of oil has enjoyed an impressive rally since last summer and is now trading at a three-and-a-half-year high. As a result, the U.S. oil production has reached new all-time highs this year and is expected by EIA to continue to post new records next year. The number of active rigs has more than doubled since it bottomed in 2016. These developments bode well for the domestic land drilling service providers.

In this article, we will compare the expected 5-year returns of the four leading U.S. land drilling services companies, namely Helmerich & Payne (HP), Patterson-UTI Energy (PTEN), Precision Drilling (PDS) and Nabors Industries (NBR). Helmerich & Payne, Patterson-UTI, and Nabors pay dividends to shareholders and can be found on our list of 294 dividend-paying energy stocks.

This article will review the major drilling service companies’ expected book value growth and total return potential over the next five years.

U.S. Land Drilling Stock #4: Helmerich & Payne

Helmerich & Payne provides contract drilling services primarily to onshore U.S. producers of oil and natural gas. It is the market leader in the domestic market, with a market cap of $7.0 billion.

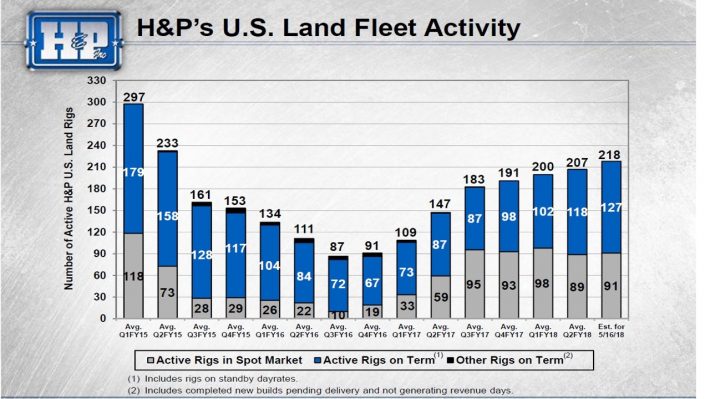

Thanks to the recovery in the oil market since last summer, Helmerich & Payne has posted the largest increase in its domestic rig activity in its history, with its rig count rising from 95 in the beginning of the last fiscal year to 197 at the end of the year. The increase in the rig count has continued this year, as shown in the chart below.

Source: Investor Presentation

Moreover, the company upgraded 30 rigs to super-spec rigs during the last two quarters. As this market is much tighter than the broad market of rigs, the company will benefit from the higher day rates for this type of rigs. Notably, almost all its super-spec rigs are currently utilized, while the company has a greater than 40% market share in this rig category.

In the 2018 second quarter, Helmerich & Payne grew revenue by 43%, and narrowed its net loss per share, from -$0.45 to -$0.12. Thanks to the strong momentum in its business, the company is expected to make a marginal profit of $0.11 per share this year, after two consecutive years of losses. This is in sharp contrast to its peers, which are expected to continue to post losses this year.

Helmerich & Payne is currently trading at a price-to-book value ratio of 1.55, which is very close to its historical average of 1.51. As the stock can be reasonably expected to trade around its average valuation level in five years from now, it is likely to incur a 0.5% annualized drag due to contraction of its valuation multiple.

The book value per share currently stands at $41.30. While the company is expected to return to profitability from this year, it currently distributes an annual dividend of $2.80 per share, which is much higher than its expected earnings of this and next year.

Overall, due to the extremely generous dividend of the company, its book value is not likely to change much in the next five years. Therefore, Helmerich & Payne is likely to offer an approximate 3.9% average annual return over the next five years, thanks to its 4.4% dividend, which will be partly offset by a 0.5% annualized contraction of its valuation level.

U.S. Land Drilling Stock #3: Patterson-UTI Energy

Patterson-UTI Energy provides onshore oilfield services and products to the producers of oil and natural gas in North America. Its two major segments are the contract drilling and the pressure pumping segments, which generate 44% and 51% of the total revenues, respectively.

The improving fundamentals of the oil market are certainly evident in the performance of Patterson. The company more than doubled its revenues in the first quarter, from $305 M in Q1-2017 to $809 M, and narrowed its losses, from -$0.40 to -$0.16 per share. In Q1, its active rig count averaged 169 rigs, higher than the average of 161 reported in the previous quarter, while its rig revenue per day increased 3%. Moreover, management expects the rig count to rise to 176 in the second quarter.

While the outlook of the broad sector of drilling service providers has greatly improved, this is particularly true for high-spec rigs. This market is especially tight, with only few idle rigs being able to be upgraded to super-spec. Patterson, which has 134 out of its 169 active rigs in the super-spec category, has greatly benefited from the focus on super-spec rigs. Management expects that the demand for super-spec rigs will remain strong next year and will thus enable the company to raise its day rates even further.

Patterson has a much healthier debt level than Nabors Industries and Precession Drilling, as evidenced by its low debt-to-assets ratio. Moreover, Patterson has a ‘Baa’ credit rating from Moody’s and a ‘BBB’ rating from S&P. These investment-grade ratings enabled the company to issue 10-year bonds at an interest rate of only 3.95%.

The proceeds of those bonds were used for the payment of debt maturities. Since the company is expected to return to profitability from next year and it has a relatively healthy balance sheet, it is not likely to face any problems servicing its debt.

Patterson has reported losses for three consecutive years. Analyst consensus is for the company to report a marginal loss of -$0.07 per share this year. Given the improving business environment, the company is likely to return to profitability next year. Thanks to the earnings that will be accumulated in the years ahead, the book value per share is likely to rise from its current level of $17.93 to about $21.00 in 2023, for a 3.2% average annual growth rate.

Moreover, the stock is now trading at a price-to-book value ratio of 1.02, which is lower than its 10-year average of 1.18. As the company will continue to recover in the upcoming years, it can be reasonably expected to revert to its average valuation level within the next five years. In that case, the stock will enjoy a 3.0% annualized gain thanks to the expansion of its valuation level. Combining the 0.9% dividend, and the stock is likely to offer a 7.1% average annual return over the next five years.

U.S. Land Drilling Stock #2: Precision Drilling

Precision Drilling provides onshore drilling and completion & production services to oil and natural gas producers. It generates 43% of its revenues in the U.S., 43% in Canada, and the remaining 14% in other countries.

Thanks to record output in the U.S., the company has seen its rig count rise to a 3-year high, while conditions in Canada remain weak. Consequently, although the company grew its revenues 9% in the 2018 first quarter, it only slightly narrowed its losses, to -$0.06 per share last quarter, from -$0.08 in the 2017 first quarter. Management expects the favorable conditions to persist in the U.S. market, but it also expects drilling activity in Canada to remain flat compared to last year.

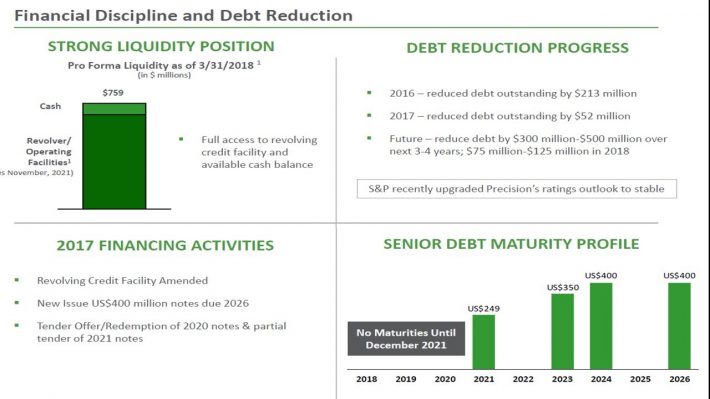

Due to the downturn in the oil market, Precision Drilling has posted losses for four consecutive years. As a result, it has been unable to cover its interest expense. Rising interest rates could increase the pressure on the company, as it is likely to incur higher costs of capital in a rising-rate environment. Fortunately, management has made debt repayment a priority and intends to retire about $100 million of debt this year and about $300 million – $500 million of debt over the next three to four years.

Source: Investor Presentation

Overall, while the debt of the company is a concern, it seems to be manageable if the ongoing recovery in drilling activity continues in the years ahead, which is the most likely scenario.

Precision Drilling is currently trading at a price-to-book value ratio of 0.67, which is much lower than its historical average of 0.94. The deep discount of the stock to its book value signals that the market expects the asset write-offs to persist. Moreover, the company is expected to report a loss of -$0.23 per share this year and a marginal loss of -$0.01 per share next year. As a result, the book value per share is likely to rise only modestly in the upcoming years, from $4.80 this year to about $5.00 in 2023, for a 0.8% annualized gain over the next five years.

On the other hand, as the company will complete its asset write-offs in the next few years, its price-to-book value ratio is likely to revert towards its historical average of 0.94 until 2023. In such a case, the stock will enjoy a 7.0% annualized gain thanks to the expansion of its valuation multiple. Overall, the stock is likely to offer a 7.8% average annual return over the next five years thanks to 0.8% average annual growth of its book value and 7.0% annualized expansion of its valuation level.

U.S. Land Drilling Stock #1: Nabors Industries

Nabors Industries owns and operates one of the world’s largest onshore drilling rig fleets, and also operates some offshore platforms in the U.S. and abroad. Last year, it generated 62% of its total revenue from international markets.

Thanks to the recovery in the oil market, Nabors exhibited improved performance in the most recent quarter. Its U.S. drilling segment grew its EBITDA by 36% over the prior quarter, thanks to an increase in active rig count by 6, and a 27% expansion of its gross margin per day.

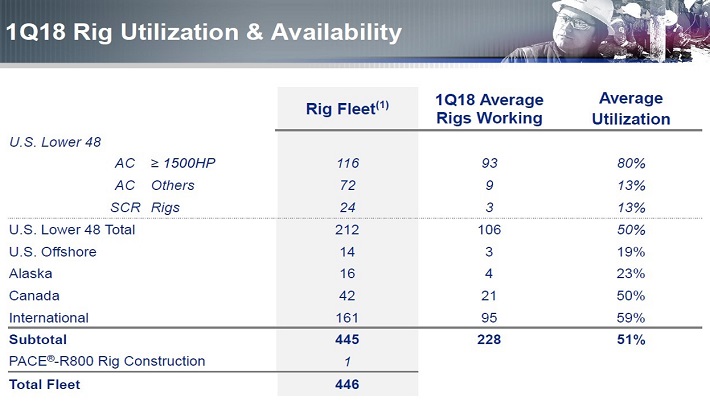

Like others in the space, Nabors has greatly benefited from the tightening market of high-spec rigs, which has resulted in higher day rates. The company enjoys an 80% utilization rate of its high-spec rigs, which is much higher than its 51% utilization rate of its whole fleet.

Source: Investor Presentation

However, as the company generates more than half of its revenues from international markets, it has less exposure to the booming U.S. rig activity than its peers. Consequently, it is expected to incur a loss of -$0.85 per share this year.

Moreover, its book value has plunged 60% in the last five years, due to its losses and extensive asset write-offs. As the stock is currently trading at a price-to-book value ratio of 0.75, it is evident that the market expects further asset write-offs in the years ahead. As a result, the book value per share is likely to rise only modestly, from $8.53 this year to about $9.50 in 2023 for a 2.2% average annual gain.

On the other hand, the company will complete its asset write-offs in the upcoming years. Its price-to-book value ratio could rise as a result, from the current level of 0.75 to the historical average of 0.91. Thus, the stock is likely to enjoy a 3.9% annualized gain thanks to the expansion of its valuation level. Overall, the stock is likely to offer a 9.8% average annual return over the next five years, due to 2.2% annual book value growth, a 3.9% annualized gain from the expansion of its price-to-book value ratio, and its 3.7% dividend. This is the highest return in this group of stocks.

Investors should note that the company has increased its leverage in recent years, partly due to its persistence to keep paying a generous dividend through the oil downturn. Its debt-to-assets ratio has greatly increased in recent years while its net debt has climbed to $4.2 billion. With interest rates on the rise, its debt load could become even more burdensome in the years ahead. The company increased its net debt by $200 million in the first quarter. The company has also issued new shares in the last two years, diluting shareholders by 12% during this period.

Overall, Nabors Industries is the stock with the highest expected 5-year return in its peer group as long as the oil market remains strong in the upcoming years. Investors should be aware that this is the most leveraged–and therefore the most vulnerable stock–to any unforeseen downturn.

Final Thoughts

As long as the oil market remains strong in the upcoming years, Nabors Industries is likely to offer the highest five-year return whereas Helmerich & Payne is likely to offer the lowest return. This is partly because Helmerich & Payne has significantly outperformed its peers in the last two years, as it has lost only 4% whereas its peers have fallen much more. Nabors Industries and Precision Drilling have plunged 35% in that time.

Investors should note that all the onshore drilling services companies are highly cyclical, and thus vulnerable to any downturn in their business. Helmerich & Payne has posted losses for two consecutive years while the other three companies have posted losses for at least four years in a row. Therefore, these stocks are not suitable for income-oriented investors.

That said, these stocks should generate positive returns, and could be a way for investors to profit during the next oil and gas drilling growth phase.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more