The 2nd Calmest Year Ever

Bullish Streaks

The stock market was down slightly on Thursday, but the amazing year for stocks continues. The chart below shows the maximum drawdown for stocks in each year. This year, the biggest decline in the S&P 500 has been 2.8% which is the second lowest maximum drawdown ever. The Investors Intelligence sentiment is showing a 45.3% advantage for the bulls over the bears. That’s in the 96th percentile which makes sense because even the bears are bullish in this market that never falls. The CAPE ratio has been above its average for 101 straight months (239 months is the longest streak). The streak without a 3% pullback is 234 days which is 7 shy of the record. The annualized volatility is 6.9% which is the second lowest ever. The lowest was in 1964 which was 5.1%. This has been a great year as the S&P 500 is up 15.8% so far.

As I said, the most bearish investors are long the market. If you research critics of the market who call it a bubble, they are usually long index funds. While it’s still profitable to sell fear to investors to generate clicks, it’s not feasible to be net short stocks. The chart below shows the most bearish investors are net long. The survey shows they are 90% long the market which is the reverse of the normal positioning which has them short 93%. This is being considered as a reverse indicator which means the top is near. My opinion is it’s clearly closer to a top them a bottom when everyone is bullish, but there probably needs to be a reason for stocks to fall. That catalyst could occur if earnings estimates for Q4 were to fall, but as of now, there’s no reason for a 10% correction.

Bearish Potential

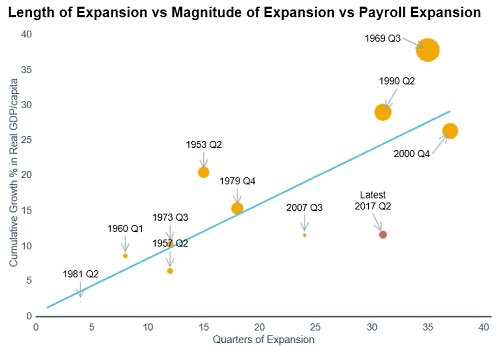

Some investors are probably wondering if the cycle can die of old age. It’s certainly possible, but we probably won’t reach that point in the next 12 months. The yield curve can be thought of as a time clock for business cycles. The difference between the 10 year bond yield and the 2 year bond yield is 80 basis points which means it’s still not at the lows of the business cycle despite the fact that the Fed is expected to raise rates 75 basis points in 2017. The chart below gives you another example of when the business cycle could be close to ending. As you can see, the current recovery is about to pass the length of the one that ended in 1990, making it the third longest ever. If you compare the cumulative growth in GDP per capita to the other long streaks, this is the weakest period. There are two recoveries which where shorter, but had more growth in total because the growth rate per year was higher. The total growth is what is more important, in my opinion. That’s why I don’t think this growth period needs to end in the next two years. Once we get closer to the percent change in GDP per capita that other recoveries had, I will get more nervous about a recession, but even then, I’d need to see a negative catalyst to cause one.

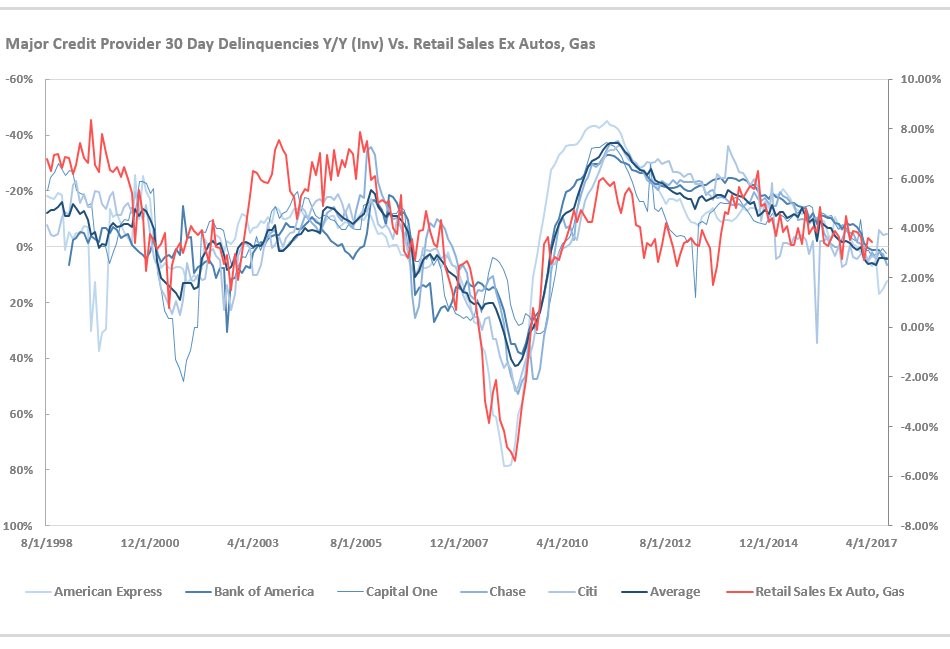

Let’s look at a specific argument the bears are making. The chart below shows one of the narratives the bears believe. The chart compares the retail sales excluding auto sales and gas with the major credit providers’ 30 day delinquencies. Keep in mind the 30 day delinquencies scale is inverted because it’s a bad thing when delinquencies increase. Unsurprisingly, the data is correlated. The retail sales are delayed, so this chart aims to predict that retail sales are about to decline into recession territory because delinquencies are up. I disagree with this thesis because delinquencies are still low and the labor market is still strong. The labor market is a lagging indicator, but I’d like these delinquencies to be translated into poor jobs growth before I turn negative on retail sales. There will be a burst in GDP after the hurricane rebuild and then there will be a boost in retail sales from tax cuts in 2018 if the GOP can get coordinated. This puts off the recession risk until at least late 2018.

Tax Cut Details

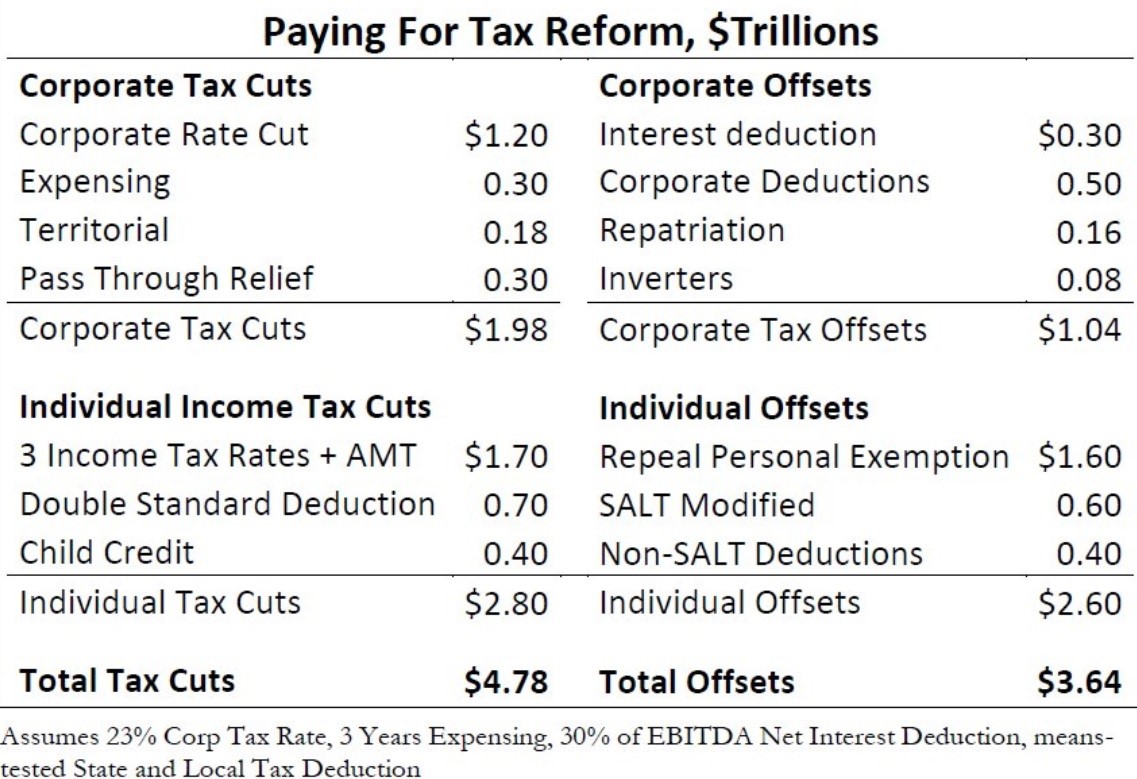

The reason I say the tax cut will come next year and not this year is because of how large the deficit is and how much the tax cut will cost. The deficit is expected to rise to 5% of GDP by about 2030 if nothing is done and there’s no recession. It could get worse with a recession, potentially leading to record high deficits. Currently PredictIt has the odds of the corporate tax cut being passed by the end of the year at 23%. The tables below explain why this process is so difficult. As you can see, taxes are expected to be cut by $1.98 trillion over 10 years for corporations and $2.8 trillion for individuals. The corporate taxes raised will be $1.04 trillion and the individual taxes raised will be $2.60 trillion. That leaves a $1.14 trillion hole that needs to be patched with spending cuts. This is why the about $700 billion in spending cuts on healthcare along with the repeal of Obamacare were so critical. This gap would have been bridged. The bottom of this image shows these calculations include a 23% corporate tax rate, 3 years expensing, 30% of EBITDA net interest deduction, and means tested state and local tax deductions. As you can see, there are problems even with a 23% tax rate which is higher than the 15% once promised.

Conclusion

I don’t believe in changes occurring just because they are due to occur. Statistics tells us that even if a quarter is flipped and heads comes out 10 times in a row, the 11th flip still has a 50% chance of being heads or tails. There’s no implicit reason to think we will have a 3% correction just because we haven’t had one. The bears think retail sales are about to turn negative, but I don’t see that happening. That being said, if the bulls are relying on tax cuts pulling the economy along in 2018, they might be in a for a rude awakening because there’s a $1.14 trillion hole.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more