The 10-Year Era Of Endless Central Bank Liquidity Has Ended… For Now

Stocks are overdue for a bounce.

Stocks are experiencing their worst month since 2008. And fund managers will do anything and everything they can to game performance so they can end the month not looking so bad.

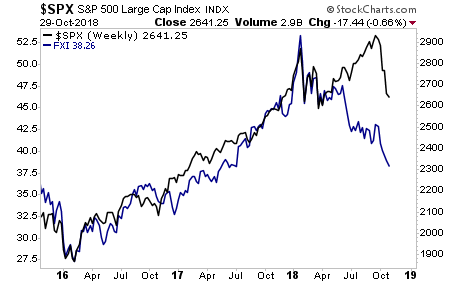

However, the BIG picture is that THE top has hit. The 10-year era of endless Central Bank Liquidity has ended… for now. The Fed’s balance sheet is shrinking. Stocks are now following.

So unless you are day trading and can catch a short term bounce, you NEED to start preparing for a MAJOR bear market.

How major?

China has given us clues…

Put simply, for those who prepare in advance for this, The Opportunity to Make Triple, If Not QUADRUPLE, Digit Gains is Here

While most people dread bear markets, the reality is that the largest investor fortunes in history were made during crises.

John Templeton DOUBLED his fortune in the Tech Crash.

John Paulson made $5 billion during 2008..

You get the idea.

We just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best ...

more