Tesla: Should Have Been Private, Now Should Be Public

When doing the work on Tesla (NASDAQ: TSLA ) we always thought the company should be private. Burning through all that cash and constantly needing new funding rounds sounds awfully like a private company, not a public one.

Shouldn't Have Been Public

The loss-making, fundraising model is normal for private companies. Private equity and venture funds that are used to it are of course searching for it.

But public shareholders are used to stead-eddy. Public shareholders are typically served earnings progressions and quarterly metrics that don't question a company's sustainability.

So when public shareholders were forced to acclimate to Tesla hands needed wringing. The sustainability before Q2 had been based on the hope that CEO Elon Musk could muster up some fresh capital. The sustainability of the business model was not based on straight-lining trends or having a few years of cash burn before you run out.

Many of those public-type shareholders then turned bearish and even shorted because this Tesla model was more like an Uber model that burned a ton of cash, but Uber wasn't public. Nobody needed to care about Uber's cash burn except its private investors.

But Tesla's cash burn model on any other company that couldn't snap their fingers for the new capital was of course quickly going to zero. Musk was, of course, a different story and could raise capital until he didn't need to.

Should Be Public, Now

But behind the curtains, Musk started seeing the gross margin ramp from S&X and Model 3. He realized he didn't need to conjure up more investors to stay afloat. He could do it from his own cash flow.

From there he quickly calculated, our guess, is "if I don't need them now, then why do I need them."

Simultaneously the story quickly turned to a potential earnings inflection story, the types most investors only dream of.

The funny thing is so many good analysts used to normal public companies dug themselves into being bearish on the cash burn, raise money model that when the company said we're going profitable in Q3 and Q4, they couldn't swivel their heads to appreciate.

The story flipped and quick.

But now with flipping fast to profits on booming S&X margins (we think 37% in Q2) and jumping Model 3 margins, growing deliveries and relatively flattish operating expenses, this company's story just flipped.

It went from a cash burn to a cash flow story.

This is the type of story that would be a great public company. If it stays public it probably won't be until about a $500-600 share price before the bears on the sell-side will finally come around and say this thing could be worth $1,500 in 5 years.

No more bull case-bear case from the same analyst who couldn't see the ramp. They all will be piling in bullish, "must own."

But before they turn bullish they have to wipe out all those 40-page cash burn reports from their memory that dug themselves bearish.

Keep It Simple Earnings, KISS

Well maybe KISS stands for something else but we use any excuse to promote an earnings focus.

We don't hate companies, we don't love companies. We love earnings stories. That's the bottom line.

The market's a market to decide where you're going to get your returns. I don't need to hate one vendor that I don't think I'll get the right return and I don't need to love another.

When I go into a Wal-Mart or shop on Amazon I don't need to love 'em or hate 'em. Either they have what I need or they don't.

So in this market, the Stock Market, I also don't need to love or hate the companies that are offering me a return to invest with them. I just need to figure out what that return is and next.

So all these bearish, negative, short reports that turn into a battleground, love 'em or hate 'em, clouds objectivity to see that this earnings progression was about to be huge.

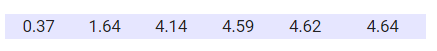

After a loss of $4+ in Q2, we have Tesla going to a gain in the following quarters. Our quarterly EPS model ramps like this from Q3 onward (Full model for subscribers):

(Click on image to enlarge)

Love 'em, hate 'em works for sports teams unless you're in sports betting. But if some bear hated the cash burn, raise money business model that public companies are not typically known for, while it's understandable, they could never objectively switch gears to catch this incredible earnings ramp.

But love 'em and hate 'em for companies tarnishes objectivity.

We offer a fix. Love or hate the earnings progression, not the company. Then you can be objective when things change up or down.

We're 60's-style, peace and love for all the companies, but the earnings are what are in question.

Conclusion

Personally, I hope this company stays public. Ok, if that gets announced maybe the stock takes a hit but the upside is much higher than $420.

The hate, I guess was built because public investors and the media weren't used to such a business model. I remember that business model in the 90s. Not many of those companies lasted. But Musk and Tesla survived.

It's funny too. Usually, sell-side analysts' and all analysts' favorite word is "inflection." You listen on conference calls and they all salivate to hear a company say "inflection."

Inflection... AAAH.

With Tesla, they have earnings inflection right before their eyes but because of the hate of the business model as a public company, they missed it.

And now this turns into one of the greatest earnings inflection stories in history.

We're ok either way. Staying public or going private we wish Tesla and Musk much continued success, profits, and love.

Disclaimer: Stocks reported by Elazar Advisors, LLC are guided by our daily, weekly and monthly methodologies. We have a daily overlay which changes more frequently which is reported to our premium ...

more

Thanks for your information

Love? You don't see that exhibited towards a public company often. Strange concept when applied to Elon Musk.This, a man who said twice that you should not be allowed to drive your own car. I don't love that totalitarian threat to freedom. Get real.