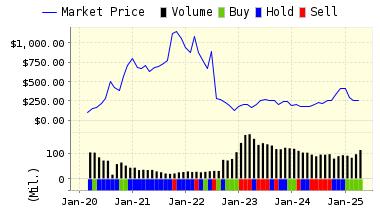

Tesla Shares Beat Down By Bad News

Tesla Inc. (TSLA) designs, develops, manufactures, and sells electric vehicles and stationary energy storage products. It operates primarily in the United States, China, Norway and internationally. Tesla Inc., formerly known as Tesla Motors Inc., is headquartered in Palo Alto, California.

Tesla has been a favorite of investors seeking transformative technological possibilities for a long time now. However, the company seems unable to put together--so far--the sort of winning record that provides confidence for the future.

Bad news at the car maker makes it tough to justify the inflated share prices. From our Valuation Model's perspective, Tesla is one of the most over-valued equities in our database. In fact, as you can see from the table below, 99% of the stocks to which we can assign a valuation figure are less overvalued

We have heard lots of news of the company and its eclectic founder lately, but much of this news seems to concern little more than "vapor ware" at this point. Articles about hyper-loop digging permissions and self-driving car tests may support the stock price, but we still wonder about capitalization figures which indicate that the company is more valuable than GM.

The company has suffered a decline in share price for most of October due to bad news about Model 3 production figures. The Model 3, which is designed to be the cheaper electric alternative, is badly missing production benchmarks. Tesla reported earlier in October that it produced just 260 of the new model in September--Tesla's earlier production schedule claimed that by December of this year they would be making 20,000 Model 3's per month.

This is doubly problematic because even at 20,000 cars per month the high share prices seem unjustified to some analysts. For this reason, analysts are warning of another quarterly loss for the company when they report Q3 numbers. Consensus analyst estimates are calling for an EPS loss of $2.28 on $2.94 billion in revenue. They also warn investors that those with positions in Tesla should expect volatility moving forward.

For now, ValuEngine continues its HOLD recommendation on Tesla Inc. for 2017-10-30. Based on the information we have gathered and our resulting research, we feel that Tesla Inc. has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Book Market Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

319.43 | -0.20% |

|

3-Month |

325.74 | 1.77% |

|

6-Month |

340.55 | 6.39% |

|

1-Year |

312.24 | -2.45% |

|

2-Year |

359.90 | 12.44% |

|

3-Year |

339.23 | 5.98% |

|

Valuation & Rankings |

|||

|

Valuation |

143.63% overvalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

-0.20% |

1-M Forecast Return Rank |

|

|

12-M Return |

61.88% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

0.97 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

49.11% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

50.37% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

110.15% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

40.13 |

Size Rank |

|

|

Trailing P/E Ratio |

n/a |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

377.68 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

0.35 |

PEG Ratio Rank |

|

|

Price/Sales |

3.99 |

Price/Sales Rank(?) |

|

|

Market/Book |

6.93 |

Market/Book Rank(?) |

|

|

Beta |

0.93 |

Beta Rank |

|

|

Alpha |

0.37 |

Alpha Rank |

|

Disclosure: None.