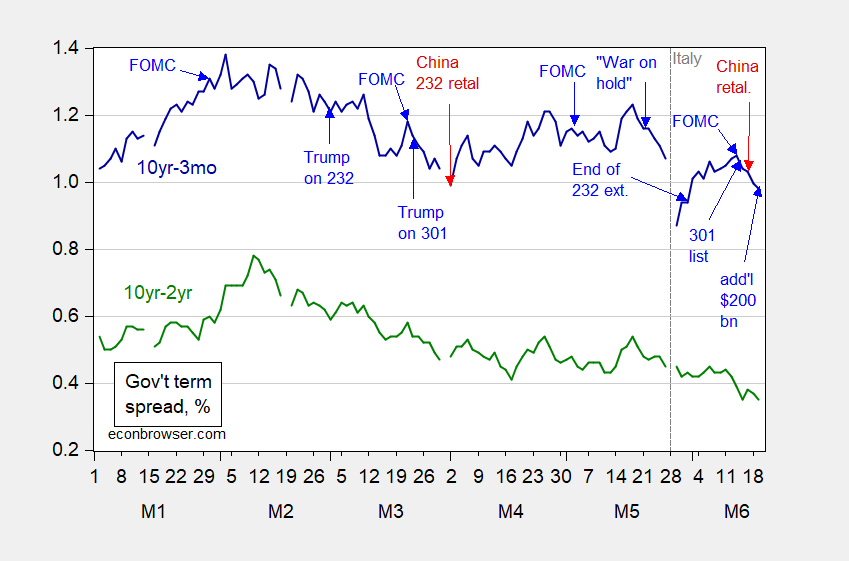

Term Spreads In 2018: An Annotated History

Today, the 10 year-3 month spread ended below 1%, in the absence of safe haven effects. The 10 year-2 year spread ended at 0.35%.

Figure 1: Ten year constant maturity Treasury minus three month Treasury secondary market yield differential (blue) and Ten year minus two year constant maturity Treasury yields (red), in %. Source: Federal Reserve Board via FRED, Bloomberg for 6/19, and author’s calculations.

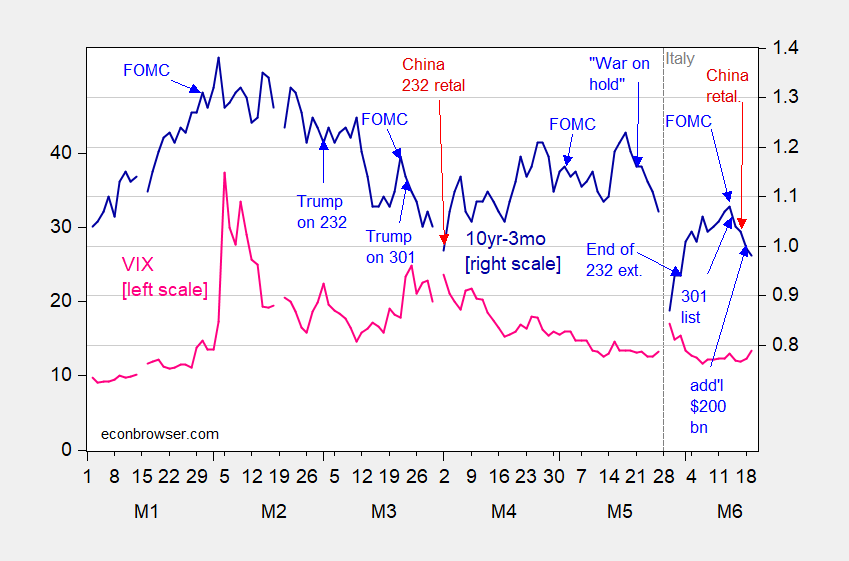

In other words, term spreads continue their downward march, albeit influenced to some degree by safe-haven effects. For the most of the observations, except for the Italy event, I think the safe haven effect is not dominant. In Figure 2, I show the 10yr-3mo spread and the VIX to verify this assertion.

Figure 2: Ten year constant maturity Treasury minus three month Treasury secondary market yield differential, % (blue, right scale) and VIX (pink, left scale). Source: Federal Reserve Board via FRED, CBOT via FRED, Bloomberg for 6/19, and author’s calculations.

To me, it seems that the more recent negative trade announcements seem to be associated with spread reductions; earlier ones (like the initial reference to Section 232 on aluminum and steel) had less impact.

To some extent, it is hard to see a macroeconomic effect from a mere $50 billion worth of imports being hit by tariffs. However, $200 billion on each side, if it comes to pass, does start getting into “real” money, particularly if it brings a lot of elevated economic and policy uncertainty.

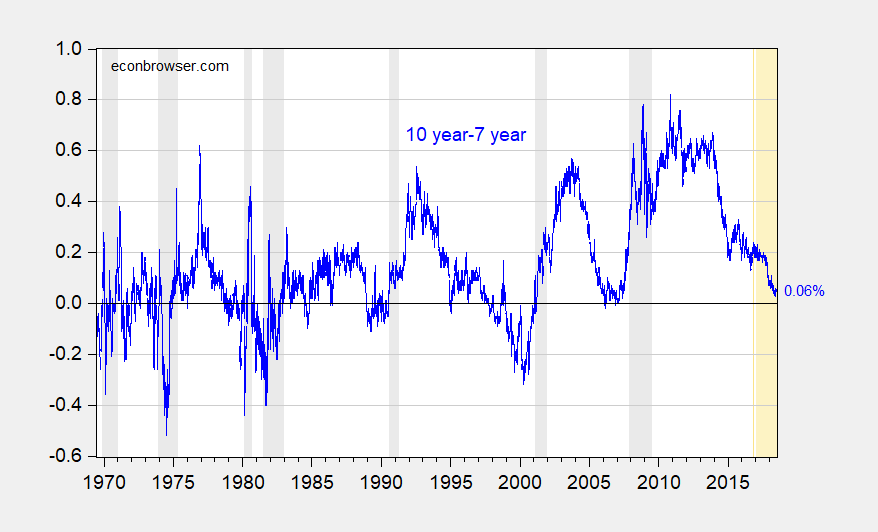

On a side note, I’ve recently heard about yield curve inversion and the 10yr-7yr spread (e.g., here). I’ve honestly never heard of any particular predictive power of this spread, but for completeness, here’s the graph.

Figure 3: Ten year minus seven year constant maturity Treasury yields (blue), in %. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, US Treasury for 6/19, and author’s calculations.

For discussion of 10yr-3mo spread and recession prediction, see Chinn and Kucko (2015).

Disclosure: None.