Technicals Always Don’t Work Out The Way You Would Expect

Take a look at the chart below. Without knowing the name, would you buy it? The chart looks pretty good. At the most recent trading day shown, the stock broke out above resistance to a new medium-term high. Not only that, but volume on the day of the breakout was also strong, coming in at twice the 50-day moving average. From a technical perspective, you really couldn’t ask for much more; just buy it and let it ride.

(Click on image to enlarge)

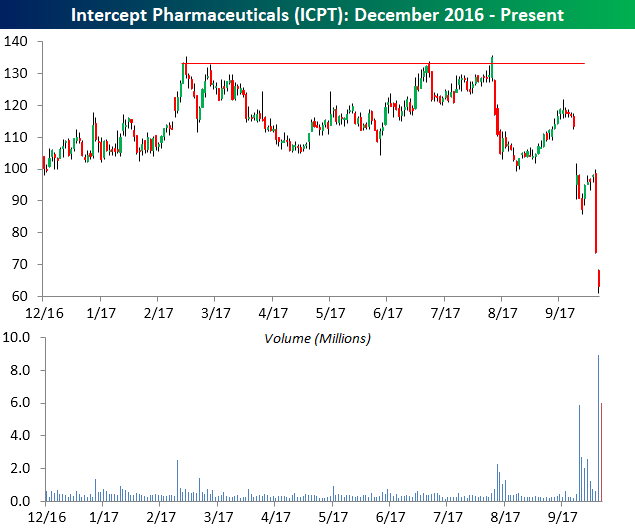

Like just every other investing discipline, though, technicals aren’t infallible. In fact, sometimes they not only get it wrong but very wrong. The chart above was the price chart of Intercept Pharmaceuticals (ICPT) from December 2016 through July 28th. If you had bought the stock based on that breakout and held through today, it would have been a very bad trade. Below we have updated the chart through early trading today. From its close on 7/28 through today, shares of ICPT have been more than cut in half with a decline of 53%. The moral of the story is twofold. First, no investing discipline works all of the time, and second, whenever you enter a trade, you should always go in with an exit plan just in case things go wrong.

(Click on image to enlarge)

Disclosure: Gain access to 1 month of any of Bespoke’s membership levels for $1!

Disclaimer: To ...

more