Tech Trades Squeeze Stops; Russell 2000 Approaches Resistance

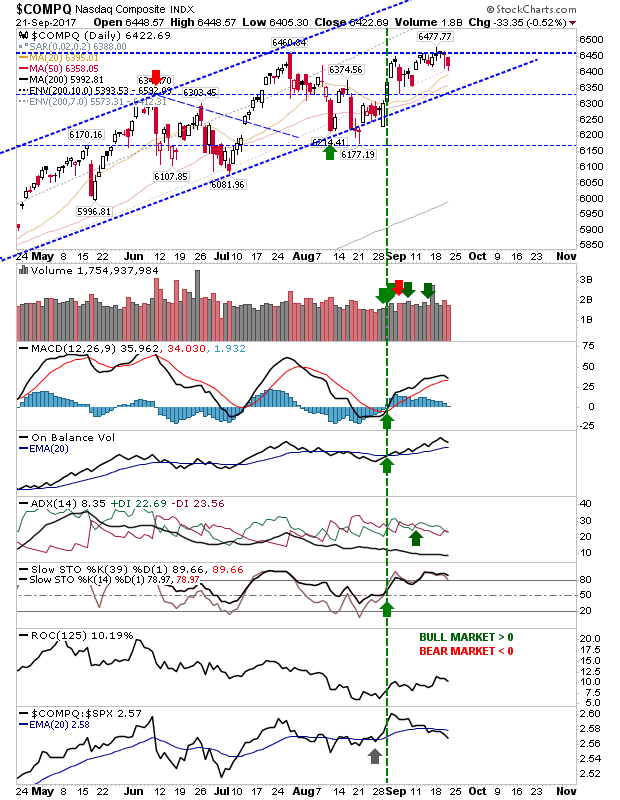

There is a bit of an overreach on today's action as the level of loss was light. However, the much-anticipated breakouts in the Nasdaq and Nasdaq 100 look like they will have to wait a little longer. Both Tech indices saw the squeeze put on tight long stops, but not enough to suggest a panic sell-off is imminent. However, any sell-off has to be watched; losses below the 50-day MA would be concerning.

(Click on image to enlarge)

The Nasdaq 100 is looking a little more vulnerable with the MACD trigger 'sell' and +DI/-DI sell' trigger. Look to this index for leads.

(Click on image to enlarge)

The index which has been offering the low-key opportunity for bulls is the Russell 2000. It fell just 2 points shy of the 1,450 target I'm looking for, but no reason to suggest it can't make this tomorrow. Technicals remain healthy.

(Click on image to enlarge)

As a footnote, the S&P and Dow did little worthy of attention. Breakouts remain intact and Technicals are sound.

(Click on image to enlarge)

For tomorrow, it's a watch-and-wait scenario for Tech indices. The Russell 2000 remains a hold with perhaps partial profits for longs - the potential for a break of 1,450 is good.